Credit Cards (AU)

ING Orange One Low Rate Review: Smart Spending Unleashed!

The ING Orange One Low Rate is a no-annual-fee card offering a competitive 11.99% p.a. variable rate on purchases. Your path to smart, low-cost spending starts here! Learn more!

Advertisement

Say goodbye to international transaction fees for eligible customers and hello to easy repayments with autopay!

Delve into the intricacies and benefits of the ING Orange One Low Rate through our detailed review. This credit card is designed to transform your financial journey!

Bid farewell to international transaction worries with zero ING fees for eligible customers and much more! Curious to know everything about this card? Then, keep reading to see what to expect!

- Credit Score: Good credit ratings.

- Annual Fee: Zero.

- Intro offer: N/A.

- Rewards: While its primary emphasis is not on rewards, the ING Orange One Low Rate card offers financial benefits due to its favorable fee structure and competitive low-interest rates.

- P.A.: Features a competitive 11.99% p.a. variable rate.

- Other Fees: When engaging in a cash advance, you’ll encounter a fee determined by the higher value between $3 or 3% of the cash advance amount. Additionally, international transactions carry a 3% fee, although this is mitigated by the card’s 100% Australian ATM fee rebate.

ING Orange One Low Rate: What can you expect?

So, get ready for an in-depth exploration as we delve into our comprehensive review of the ING Orange One Low Rate, uncovering the features and benefits associated with this credit card.

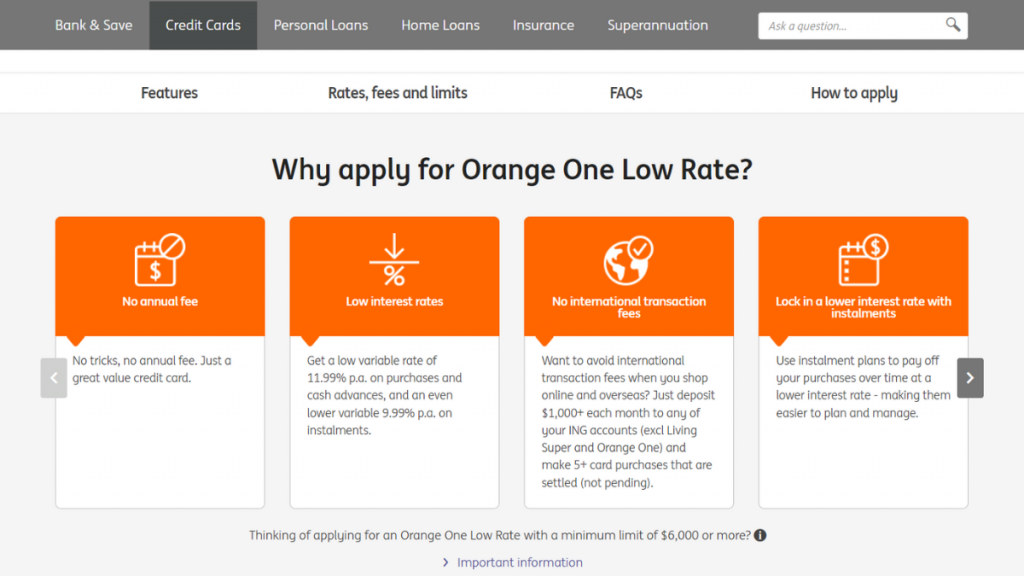

As your financial ally, it not only eliminates the burden of an annual fee but also introduces a world of cost-effective spending.

Besides, the competitive 11.99% p.a. variable rate on purchases guarantees that each transaction seamlessly aligns with your budgetary considerations.

This card offers a lower 9.99% p.a. variable rate on installments, empowering you to manage and plan your payments more efficiently.

Moreover, those with a global lifestyle bid farewell to the stress of international transactions, as eligible customers enjoy zero ING International Transaction Fees.

Essentially transcending the conventional notion of a credit card, the ING Orange One Low Rate emerges as a meticulously crafted strategic financial tool designed to enhance and complement your lifestyle.

You will be redirected to another website

Do the pros outweigh the cons?

Anticipate a pragmatic and user-friendly analysis of credit as we explore the ING Orange One Low Rate in this review.

So, if you’re interested in applying, weigh the advantages and drawbacks below to make an informed decision.

Pros

- Absence of an annual fee;

- Variable rate on purchases and installments;

- Absence of ING International Transaction fees;

- Seamless integration with mobile payment systems;

- Benefit from a complete Australian ATM fee rebate.

Cons

- It is not the ideal choice for those seeking an extensive rewards program

- No introductory offer;

- Some users may incur foreign transaction fees;

- A yearly charge of $10 is applicable for each supplementary cardholder;

- Cash advance fees.

What are the eligibility requirements?

Firstly, individuals must be 18 or older, possess a valid proof of identification such as a driver’s license or passport, and earn a minimum annual income of $36,000 before tax.

Additionally, applicants must possess and consistently maintain an Australian residential address, showcasing a credit rating that harmonizes with ING’s established credit lending criteria.

Learn how to get the ING Orange One Low Rate

So, initiating the path to financial empowerment starts with a streamlined and effective online application process for the ING Orange One Low Rate credit card! Discover the steps to apply now.

Apply online

Follow these instructions to seamlessly navigate the application process and unlock the benefits of this cost-effective financial tool. You can do it in minutes!

- Visit the website: Start by visiting the ING website. Subsequently, navigate to the “Credit Cards” section in the menu and choose the ING Orange One Low Rate for an in-depth review.

- Application process: Once the page has loaded, proceed by scrolling down and selecting the “Start application” button to begin the application process. Then, fill out the form with accurate personal and financial details.

- Further, submit and await response: Review all provided information to ensure accuracy and submit the application. You will receive confirmation of the application status, indicating whether it has been approved.

- Approval: Following a successful approval, anticipate the arrival of your ING Orange One Low Rate credit card within a timeframe of 5 to 7 business days.

What about a similar credit card? Check out the American Express Velocity Escape!

Exploring credit card alternatives for a more tailored financial experience? Then, consider the American Express Velocity Escape as a compelling option with a unique focus on travel rewards!

It provides not only a streamlined spending experience but also the excitement of accumulating points for future getaways. Intrigued? Then see a comprehensive review on this credit card!

American Express Velocity Escape Review

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Trending Topics

See how to apply for the Progen Lending Solutions

Find out how to apply for the financing or refinancing you need with Progen Lending Solutions and get access to their customer service.

Keep Reading

HSBC Low Rate Card Review: Low-rate Advantages!

Learn how to uncover the financial freedom you deserve with the HSBC Low Rate Credit Card in this review. Apply online in just 10 minutes!

Keep Reading

See how to apply for the ANZ Rewards Black Credit Card

Get all the information you need to know n how to apply for the ANZ Rewards Black Credit Card. Find out how easy it is to apply now!

Keep ReadingYou may also like

See how to apply for the Australia Post Travel Platinum Mastercard®

Ready for your next adventure? Learn how easy it is to apply and use the Australia Post Travel Platinum Mastercard®.

Keep Reading

ANZ First Credit Card: Effortless Financial Control!

Unlock the benefits of the ANZ First Credit Card to make an informed choice! Learn about its robust security, flexible payments, and more!

Keep Reading

ING Orange One Rewards Platinum Review: Cashback Bliss!

Discover the perks of the ING Orange One Rewards Platinum in this review. Your spending just got more rewarding!

Keep Reading