Uncategorized

See how to apply for the Qantas Premier Platinum Credit Card

Want to apply for the Qantas Premier Platinum Credit Card? We've got you covered with this easy-peasy step-by-step guide.

Advertisement

Qantas Premier Platinum Credit Card: Enjoy 0% p.a. Interest for 18 Months with a Reduced Annual Fee!

Applying for a credit card can be somewhat of a daunting process, so we’ve put together this guide on how to apply for the Qantas Premier Platinum Credit Card.

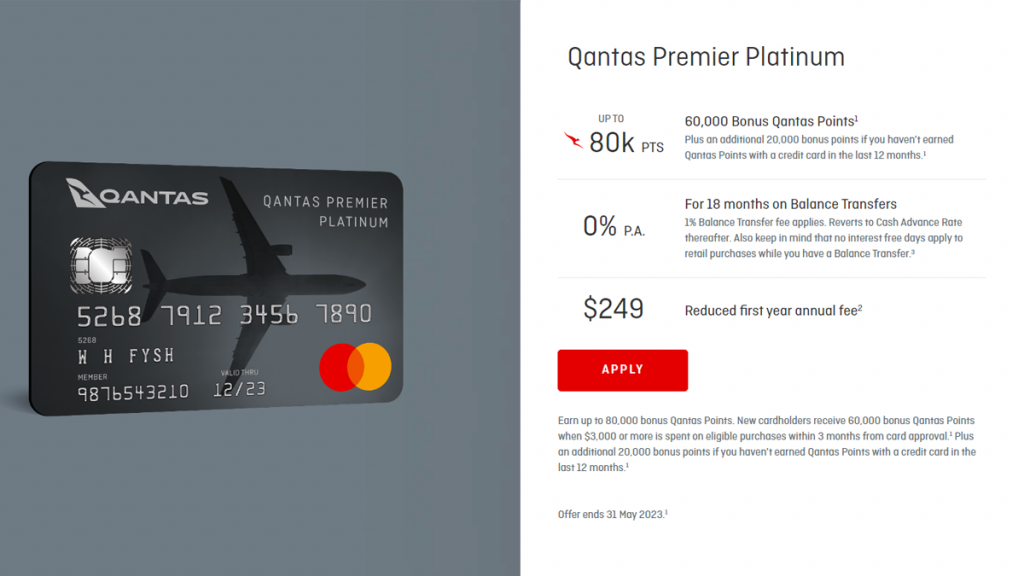

With this card, you can get rewarded with up to 80,000 Qantas Points! Apply by 31 May 2023, spend $3,000 or more on eligible purchases within 3 months from card approval, and earn 60,000 points.

Plus, if you haven’t earned Qantas Points with a credit card in the past year, you receive an additional 20,000 points.

Earn unlimited Qantas Points on purchases at home and overseas, with 1.5 points per $1 on international spending and 1 point per $1 on domestic spending.

Enjoy 0% p.a. for 18 months on balance transfer. For the first year, pay a reduced annual fee of $249 ($299 thereafter).

You can also benefit from complimentary lounge invitations, Qantas Premier Concierge, and more.

Learn how to get the Qantas Premier Platinum Credit Card online

Looking to apply for the Qantas Premier Platinum Credit Card online? No worries – it’s easy peasy!

All you have to do is head over to Qantas’ official website, click on “Credit Cards,” and then select the Qantas Premier Platinum.

Take some time to read through all the information on the page, and when you’re ready, click “Apply now.”

Make sure you have your driver’s license or passport, employment and income details, and loan and credit card repayments handy.

You’ll need them to complete the application process. Before you know it, you’ll be on your way to earning all sorts of amazing Qantas points and rewards!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

How to get it using the app

To apply for the card, follow the easy steps to their official website. Once you’re approved, download the Qantas Money App to keep track of your finances and stay on top of payments.

It’s never been easier to take control of your money and start racking up those sweet rewards!

What about a similar credit card? Check out the BOQ Platinum Visa Credit Card

If you’re considering applying for the Qantas Premier Platinum Credit Card but want to check out other options, check out the BOQ Platinum Visa Credit Card.

This card is perfect for those with good credit who want to earn rewards on their everyday purchases.

While there is a $129 annual fee, the benefits are top-tier. You get 14 months of interest-free financing with no balance transfer fees and 55 days of no interest on purchases if you pay your balance on time.

Plus, for every dollar spent on eligible purchases, you’ll earn 2 Q Rewards® points. And if you apply and spend $3,000 within the first 90 days, you’ll earn a whopping 150,000 Q Rewards® points.

So, why not explore your options and see which card best fits your needs? Follow the link below to learn how to apply.

How to apply for the BOQ Platinum Visa Credit Card

Learn what you need to know when applying for the BOQ Platinum Visa Credit Card, from eligibility criteria and fees to rewards and more.

Trending Topics

How to apply for the Low Rate Credit Card from American Express®

Find out all the features and benefits when you apply for The Low Rate Credit Card from American Express® today! Read on!

Keep Reading

See how to apply for The American Express Explorer® Credit Card

Learn how to apply for The American Express Explorer® Credit Card, plus all of the essential details and benefits of this amazing card.

Keep Reading

The best apps for meditation: Recharge in a minute with an application

Technology is here to help us stay mindful even in the busiest times. Here are 3 of the best meditation application for free!

Keep ReadingYou may also like

See how to apply for the Household Capital Loans

Looking to purchase your dream home? Here's how to apply for a Household Capital Loans and get the best interest rate possible.

Keep Reading

The 5 Best Prepaid Travel Cards for Australians

Don't get caught out abroad! Check out our list of the five best prepaid travel cards for Australians and find the one that suits your needs.

Keep Reading

ING Personal Loan Review: Make Your Dreams a Reality!

Enjoy a low fixed interest rate, no ongoing fees, and the freedom to pay it off faster. Discover the ING Personal Loan in this review!

Keep Reading