SA

DirectAxis Loan review

Find out everything you need to know about the DirectAxis Loan with this comprehensive review. Learn about the interest rates, repayment terms and more.

Advertisement

DirectAxis Loan: Borrow up to R200,000 with fast funding and flexible terms!

Are you considering DirectAxis to help you with your financial needs? We understand how important it is to make the right decision when searching for a loan provider and we are here to give you an in-depth DirectAxis Loan review.

See how to apply for a DirectAxis Loan

Learn how to apply for a DirectAxis Loan and get the cash you need to cover your expenses. Their online process makes it easy!

- Interest Rate: Your personal rate will be determined according to your financial profile. DirectAxis’ maximum interest rate is 28.00% per annum, compounded monthly.

- Loan Purpose: You can use your personal loan for whatever reasons you may have. From a vacation overseas to home renovations – you choose how to spend it.

- Loan Amount: You can borrow up to R200,000.

- Repayment Terms: 24 months to 6 years.

- Credit Needed: You need a good credit record to qualify for this loan.

- Initiation Fee: Your initiation fee will be determined according to your risk profile.

DirectAxis offers customers personal loans of up to R200,000 with flexible repayment options that are tailored to fit your budget. They also offer competitive and fixed interest rates for the life of the loan.

Furthermore, the company also provides quick and easy approval of loans, so you can get the money you need fast.

So if you need fast funding to cover your expenses, keep reading our DirectAxis Loan review to learn what else this leading lender can do for you!

DirectAxis Loan: What can you expect?

DirectAxis Loan is the perfect loan option for those looking to get ahead. With DirectAxis, you can expect a hassle-free loan process with flexible repayment options, competitive and personalised interest rates, and fast decision-making times.

The company makes it easy to apply online – simply fill out an application at DirectAxis website and you’ll receive a response in minutes. You can borrow up to R200,000 and pay them back between 24 months and 6 years.

DirectAxis has an experienced team of financial advisors on hand to help with any questions or concerns you may have. All you need to qualify is a good credit record, a monthly income of R5,000 or more, and provide the bank account into which your salary is paid.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

This provider can help you get the funds you need to finance your dreams or tackle a big expense. Still, it’s important to look at both the pros and cons before taking out this type of loan. See them below in our DirectAxis Loan review.

Pros

- DirectAxis offers a simple, secure and straightforward online application;

- You can borrow up to R200,000 with fast funding;

- Flexible repayment terms up to 6 years;

- This is an unsecured loan, which means you won’t need to offer a collateral;

- The loan includes a Personal Protection Plan that covers your balance in case of disability or death;

- Your interest rates are fixed for the life of the loan.

Cons

- You need a regular income of at least R5,000 per month to qualify;

- This loan is not available to all as new applicants need a good credit record to become eligible.

What are the eligibility requirements?

To qualify for this loan, you need to have a good credit record and a monthly income of R5,000 or more. You also need to be a South Africa resident with a valid ID and provide a recent document confirming your address.

DirectAxis also requests all new applicants to provide their latest bank statements or payslips from the past 3 months as proof of income.

Learn how to request a DirectAxis Loan

If this DirectAxis Loan review has you interested in applying for their services, we can help. In the following link you’ll find more information about their application process and requirements.

Keep reading to learn how you can request this loan and get the funding you need to achieve your financial goals!

See how to apply for a DirectAxis Loan

Learn how to apply for a DirectAxis Loan and get the cash you need to cover your expenses. Their online process makes it easy!

Trending Topics

Mr Price Money: Break Free from Budget Limitations and Shop Smarter

Stop saying no to the things you need or want. Say hello to Mr Price Money and shop smarter today! Unleash your purchasing power.

Keep Reading

FNB Premier Credit Card review: Make the most of your money with this card!

Looking for a credit card that offers maximum rewards and travel perks? Look no further than the FNB Premier Credit Card review!

Keep Reading

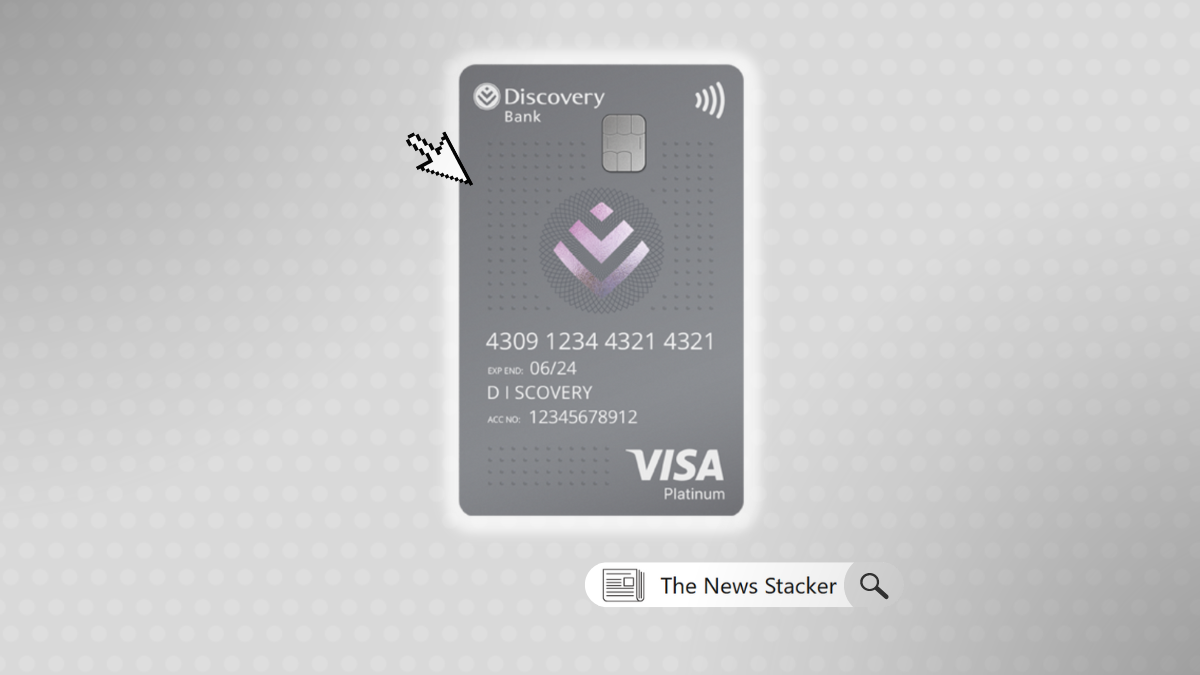

See how to apply for the Discovery Bank Platinum Card

You can now apply for the Discovery Bank Platinum Card and enjoy amazing lifestyle rewards, shopping deals, and more!

Keep ReadingYou may also like

See how to apply for the Sanlam Loans

Learn how to apply for the Sanlam Loans. With competitive rates and helpful customer service, it's easy to get the funds you need.

Keep Reading

Woolworths Gold credit card review: Get rewards and cashback offerings!

If you're looking for a credit card with great rewards and cashback offers, read our Woolworths Gold Credit Card review and learn more.

Keep Reading

See how to apply for the NedBank SAA Voyager Gold Credit Card

Ready to take off on your next adventure? Apply for the Nedbank SAA Voyager Gold Credit Card, and enjoy perks and many rewards!

Keep Reading