US

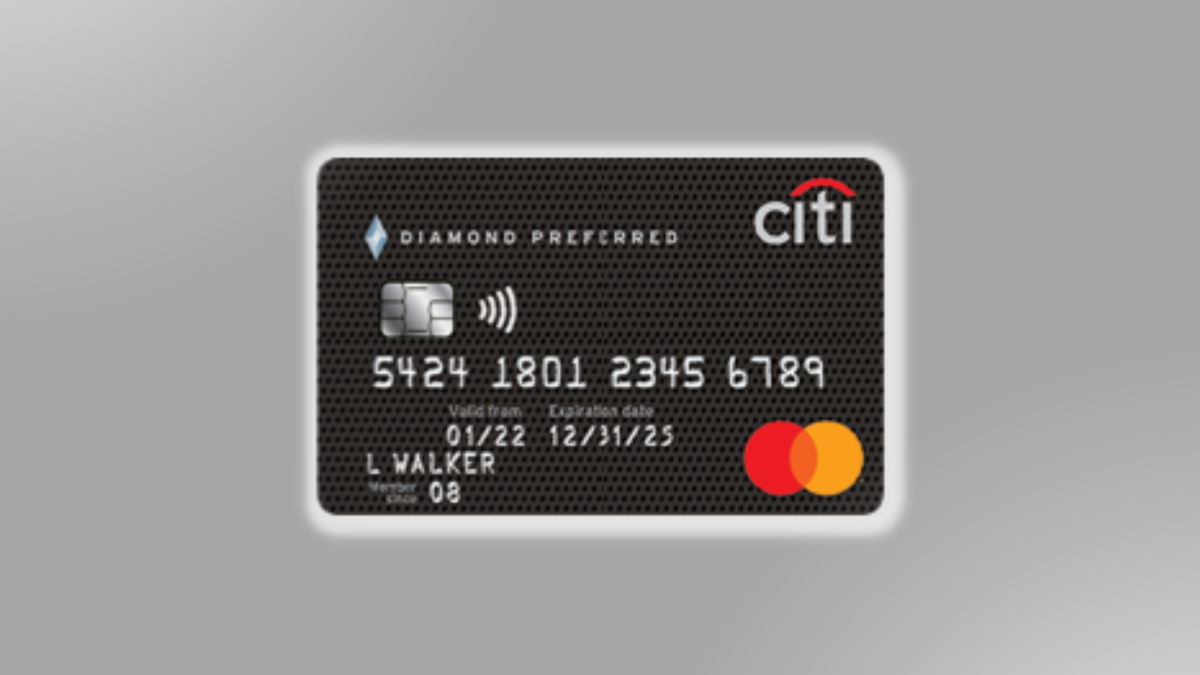

See how to apply for the Citi® Diamond Preferred® Card

Here's a complete guide on how to apply for the Citi® Diamond Preferred® Card! Get all of your questions answered and find out what benefits this reward card can offer.

Advertisement

Citi® Diamond Preferred® Card: Discover a new level of convenience and security!

Are you looking to refinance your debt and reach your financial goals with a helpful and prestigious ally? When you apply for the Citi® Diamond Preferred® Card, you get a powerful tool to help you take charge of your finances.

With zero membership fees, new members can refinance their credit card debt or make large purchases.

There’s a 21-month 0% APR on balance transfers, and 12 months of 0% APR on purchases (variable 17.74% – 28.49% thereafter).

The card comes with a host of security features and offers special access to Citi Entertainment®.

You can have free access to your FICO® score to monitor and track your score progress. Plus, use technology such as Tap to Pay.

So, would you like to start saving on interest and take the plunge into a debt-free life? Then keep reading to learn how you can easily apply for the Citi® Diamond Preferred® Card next in our complete guide!

Learn how to get the Citi® Diamond Preferred® Card online

To apply for the Citi® Diamond Preferred® Card online, the first thing you need to do is visit the official website of Citibank.

Once you’re on the website, search for the “credit cards” section and click on “Citi® Diamond Preferred® Card”.

You’ll be redirected to the card’s application page, where you need to provide some basic information such as your name, address, social security number, and employment status.

Make sure to double-check the information you’ve entered to avoid any errors.

After entering your personal and financial details, you’ll have to agree to the terms and conditions of the card.

Read through the terms carefully and make sure you understand them before proceeding with the application.

Once you’ve completed the application form, review your application one last time and click the “submit” button. You’ll receive a confirmation email from Citibank acknowledging receipt of your application.

Wait for a few business days for Citibank to review your application and determine whether you’re eligible for the Citi® Diamond Preferred® Card.

If you get the card, they should contact you with further details.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Learn how to get it using the app

If you’re interested in applying for the Citi® Diamond Preferred® Card through the mobile app, the first step is to download and install the Citi Mobile® App on your smartphone.

You can find it on the App Store or Google Play.

Once you’ve logged in to the app, navigate to the “Credit Cards” section and select “Citi® Diamond Preferred® Card”.

You’ll be taken to the card’s application page, where you can provide your personal and financial information.

Review the information you’ve entered, agree to the card’s terms and conditions, and hit the “submit” button to complete your application.

It usually takes a few business days for Citibank to review your application and determine your eligibility for the card.

How about a similar credit card?

If balance transfers is what you’re after, the Chase Slate Edge℠ Credit Card offers a fantastic alternative to the Citi® Diamond Preferred® Card.

Not only do new members get a 18-month intro period of low APR on purchases and balance transfers, but they have the chance to lower their regular APR by 2% every calendar year.

To learn more about the Chase Slate Edge℠ Credit Card and how to apply for it, check the following link!

Chase Slate Edge℠ Credit Card review

Are you in the market for a great card that’ll give you the ability to pay down debt or make big purchases interest-free? Then check out our Chase Slate Edge℠ Credit Card

Trending Topics

What are the best original Netflix series?

Wondering what the best original Netflix series are? Look no further! We break down the top five shows that you need to watch right now.

Keep Reading

What are the 10 most expensive colleges in us: find the one for your income!

Learn what are the most expensive colleges in the US. Can you imagine how much you'd have to pay for them? Read this post to find out.

Keep Reading

What are the most ancient museums in the world?

Do you want to know where some of the world's most ancient museums are? Check out our list with the 7 oldest museums on earth.

Keep ReadingYou may also like

Regulators shut down Silicon Valley Bank

Regulators shut down the Silicon Valley Bank in what is considered the largest bank failure in decades. Read on for more!

Keep Reading

Some habits might be affecting your sleep quality

Do you have trouble falling asleep at night? If so, check out these bad habits that might be affecting your sleep quality and how to fix them.

Keep Reading

Navy Federal GO REWARDS® Credit Card review

Learn more about the Navy Federal GO REWARDS® Credit Card and how it can help you save money with its great rewards program.

Keep Reading