Loans (AU)

Harmoney Personal Loan Review: Empowering Your Aspirations!

Embark on your financial journey with Harmoney Personal Loans. Explore loan options for cars, education, debt consolidation, and more. Your dreams, our commitment.

Advertisement

Enjoy fixed rates, no hidden fees, and a swift 24/7 online application!

Whether it’s a holiday, business venture, or home renovation, in this review, you’ll find that the Harmoney Personal Loan can help support any of your goals! Your financial journey is simplified, 100% online.

If you’re dreaming of a new car, pursuing education, consolidating debt, or planning a dream wedding, Harmoney provides tailored solutions with transparent terms. So, find out how it works today!

- APR: Competitive fixed APRs, ranging from 5.66% to 24.03% (comparison rate 6.45% to 6.55%).

- Loan Purpose: Tailored to your needs, Harmoney Personal Loans are versatile, covering everything from car purchases and education expenses to debt consolidation, holidays, business endeavors, medical needs, weddings, and home renovations.

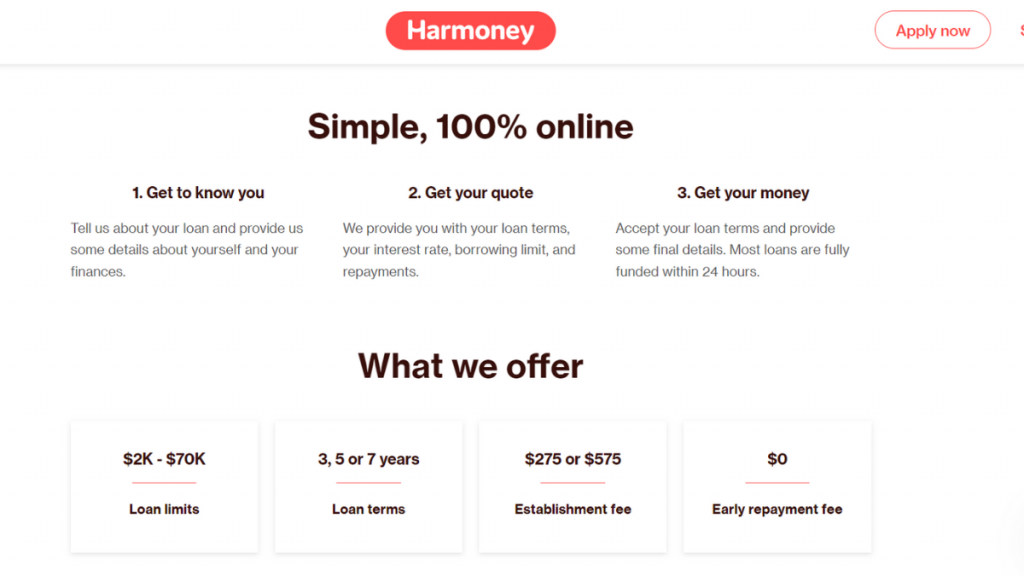

- Loan Amount: Choose a loan amount that suits you, with limits ranging from $2,000 to $70,000.

- Credit Needed: Harmoney assesses your individual credit profile to determine interest rates.

- Terms: Options for 3, 5, or 7 years.

- Origination fee: Establishment fee of $275 for loans under $5,000 and $575 for loans $5,000 and over.

- Late Fee: There are no monthly account-keeping fees, and late fees won’t catch you off guard.

- Early Payoff Penalty: Harmoney Personal Loans have no early repayment fees.

Harmoney Personal Loan: what can you expect?

While Harmoney offers a unique lending experience, when it comes to a Personal Loan it’s important to review and understand terms and how it works.

Firstly, their Personal Loans are designed to cater to a spectrum of needs, ranging from purchasing a new vehicle, funding education, consolidating debt, planning a dream holiday, or even launching a business.

Furthermore, one of the hallmarks of Harmoney Personal Loans is transparency. Your interest rates are determined based on a thorough assessment of your credit profile, ensuring fairness and accuracy.

With fixed rates ranging from 5.66% to 24.03% (comparison rate 6.45% to 6.55%), you can enjoy the stability of knowing your rate won’t fluctuate throughout the life of the loan.

Moreover, Harmoney Personal Loans offers the freedom to select a loan term of 3, 5, or 7 years, empowering you to align your repayment schedule with your individual preferences.

Besides, experience the convenience of a 100% online application process with Harmoney. Harmoney’s commitment to innovation ensures that getting the financial support you need is tailored to the digital era.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

So, if you’re thinking about requesting a Personal Loan from Harmoney, it’s time to review the advantages and disadvantages in order to make an informed decision.

Then, uncover the benefits that make it a standout choice for personalized lending, along with insightful considerations that provide a well-rounded perspective.

Pros

- Designed to cater to a variety of needs;

- Enjoy the stability of fixed interest rates throughout the life of the loan;

- Choose a loan term that suits your lifestyle;

- Swift online application and funding;

- Acknowledged in the Top 10 of the 2023 AFR Most Innovative Awards;

- Wide range of loan amounts.

Cons

- Harmoney charges an establishment fee;

- Not ideal for short-term borrowing;

- Eligibility criteria.

What are the eligibility requirements?

So, to be eligible for a Harmoney Personal Loan, applicants must be at least 18 years old, be a permanent resident or citizen of Australia, and have a regular source of income.

Learn how to request the Harmoney Personal Loan

This review wouldn’t be complete without a complete step-by-step on how to apply for the Harmoney Personal Loan. After all, it’s time to empower your financial journey!

Learn how to request online

So, navigate the application and set the wheels in motion for a personalized lending experience that aligns with your unique goals.

- Access the official website: Firstly, go to the Harmoney website. Then, scroll down and review the types of Personal Loan that Harmoney offers.

- Online application: When you find the one that fits your needs, click on the “Apply now” button.

- Complete the online form: Fill in the required information, including personal details, financial information, and the purpose of the loan.

- Credit assessment: Harmoney conducts a comprehensive credit assessment based on the information provided. This step is crucial for determining your eligibility.

- Accept terms: Upon completion of the credit assessment, Harmoney provides you with your loan terms. Finally, if you’re satisfied with the provided terms, accept the loan agreement, and provide any final details required to complete the process. Harmoney aims to fund most loans within 24 hours fully!

What about another recommendation: ING Personal Loan!

If you want to review other financial tools, the ING Personal Loan is a great alternative to the Harmoney Personal Loan. With ING, you experience simplicity and flexibility

So, get ready to experience a streamlined application process, competitive interest rates, and loan amounts tailored to your needs with ING Personal Loan! Further, find out more in the full review below.

ING Personal Loan Review

Enjoy a low fixed interest rate, no ongoing fees, and the freedom to pay it off faster. Discover the ING Personal Loan in this review!

Trending Topics

Progen Lending Solutions review: Get the perfect financial solution for you

Our comprehensive Progen Lending Solutions review will help you discover how to get the perfect financial solution for your needs.

Keep Reading

ING Orange One Low Rate Review: Smart Spending Unleashed!

Discover financial freedom in this ING Orange One Low Rate review. Enjoy zero ING fees on international transactions for eligible users.

Keep Reading

See how to apply for the Westpac Altitude Platinum Credit Card

Check out how to apply for the Westpac Altitude Platinum Credit Card! Find out all you need to know before and take advantage of points.

Keep ReadingYou may also like

The Low Rate Credit Card from American Express® review: An Easy Way To Save Money

Check out our in-depth The Low Rate Credit Card from American Express® review to see if it works for you. Learn more here.

Keep Reading

Bendigo Ready Credit Card Review: Ignite your travel dreams

Get ready for spontaneous trips abroad! Check out our detailed Bendigo Ready Credit Card review to learn about it. Start your journey here!

Keep Reading

Hacks for Sustainable Travel On a Budget

Don't skimp on an adventure. Discover hacks that let you travel on a budget without harming the environment. Read more to find out how!

Keep Reading