Loans (US)

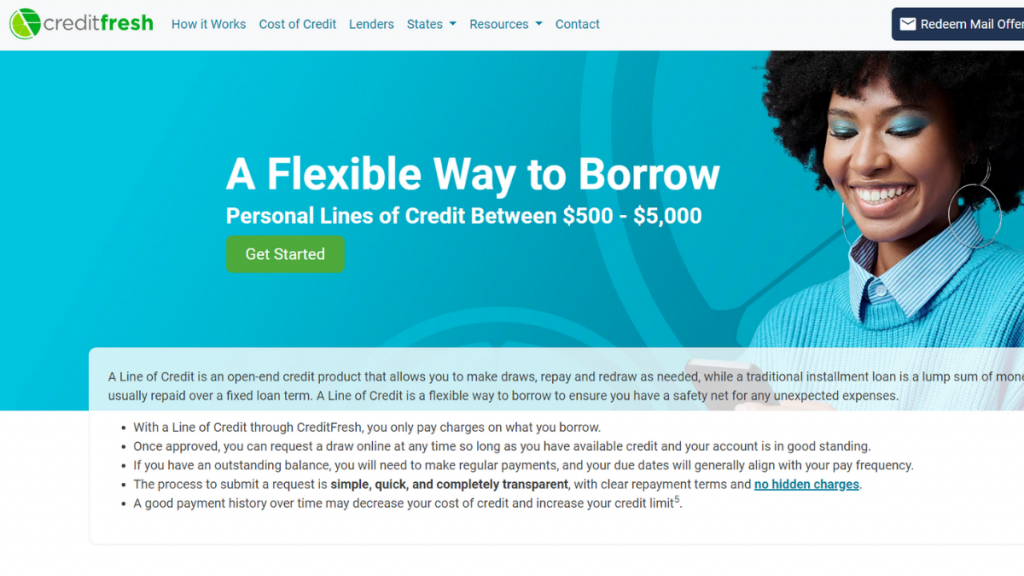

CreditFresh Review: Elevate Your Credit Experience!

Enjoy a transparent, hassle-free borrowing experience with CreditFresh! Navigate unexpected expenses seamlessly, make draws online, and enjoy transparent terms designed to fit your financial needs.

Advertisement

From quick approvals to transparent charges, take control of your borrowing with ease!

If you’re on the lookout for a platform that redefines the borrowing experience, then review the features and benefits of CreditFresh! This is a dynamic financial companion designed to adapt to your needs!

Whether you’re looking for flexibility in terms of loan amounts or transparency when it comes to fees, the CreditFresh Lines of Credit can give you the power to make draws and repay at your own pace!

- APR: CreditFresh’s Annual Percentage Rate (APR) varies and is influenced by factors such as creditworthiness, the selected loan amount, and the repayment terms.

- Loan Purpose: It caters to a variety of financial needs.

- Loan Amount: $500 to $5,000.

- Credit Needed: N/A.

- Terms: N/A.

- Origination fee: It doesn’t charge an origination fee.

- Late Fee: N/A.

- Early Payoff Penalty: CreditFresh does not impose an early payoff penalty.

CreditFresh: what can you expect?

If you’re looking for a borrowing experience that adapts to your unique financial needs, this review of CreditFresh will offer you a dynamic solution.

Firstly, unlike traditional installment loans, CreditFresh provides a line of credit, giving you the flexibility to make draws, repay, and redraw within your approved credit limit.

In other words, you have the freedom to access funds ranging from $500 to $5,000, tailoring your borrowing to match the ebb and flow of your life.

Moreover, another standout feature is a commitment to transparency. CreditFresh offers clear and straightforward terms, ensuring you understand the charges and repayment structures.

Furthermore, CreditFresh goes beyond being a mere financial tool, offering users the potential to impact their credit history positively. After all, account statuses may be reported to TransUnion.

Finally, with CreditFresh, the online platform streamlines the request and approval process, allowing you to submit requests quickly and potentially receive funds on the same business day.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

Whether you prefer to make draws online or need quick access to funds, CreditFresh prioritizes efficiency to ensure that your borrowing experience aligns with your fast-paced lifestyle.

So, if you’re thinking about applying for CreditFresh Lines of Credit, it’s time to review the advantages and potential drawbacks in order to make an informed financial decision.

Pros

- Flexible borrowing experience tailored just for you;

- Enjoy the clarity of transparent terms;

- Provides users with quick access to funds;

- Contribute to potential credit growth over time;

- Timely repayments may lead to increased credit limits.

Cons

- Mandatory Principal Contributions and Minimum Payments;

- Not available to certain regions or individuals;

- Borrowers should be mindful that interest charges;

- Some may find the approved credit limit insufficient;

- Strict eligibility criteria.

What are the eligibility requirements?

What’s also important to review when it comes to CreditFresh Lines of Credit is the eligibility criteria. Firstly, individuals must be of legal age to contract in their state of residence, typically 18 years or older.

Secondly, applicants need to be either U.S. citizens or permanent residents. Maintaining an active bank account is also a fundamental requirement.

Additionally, having a valid contact number and an active email address is crucial for communication purposes throughout the application and borrowing process.

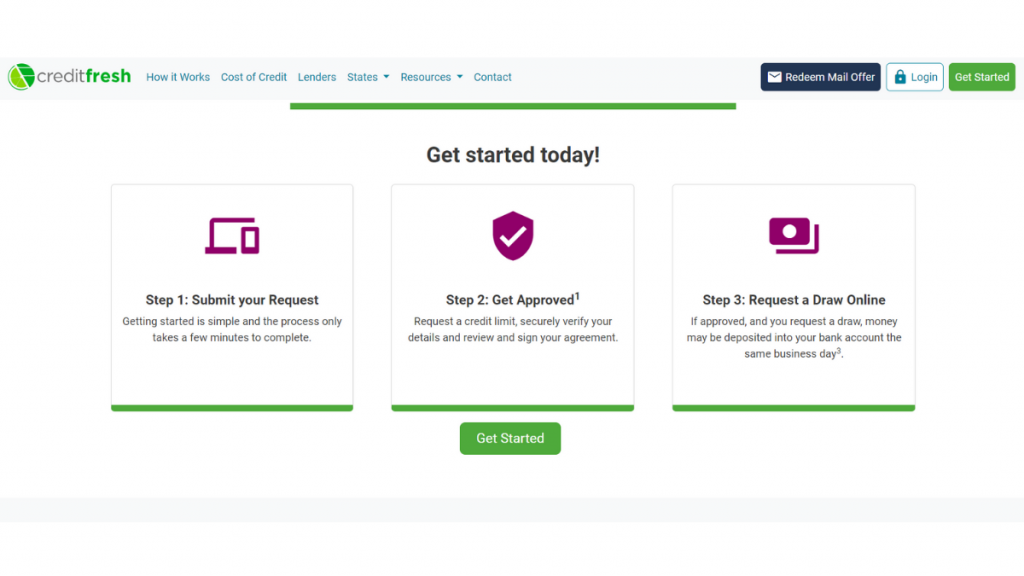

Learn how to request CreditFresh

This CreditFresh review wouldn’t be complete without a hassle-free guide on how to apply for their Lines of Credit.

So, keep reading to find out how to apply online in a few easy steps!

Learn how to request online

Are you ready to unlock the financial flexibility offered by CreditFresh? Then explore a seamless application process now!

- Access the official website: First, visit CreditFresh’s official website and check this dynamic platform, reviewing the eligibility requirements. Confirming your eligibility sets the foundation for a smooth application process.

- Start your application: When you’re done, click on “Get Started”. This initial step involves a straightforward form and ensures a quick and efficient start to your CreditFresh experience.

- Approval and credit limit: After submitting the initial form, CreditFresh will assess your information. If approved, you can request your desired credit limit securely.

- Receive your funds: When the credit limit requested is approved, you can request a draw online. Then, CreditFresh will deposit the funds into your bank account.

What about another recommendation: Harmoney Personal Loan!

Although CreditFresh offers flexibility in terms of borrowing, you can review alternatives that are different from a line of credit.

For example, the Harmoney Personal Loan is a fixed-term installment loan.

This means it provides borrowers with a predetermined lump sum amount. With competitive interest rates and a user-friendly platform, Harmoney simplifies the borrowing process. Find out how it works now!

Harmoney Personal Loan Review

From car loans to dream weddings, learn to get tailored solutions in this Harmoney Personal Loan review! Your unique journey begins here!

Trending Topics

What is the Big Mac Index?

Ever heard of the Big Mac Index? This blog post will explore everything you need to know about this index is and why it matters.

Keep Reading

95th Academy Awards: where to watch and what to expect

The 95th Academy Awards takes place this Sunday and you won’t want to miss it! See how to catch the livestream of the event.

Keep Reading

The great debate: who is the most famous person?

This post looks at some of history's most famous people and attempts to answer the question - who is the most famous person in the world?

Keep ReadingYou may also like

How to make money using the internet: it’s a world of possibilities!

You can make money just by using the internet to support your home business. This post has some excellent tips to achieve this goal.

Keep Reading

Upgrade Personal Loan review: Get your dream project funded today!

Check out our Upgrade personal loan review to see if why is right for you. With low, fixed rates, it may be just what you're looking for!

Keep Reading

See how to apply for the Venture X Rewards Credit Card

Applying for the Capital One Venture X Rewards Card is easy! Learn how to do it in minutes and get rewards for all of your spending.

Keep Reading