AU

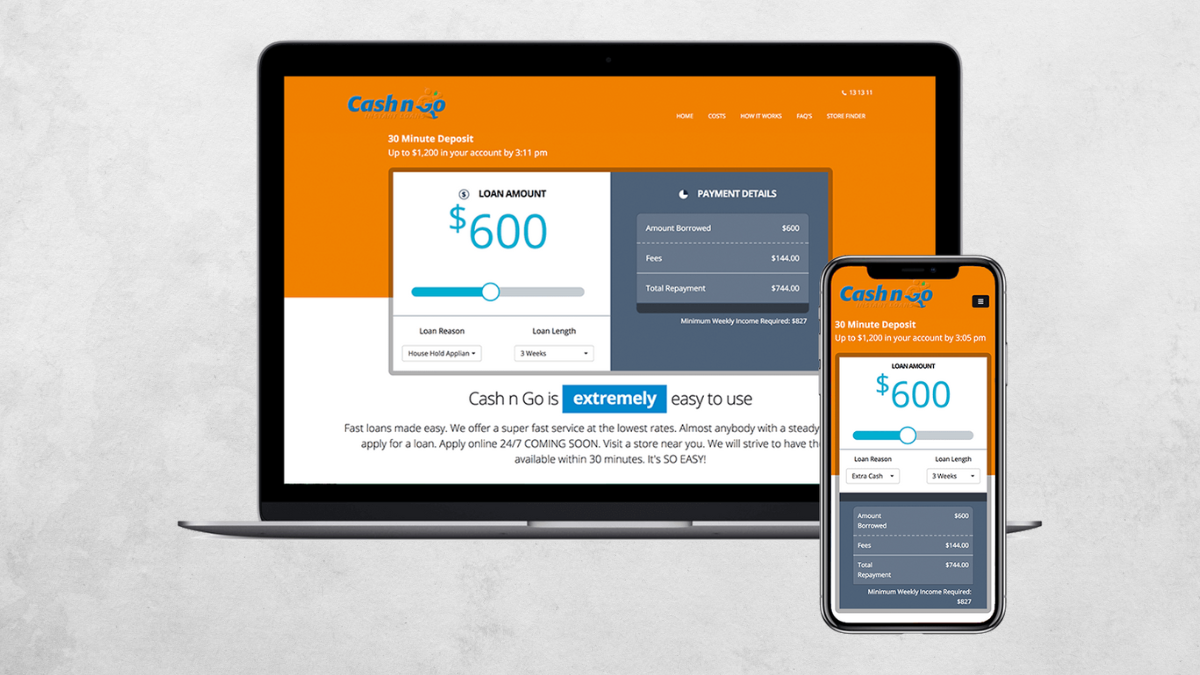

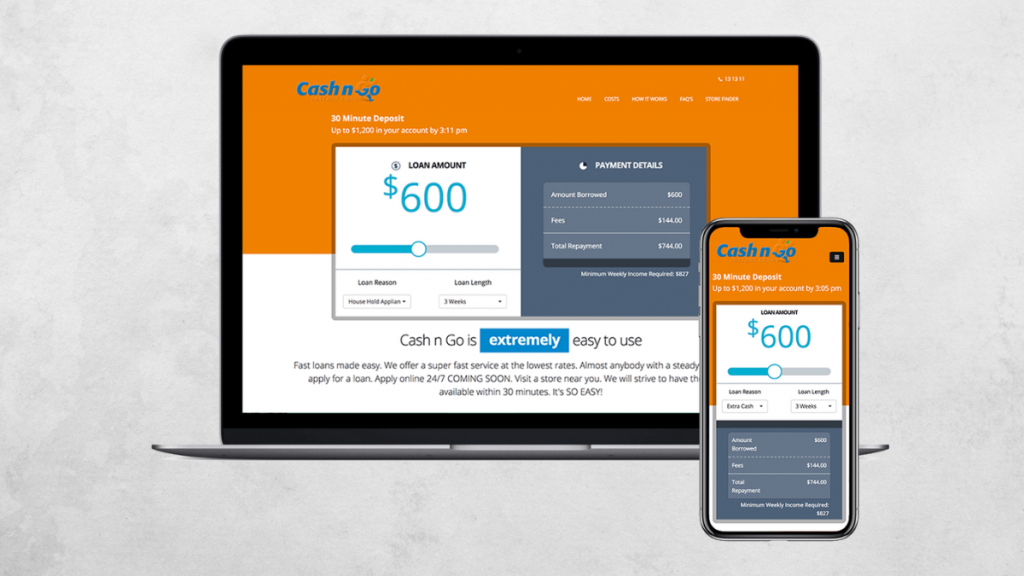

See how to apply for the Cashngo Loans

Need financial help? Learn how to apply for a CashnGo loan today. With customized repayment schedules, you can get up to $2,000 quickly approved!

Advertisement

Cashngo Loans: Get Fast Financial Relief

With loans catered towards people who need a short-term solution, almost anyone with a steady income can apply for up to $2,000 with Cashngo Loans.

For first-time customers, the maximum amount is slightly lower, but still significant at $600 if employed and $300 for those relying on Centrelink benefits.

And once you’re approved, you can customize your repayment schedule to best suit your circumstances. So if you need help making ends meet, learn how to apply for a CashnGo Loans today!

Learn how to get the Cashngo LoansE online

Ready to apply for Cashngo Loans? It’s as simple as ticking a few boxes.

Firstly, ensure you’re 18 or older – that’s a given. Secondly, have a regular income – it doesn’t matter if it’s from your job, or if you’re self-employed.

As long as you’re earning a consistent income, you’re golden. Lastly, make sure you can handle those repayments.

You can simply head to their website and select the amount you wish to borrow. From there, you’ll be taken through the application process requiring some basic information and documents.

This includes your contact details, job information, earnings and expenditures, a recent bank statement within the last 60 days, photo identification, and two recent payslips. It’s that easy!

Don’t let a financial hiccup ruin your plans, apply for Cashngo Loans today!

You will be redirected to another website

How to get it using the app

To apply for this lender you must do it via their website. There isn’t an app available.

What about a similar loan? MoneyPlace Personal Loan!

If you’re looking for financial aid but want to explore your options before you apply for a Cashngo Loans, MoneyPlace might be a great place to start.

With secured and unsecured personal loan options, MoneyPlace offers flexibility for those with good or better credit scores.

What’s great about the unsecured option is that you can borrow between $5,000 and $80,000 without disclosing the purpose of the loan.

That means you can use the funds for whatever financial need. And the best part? You can check your rate online without it impacting your credit score.

So if you want to broaden your horizons regarding quick cash, consider checking out MoneyPlace.

How to apply for a MoneyPlace Personal Loan?

Looking to borrow money? Learn how easy and simple it is to get the funding you need when you apply for a MoneyPlace Personal Loan!

Trending Topics

Hacks for Sustainable Travel On a Budget

Don't skimp on an adventure. Discover hacks that let you travel on a budget without harming the environment. Read more to find out how!

Keep Reading

NAB StraightUp Credit Card review

Take a detailed look at the features and benefits of the innovative NAB StraightUp Credit Card and see if it’s right for your needs!

Keep Reading

HSBC Premier Credit Card review

Learn about what the HSBC Premier Credit Card has to offer and how you can make the most out of your rewards in our comprehensive review!

Keep ReadingYou may also like

See how to apply for the CommBank Neo Card

Learn how to apply for the CommBank Neo card, including eligibility requirements and documents required. Read on for more!

Keep Reading

Australia Post Travel Platinum Mastercard® review: Make International Travel Hassle-free!

Read our Australia Post Travel Platinum Mastercard® review to know if this card is right for you and make international travel hassle-free.

Keep Reading

See how to apply for the HSBC Premier Credit Card

Take your finances to the next level and learn how you can apply for the HSBC Premier Card to discover its rewards and benefits today.

Keep Reading