Credit Cards (US)

First Citizens Rewards Business Review: Enjoy Travel Rewards!

Fuel your business success with the First Citizens Rewards Business Card. Earn points on gas, benefit from a 0% introductory APR, and redeem points for cash back, travel, and more!

Advertisement

Enjoy bonus points and a range of redemption options, from travel rewards to statement credits!

Get ready to take control of your business expenses! In this review of the First Citizens Rewards Business Card, learn how to get bonus points and maximize your business earnings!

Looking to maximize your business spending? Then keep reading to discover everything the First Citizens Bank Rewards Business Card can offer! Weigh the pros and cons to make an informed decision!

- Credit Score: 600 or more;

- Annual Fee: $0;

- Intro offer: 10,000 bonus points, but only after spending $3,000 in the first 90 days of account opening;

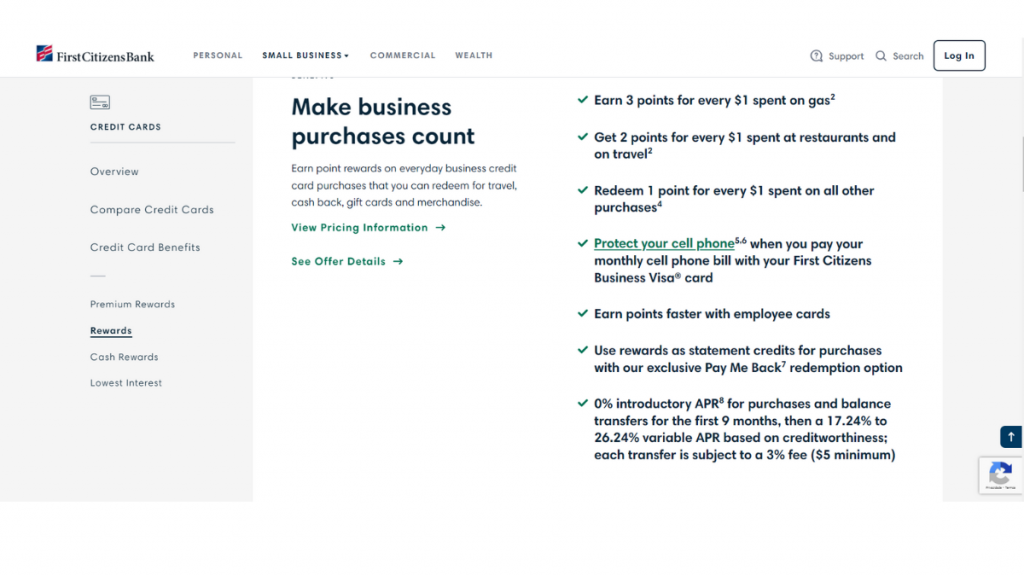

- Rewards: You get triple the points for every $1 spent on gas. Moreover, get double the points on travel or even restaurants and 1 point on all other purchases. Plus, explore diverse redemption options;

- APR: 17.24% to 26.24%. However, if you’re a new card member, the first 9 months come with a 0% introductory APR;

- Other Fees: Balance transfer fees (3% or $5 minimum) and cash advance fees are charged.

First Citizens Rewards Business: What can you expect?

If you’re looking for ways to maximize your business spending, review the First Citizens Rewards Business Card. With it, every purchase becomes a strategic move towards valuable rewards.

With a generous 10,000 bonus points for new cardholders, the card sets the stage for a rewarding journey, allowing businesses to accumulate points swiftly and efficiently.

Furthermore, it empowers your business with triple points on gas and double the points on travel expenses and restaurants.

The First Citizens Rewards Business Card is not just about earning points, it’s about unlocking a suite of benefits tailored for the discerning business owner.

After all, with a 0% introductory APR, you’ll have the flexibility to manage your finances strategically. And the absence of an annual fee further sweetens the deal.

Whether you’re looking to redeem points for cash back or travel rewards, the First Citizens Rewards Business Card ensures that your business spending translates into tangible and valuable returns.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

This card promises not just spending power but a suite of benefits designed to elevate businesses to new heights.

But, it’s important also to review the benefits and disadvantages of the First Citizens Bank Rewards Business Card in order to make an informed financial decision.

Pros

- Strategic rewards earning;

- A diverse range of redemption options;

- Absence of an annual fee;

- Substantial bonus points;

- Temporary relief from interest costs;

- Conduct business globally without incurring foreign transaction fees.

Cons

- Monthly points cap;

- Cash advances carry a higher APR;

- 0% introductory APR is only temporary;

- The bonus points offer is under the Commercial Spend Bonus description.

What are the eligibility requirements?

So, to be eligible, applicants must provide detailed information about their business. Depending on the business size, financial statements, tax returns, or other documents may be required.

Learn how to get the First Citizens Rewards Business

If you want to acquire the First Citizens Bank Rewards Business Card, get ready to review an easy step-by-step to understand how the application process works.

Apply in person

From understanding eligibility criteria to navigating the documentation requirements, this guide will walk you through the necessary steps to successfully get the First Citizens Rewards Business Card.

- Visit the First Citizens Bank website: Although the application process for this credit card must be done in person, it’s important to access the official website to review the terms and conditions. So, click on “Small Business” on the menu, then “Credit & Financing” and finally, select “Credit Cards”.

- Check your business’ eligibility: Once the page loads, locate the First Citizens Rewards Business Card and click on “Learn more” to review it. Then, click to find a branch closest to you.

- Talk to a representative: After locating the branch nearest you, talk to the representative about applying for this credit card and fill out the application form. Provide details about your business, personal information, and financial status.

- Submit your application: Before finalizing the application, review it with the banking representative and submit the form.

- Approval: Check back with the branch or contact the customer service line to inquire about the status of your application. When you’re approved, you should receive the First Citizens Bank Rewards Business Card.

What about a similar credit card? Check out the U.S. Bank Business Leverage® Visa Signature® Card!

If, even after this review, you’re still not sure the First Citizens Rewards Business Card is the right fit for your business, consider the U.S. Bank Business Leverage® Visa Signature® Card as a viable alternative.

This card also offers a generous sign-up bonus, providing businesses with a strong incentive to make the most of their initial card usage. If you want to know more features, just click below to see a full review!

U.S. Bank Business Leverage® Visa Signature® Card

Discover the U.S. Bank Business Leverage® Visa Signature® Card review and get up to 2% cash back on business expenses and unlimited rewards!

Trending Topics

See how to apply for the Citi Custom Cash℠ Card

If you’re ready to enter a new world of cash back rewards, check out how you can easily apply for the Citi Custom Cash℠ Card online!

Keep Reading

Who is the most hated person in the world?

Take a look at some of the most notable people who became "the most hated person in the world" and what they did to achieve this status.

Keep Reading

Netflix’s subscriber numbers are better than expected

Netflix’s ad-tier plan is paying off as the streaming giant had a much better result than expected in subscriber numbers during Q4 2022.

Keep ReadingYou may also like

FTX might be on the brink of collapse

On Wednesday, Binance announced it’s no longer going to acquire crypto firm FTX, which leaves the company on the brink of collapse.

Keep Reading

How to apply for the Cash Magnet® Card

Learn how to easily and quickly apply for the Cash Magnet® Card from American Express - a great rewards card with no annual fee.

Keep Reading

See how to apply for the PREMIER Bankcard® Mastercard® Credit Card

Ready to take the plunge and establish a healthy credit score? Here's how you can apply for the PREMIER Bankcard® Mastercard® Credit Card.

Keep Reading