Credit Cards (SA)

African Bank Black Card Review: A Symbol of Prestige!

The African Bank Black Credit Card is where style meets substance in banking. Get an instant, personalized card with a credit limit up to R250k! This is your gateway to rewarding financial transactions!

Advertisement

Earn interest on a positive balance, enjoy up to 62 days interest-free, and access a substantial credit limit!

Get ready to dissect the elegance and efficiency of the African Bank Black Credit Card in this complete review. You’ll discover a card that seamlessly combines global accessibility with exclusive benefits.

Designed for those who seek a seamless blend of style and substance in their banking experience, this elite card offers a host of features, from instant issuance to personalized transaction limits!

- Credit Score: N/A;

- Annual Fee: R65 per month;

- Intro offer: N/A;

- Rewards: Embrace the chance to accumulate a remarkable 3% interest on any positive balance you maintain;

- P.A.: N/A;

- Other Fees: There are some specific fees, such as a card replacement fee of R130.00, and an initiation fee of R140.00.

African Bank Black Card: What can you expect?

Firstly, the African Bank Black Credit Card extends an invitation to a realm of unparalleled sophistication that you can review now!

Instantly obtainable at any African Bank Branch, this card not only serves as a symbol of financial prestige but also embodies a sleek and personalized touch.

Besides, its distinctive features, including a credit limit that can reach up to R250k, make it a suitable companion for those who appreciate the fusion of style and substance.

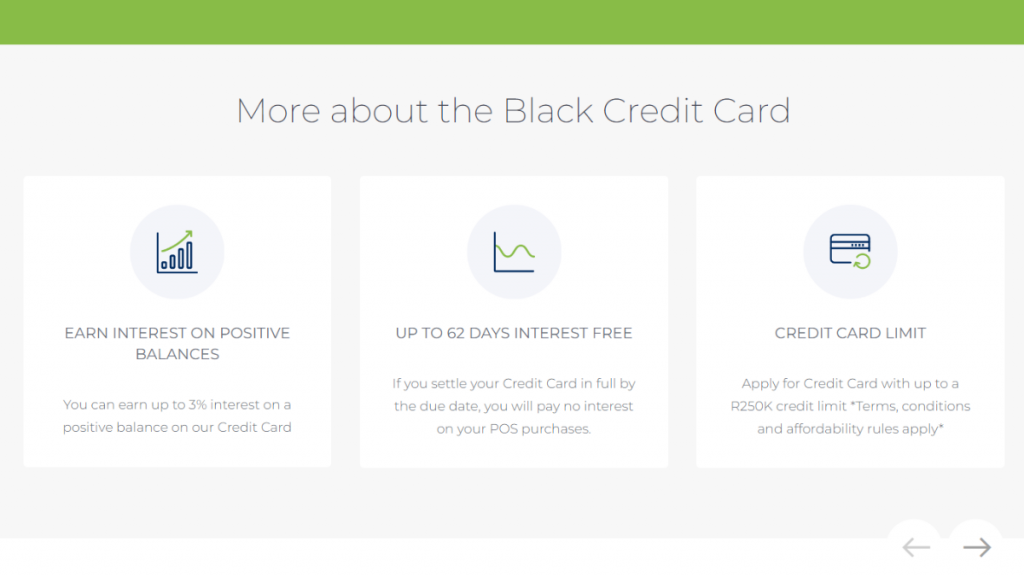

Moreover, one of the standout features of the African Bank Black Credit Card lies in its ability to transform your positive balance into a source of earnings.

Furthermore, unlock the prospect of earning a generous 3% interest on the positive balance! Additionally, settling the credit card in full by the due date translates to up to 62 days of interest-free credit.

Whether it’s checking your available balance, obtaining statements, or even adjusting your limits, the card puts the power of financial management at your fingertips with exclusive mobile services.

However, the card does charge fees such as a monthly service fee of R65.00, a card replacement fee of R130.00, and an initiation fee of R140.00. Overall, the pricing structure is transparent.

You will be redirected to another website

Do the pros outweigh the cons?

Embarking on the journey of selecting the right credit card is akin to navigating a landscape of financial opportunities and considerations.

So, are you ready to review the pros and cons of the African Bank Black Credit Card? Then, delve into the nuanced features that define its allure and make an informed decision!

Pros

- Accumulate a noteworthy 3% interest on any positive balance you maintain;

- Global Acceptance;

- Experience up to 62 days of interest-free credit;

- Instant issuance;

- Access complimentary online and mobile services at your convenience;

- After six months of card ownership, unlock the potential for a limit increase.

Cons

- Variable interest rates;

- The card comes with a monthly service fee;

- Prospective cardholders should be aware of the initiation fee;

- Doesn’t offer an introductory bonus.

What are the eligibility requirements?

So, the threshold begins at 18 years of age, signifying the entry into a financial realm tailored for adulthood. Alongside this requirement, applicants must furnish their most recent proof of income.

Additionally, the submission of the latest three-month bank statement is imperative, providing a dynamic snapshot of salary deposits and contributing to the bank’s rigorous credit assessment process.

Learn how to get the African Bank Black Card

So, are you ready to start navigating the path to financial prestige? Then review the steps on how to apply for the African Bank Black Credit Card! Don’t worry, it’s a hassle-free process!

Exclusive financial benefits and a personalized banking experience are now simpler than ever. The application process is done in minutes! Learn more!

Apply online

Applying for the African Bank Black Credit Card online provides a seamless gateway to the world of financial sophistication!

- Access the website: Begin by visiting the official African Bank website and exploring the dedicated “Credit Cards” section. Dive into comprehensive details about the African Bank Black Credit Card, taking the time to review and understand the information provided thoroughly.

- Online application: Look for the dedicated section on the website to initiate the online application process. Initiate your application journey by selecting the “Apply Now” button.

- Fill out the form and submit: The online application form will guide you through the necessary steps to provide your personal information, contact details, and financial details. Once you’re done, submit the form.

- Confirmation: Upon the submission of your online application, anticipate receiving a confirmation verifying the receipt of your submission. Then, the bank will process your application. If you’re approved, you can stop by any African Bank branch and collect your personalized card immediately!

What about a similar credit card? Check out the Standard Bank World Citizen Card!

However, if you’re seeking more exclusive benefits than the African Bank Black Card can offer, review the Standard Bank World Citizen Card! This credit card opens doors to a world of privileges.

Indeed, with wide acceptance at international merchants and ATMs, it seamlessly combines sophistication and practicality. Curious to learn more features?

So explore a complete review by clicking below!

How to apply for the World Citizen Credit Card

Learn how to apply for the World Citizen Credit Card! This card is perfect for travelers who want to enjoy luxurious experiences.

Trending Topics

See how to apply for the World Citizen Credit Card

Learn how to apply for the World Citizen Credit Card! This card is perfect for travelers who want to enjoy luxurious experiences.

Keep Reading

See how to apply for the Standard Bank Platinum Card

Are you wondering how to get your hands on a Standard Bank Platinum Card? We will tell you everything you need to know!

Keep Reading

DirectAxis Loan review

Check out our comprehensive DirectAxis Loan review and find out everything you need to know about this top South African lender.

Keep ReadingYou may also like

See how to apply for the Absa Flexi Core Credit Card

Unlock the potential of your finances and apply for a Absa Flexi Core Credit Card. And get added extras such as cashback.

Keep Reading

See how to apply for the Pick n Pay Digital Vouchers

Need to send a special gift? Now you can apply for the Pick n Pay Digital Vouchers online quickly. Learn more about how these vouchers work.

Keep Reading

See how to apply for the NedBank Gold Card

Learn how to apply for the Nedbank Gold Card and enjoy exclusive benefits such as rewards, fuel savings, security features and much more.

Keep Reading