Credit Cards (AU)

Westpac Lite Credit Card review: Simplify Your Finances!

Considering the Westpac Lite Credit Card? Our review breaks down its rewards, costs, and eligibility requirements to help you decide! See if it aligns with your spending and savings goals.

Advertisement

Your gateway to smarter spending and financial flexibility, designed with simplicity and affordability in mind!

Welcome to our comprehensive Westpac Lite Credit Card review, where we delve into the finer details of this financial gem designed to elevate your spending experience.

Whether you’re looking to minimize fees, streamline payments, or gain greater control over your finances, this card offers a straightforward approach with benefits to manage your money easily.

With one of the lowest annual fees in the market, this card lets you save right from the start! Review the Westpac Lite Credit Card to ensure you have all the information you need to make an informed decision!

- Credit Score: A credit score typically falling between 700 and 749 or higher tends to enjoy a heightened likelihood of securing approval.

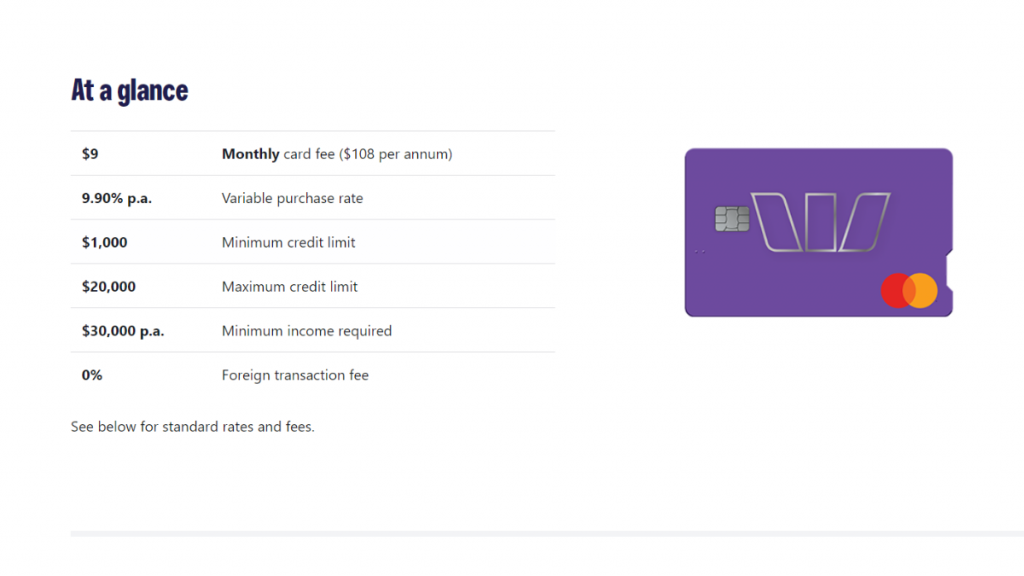

- Annual Fee: Renowned for its affordability, this card has a modest monthly fee of just $9.

- Intro offer: It’s important to note that no introductory bonuses or special promotions are currently available for this card.

- Rewards: Unlock exclusive cashback opportunities tailored just for you with Westpac Extras. Additionally, you can accrue bonus cashback while shopping through the Westpac Lounge on ShopBack.

- P.A.: Up to 45 interest-free days after, the Westpac Lite Credit Card boasts competitive interest rates, with variations starting at 9.90%.

- Other Fees: Apart from the annual fee and interest rates, there might be additional fees associated with this card. It’s crucial to consult the card’s terms and conditions for a comprehensive breakdown of applicable fees.

Westpac Lite Credit Card: What can you expect?

The Westpac Lite Credit Card is a straightforward financial tool that simplifies spending and payment processes. It typically comes with a low annual fee and competitive interest rates.

With the convenience of contactless payments, you can make swift and secure transactions at various merchants. And it comes equipped with advanced security features and fraud protection!

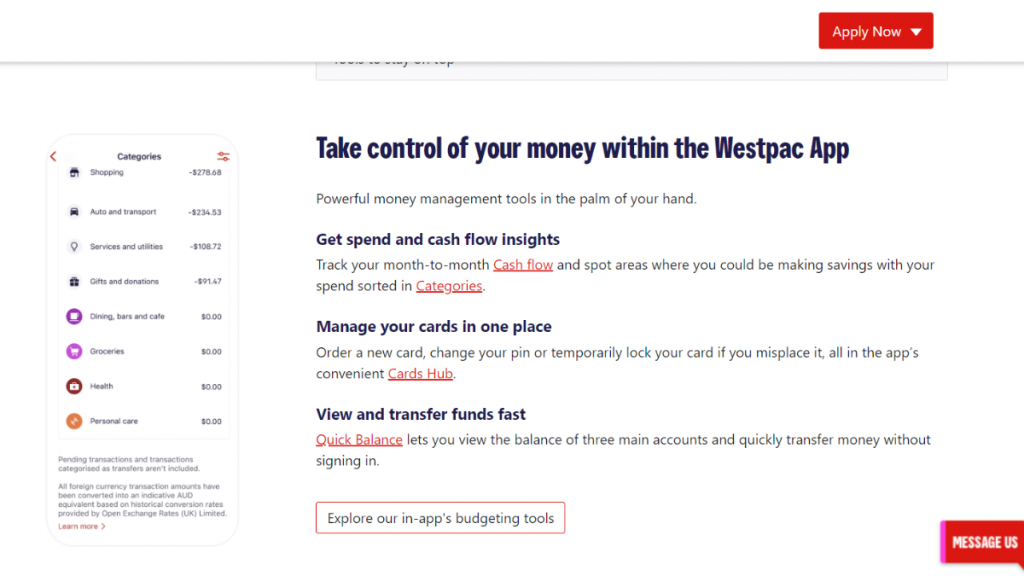

The Westpac Lite Credit Card also offers a user-friendly mobile app, allowing you to review and monitor your account, track transactions, and make payments.

While it excels in affordability and simplicity, it’s important to note that the Westpac Lite Credit Card may have limited rewards compared to premium cards.

Therefore, assessing your specific financial needs and preferences is essential to determine if this card aligns with your goals.

You will be redirected to another website

Do the pros outweigh the cons?

Check out the strengths and weaknesses of this credit card to help you make an informed financial decision. Take a balanced approach, highlighting the pros that make this card a popular choice.

Besides, find out the limitations you should consider before applying. So, let’s dive in and uncover the key aspects that can impact your financial journey.

Pros

- Low annual fee;

- No foreign transaction fees;

- Competitive interest rates;

- Fraud protection;

- Mobile app;

- Contactless payments.

Cons

- Although it’s low, this card does charge an annual fee;

- Limited rewards;

- Basic features;

- Credit score requirements.

What are the eligibility requirements?

As a general guideline, applicants are typically required to be at least 18 years old and residents of Australia. Besides, your credit history is vital since Westpac will review your credit history.

So, be sure to have a good to excellent credit score, as it’s usually preferred. Moreover, you’ll need to meet all legal requirements and provide valid identification documents for verification purposes.

Learn how to get the Westpac Lite Credit Card

Firstly, remember it’s essential to meet the eligibility criteria and understand the card’s terms and conditions. This includes fees and interest rates to maximize your credit card experience.

Embarking on your journey to attain the Westpac Lite Credit Card is a seamless and convenient process through Westpac’s online application platform. See below for an easy step-by-step.

Apply online

Begin by visiting the official Westpac website, where you’ll find the “Credit Cards” section. Then, click on it and find the Westpac Lite Credit Card among the cards available to review its features.

Now, you can explore the Westpac Lite Credit Card’s features and benefits to ensure it aligns with your financial needs. When you’re done, simply click on the “Apply Now” button associated with the card.

This action will lead you to a secure online application form where you’ll provide essential details such as personal and financial information. Once you’re done, apply.

Westpac will then assess it, which includes conducting a credit check. Upon approval, Westpac will mail your Westpac Lite Credit Card, along with instructions on card activation and usage.

If you’re looking for a compelling alternative to the Westpac Lite Credit Card with exclusive rewards and benefits, what about the ANZ Rewards Black Credit Card? This card offers a range of premium perks!

With ANZ Rewards Black, you can unlock benefits, including rewards, complimentary insurance, and exclusive access to events and experiences. Want to know more details?

To explore this card’s full suite of features and benefits, we invite you to check out our in-depth review of the ANZ Rewards Black Credit Card below!

How to apply ANZ Rewards Black Credit Card

Learn how to apply for the ANZ Rewards Black Credit Card in our simple step-by-step guide and start reaping valuable rewards today!

About the author / Vinicius Barbosa

Trending Topics

How to apply for The Qantas American Express Ultimate Card

Ready to take the plunge and apply for your Qantas American Express Ultimate Card? Get lounge passes, travel insurance, and more.

Keep Reading

ING Personal Loan Review: Make Your Dreams a Reality!

Enjoy a low fixed interest rate, no ongoing fees, and the freedom to pay it off faster. Discover the ING Personal Loan in this review!

Keep Reading

HSBC Low Rate Card Review: Low-rate Advantages!

Learn how to uncover the financial freedom you deserve with the HSBC Low Rate Credit Card in this review. Apply online in just 10 minutes!

Keep ReadingYou may also like

See how to apply for the NAB StraightUp Credit Card

Looking for a credit card that suits your needs? Here's how you can apply for the NAB StraightUp Credit Card and get the best perks!

Keep Reading

American Express Velocity Escape Review: up to 1.75 points on purchases!

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Keep ReadingThe News Stacker recommendation – Household Capital Loans

If you're over the age of 60, look no further than Household Capital Loans! Enjoy low-interest rates and flexible payment options.

Keep Reading