US

Citi® Diamond Preferred® Card review

Explore all that the Citi® Diamond Preferred® Card has to offer with our comprehensive review. Discover all you need to know to make an informed decision here!

Advertisement

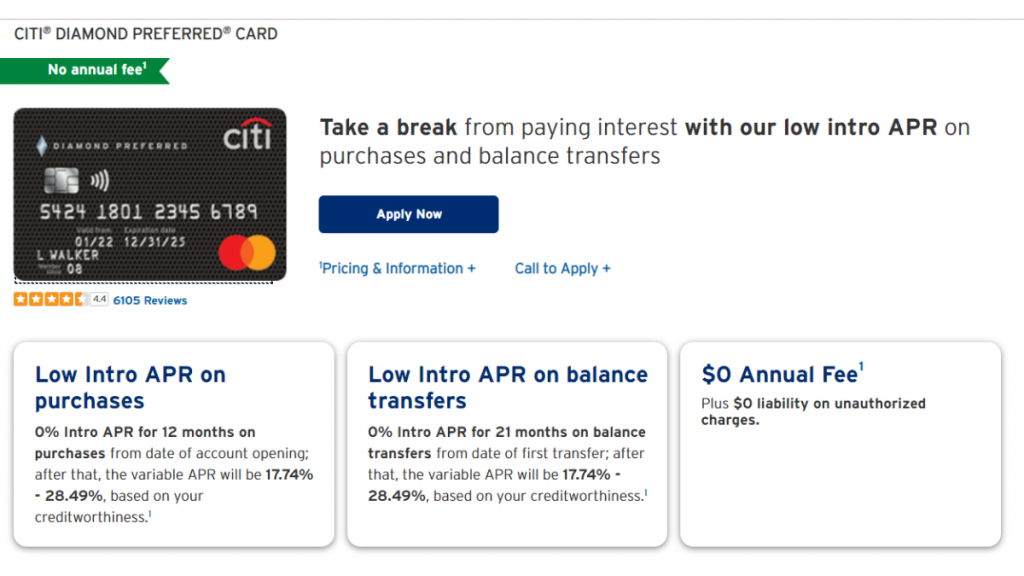

Citi® Diamond Preferred® Card: Elevate your experiences with the ultimate card for balance transfers!

Are you considering a balance transfer card to tackle high-interest debt and gain some financial freedom? The Citi® Diamond Preferred® Card is often considered one of the best cards on the market for maximum savings.

How to apply for the Citi® Diamond Preferred® Card

Here's how to quickly and easily apply for a Citi® Diamond Preferred® Card and enjoy all that it has to offer!

- Credit Score: You need a good to excellent score to qualify for the Citi® Diamond.

- Annual Fee: There are no membership fees to this card.

- Intro offer: There are no current promotions with the Citi® Diamond.

- Rewards: The Citi® Diamond is not a rewards card. But you can still benefit from its extensive intro APR and Citi® Entertainment.

- APRs: New members can enjoy 21 months of low APR on balance transfers and 12 months on purchases. After that period, a variable 17.74% – 28.49% applies.

- Other Fees: Foreign purchases have a 3% fee, cash advances are either $10 or 5%.

With its 0% APR on balance transfers for 21 months, no annual fee, and access to exclusive perks like 24/7 customer service and fraud protection, it’s not surprising that this card has so many fans.

In this review, we’ll take a closer look at everything the Citi® Diamond Preferred® Card has to offer. From its benefits to its drawbacks.

So you can make an educated decision about which credit card will work best for your budget.

Citi® Diamond Preferred® Card: What can you expect?

The Citi® Diamond Preferred® Card is a credit card designed to provide cardholders with exclusive benefits and perks, including low introductory APRs on balance transfers and purchases, and access to VIP experiences and events.

Issued by Citibank, the card is widely accepted by millions of merchants worldwide (with a 3% foreign fee).

While it doesn’t have rewards on purchases, the Citi® Diamond Preferred® offers exclusive access to Citi Entertainment® and a host of special deals.

The card has no annual fee, and it also comes with advanced security features, such as fraud detection and zero liability protection, to help protect your purchases and personal information.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

When it comes to finding the right balance transfer credit card, there’s no better option than the Citi® Diamond Preferred® Card.

But before rushing out to apply for one, it’s important to evaluate whether or not its benefits outweigh its potential drawbacks.

Pros

- Extensive low intro APR period (21 months for balance transfers and 12 months for purchases);

- Consolidate your debt or purchase a big ticket item without worrying about extra charges – the card has a $0 annual fee;

- Advanced security features and mobile banking for account management;

- Exclusive access to special events and special offers with Citi Entertainment®.

Cons

- The card charges an overseas currency conversion on international purchases;

- There are no rewards programs attached to the Citi® Diamond Preferred®.

What are the eligibility requirements?

To be eligible for the Citi® Diamond Preferred® Card, you must be at least 18 years old and a resident of the United States with a valid Social Security number.

You must also have a good credit history and meet the income requirements set by Citibank.

While the exact requirements may vary, a credit score of 680 or above is generally considered good enough to qualify for the card.

Additionally, you must not have any recent bankruptcies or delinquent accounts.

Learn how to request the Citi® Diamond Preferred® Card

With flexible financing and attractive benefits, the Citi® Diamond Preferred® is one of the most powerful financial tools available.

Read on to learn how you can request this card today and take control of your spending!

How to apply for the Citi® Diamond Preferred® Card

Here's how to quickly and easily apply for a Citi® Diamond Preferred® Card and enjoy all that it has to offer!

Trending Topics

Save money on streaming subscriptions

Streaming can be expensive, but it doesn't have to be. Follow these tips and tricks to save money on your favorite streaming services.

Keep Reading

Can music boost your performance while you’re exercising?

The benefits of listening to a good playlist while exercising are numerous. Read on to learn how music can boost your performance.

Keep Reading

How to legally watch movies online for free

Looking for a way to watch your favorite flicks without breaking the law? Check out our list of legal ways to watch movies online for free.

Keep ReadingYou may also like

How to effectively de-stress and live better

Stress can have a negative impact on your wellbeing. Here are some tips to help you effectively de-stress and regain your equilibrium.

Keep Reading

Learn how to tackle debt efficiently using the debt snowball method

Are you overwhelmed by debt? Learn about the debt snowball method and how it can help you find your way out of financial difficulty.

Keep Reading

Cost-of-living adjustments will have a significant increase for 2023

The new cost-of-living adjustments for 2023 will be announced next Thursday, and retirees can expect a significant increase.

Keep Reading