Credit Cards (US)

Upgrade OneCard Review: New Level of Financial Freedom!

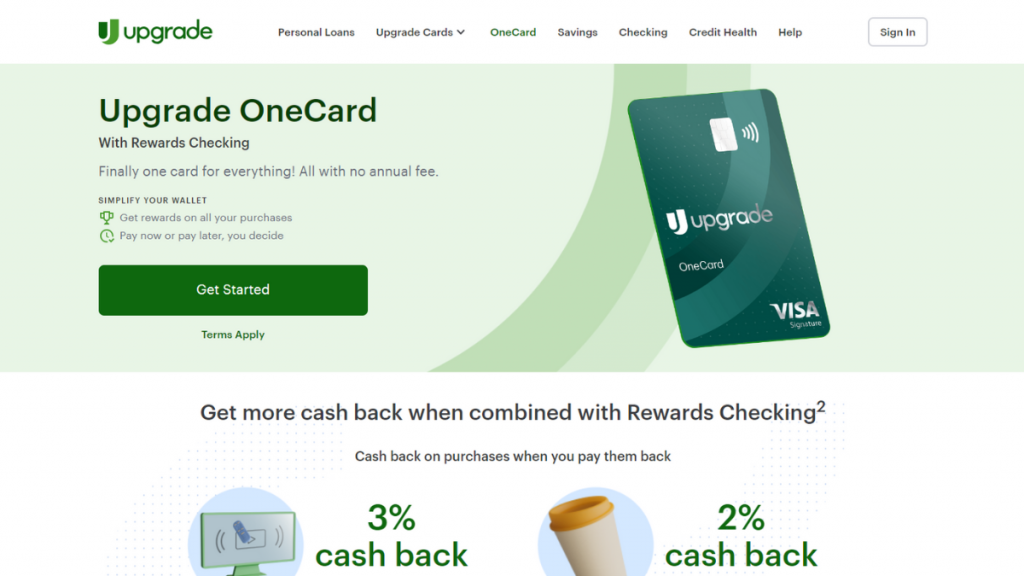

Your all-in-one solution for personalized spending is the Upgrade OneCard! Control your payments with Pay Now or Pay Later options and get extra spending power with chip-enabled contactless payment!

Advertisement

Enjoy up to 3% cash back, a $200 welcome bonus, and control over your spending!

If you’re on the lookout for a credit card that adapts to your financial lifestyle, then meet the Upgrade OneCard and learn how it can change the future of banking in this review.

When it comes to a personalized experience, the Upgrade OneCard brings a range of benefits to the table! So, keep reading and find out how you can unlock financial control with this credit card!

- Credit Score: Approval is possible for individuals with various credit histories.

- Annual Fee: This card stands out with its no annual fee feature.

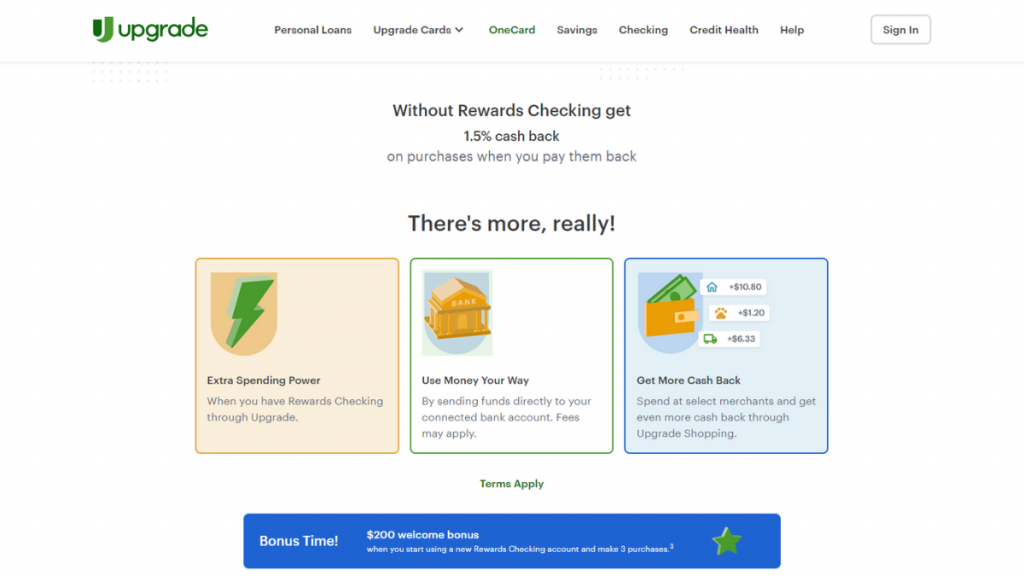

- Intro offer: Begin your experience with a generous $200 welcome bonus. Simply start using your new Rewards Checking Plus account and make 3 purchases within 60 days to claim this exciting offer.

- Rewards: This card offers 3% cash back for everyday purchases. Besides, you get a 2% cash back on other eligible purchases.

- APR: When you choose to Pay Later, the current APR for the Secured OneCard is 19.99%.

- Other Fees: N/A.

Upgrade OneCard: What can you expect?

Firstly, the Upgrade OneCard is designed to provide users with unparalleled flexibility and control over their spending, and you’ll learn all the features this card has to offer in this review.

With no annual fee, it offers a cost-effective solution for a diverse range of credit scores, making it accessible to a broad audience.

Moreover, the unique feature of Upgrade OneCard lies in its dual payment options: Pay Now and Pay Later. With Pay Now, you can make purchases without incurring any interest.

This provides a convenient way to handle short-term expenditures. On the other hand, the Pay Later option allows you to pay off your balances at a fixed rate over a fixed repayment term.

Moreover, this card goes beyond the conventional credit card by offering up to 3% cash back for everyday purchases. And, for all other transactions, you get 2%.

By linking your card to a Rewards Checking account, you unlock extra spending power and gain access to a higher rewards program.

Furthermore, the card’s compatibility with Upgrade Shopping powered by Dosh® enables users to earn up to 10% additional cash back on qualifying purchases, making every transaction more rewarding.

When it comes to convenience, the Upgrade OneCard features a chip-enabled, contactless design, allowing for fast, safe, and hassle-free payments. With these features, it stands as a versatile financial tool!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

Although the Upgrade OneCard offers a wide range of benefits, it’s essential to review possible drawbacks as with any other financial tool. This will ensure you make an informed decision!

Pros

- Offers a unique and flexible payment system;

- Users can enjoy cashback rewards;

- Generous welcome bonus for new Rewards Checking Plus accounts;

- Extra cash back with Upgrade Shopping powered by Dosh®;

- Compatibility with Apple Pay® or Google Pay™.

Cons

- Pay Later option comes with an APR of 19.99%;

- Linking the Pay Now feature to an external deposit account may result in lower cash back rewards.

What are the eligibility requirements?

So, as you can see in this review, the Upgrade OneCard was designed to be inclusive, considering a diverse range of users for eligibility.

However, applicants should have a steady source of income and must be at least 18 years old. Besides, legal U.S. residency and a valid Social Security Number are also prerequisites.

Learn how to get the Upgrade OneCard

The application for the Upgrade OneCard is a seamless process that puts the power of choice and control back into your hands. So, keep reading to see a complete guide to apply online!

Apply online

Get ready to experience a credit card that adapts to your needs, offering flexibility and rewarding choices! Review this simple step-by-step and get your very own Upgrade OneCard!

- Visit the Upgrade website: Firstly, access the official website and click on “Upgrade Cards” on the main menu. Next, select the Upgrade OneCard.

- Start the application process: When the page loads, simply click on “Get Started”. will direct you to the secure application page where you can begin the process of obtaining your Upgrade OneCard.

- Provide information: Fill out the online application form with accurate and up-to-date information. This typically includes personal details, contact information, financial information, and, if desired, the option to open a Rewards Checking account for additional benefits.

- Submit the form: Once satisfied, submit your application. Then, await approval from Upgrade. Once approved, you can expect to receive your physical Upgrade OneCard within 7-10 business days.

What about a similar credit card? Check out the Pelican Pledge Visa Card!

When it comes to transparency and ease of use, the Pelican Pledge Visa Card is the right choice for your lifestyle. So, if you’re looking for an alternative to Upgrade OneCard, review this compelling option!

This card boasts a straightforward rewards program, offering cash back on all purchases without the need for complex calculations or rotating categories. Explore this alternative in a complete review.

Pelican Pledge Visa Card Review: Build Your Credit

Discover a smart way to build your credit while using your savings as collateral in this Pelican Pledge Visa Card review!

Trending Topics

Cheapest vs most expensive things in the world: find out the opposites in pricing

Can you guess what is the cheapest vs most expensive things in the world? The prices range from $0.15 to trillions!

Keep Reading

Thanksgiving: Which big retail stores will close during the holiday?

Don’t let your holiday shopping last minute as several retail stores will not open on Thanksgiving. Read on to learn which ones!

Keep Reading

2 new binge-worthy podcasts of 2022

Here’s a quick guide on 2 superbly addictive and entertaining podcasts you should be listening to right now. Keep reading to learn more!

Keep ReadingYou may also like

See how to apply for the Discover It® Student Chrome

Wondering how to get started with your new student credit card? Here's a guide on how to apply for the Discover It® Student Chrome.

Keep Reading

Best photo editing apps: learn how to transform your pictures!

Learning how to use a mobile app can make your smartphone photos look great, but which are the best photo editing apps? Find out here!

Keep Reading

Who is the quietest zodiac sign?

Find out which zodiac sign is the quietest and learn more about what their personality traits are. Maybe it is your zodiac sign!

Keep Reading