Credit Cards (AU)

ING Orange One Rewards Platinum Review: Cashback Bliss!

Earn up to $360 cashback annually, enjoy low-interest rates, and travel worry-free with complimentary international insurance of the ING Orange One Rewards Platinum. Learn more!

Advertisement

Gain a 1% cashback on qualifying purchases!

When you review the ING Orange One Rewards Platinum card, you’ll unlock a new chapter in your financial journey. After all, this is where smart spending meets exceptional rewards!

Beyond being just a credit card, the ING Orange One Rewards Platinum is your gateway to a world of benefits that transform the way you view every purchase. So, get ready to reimagine your financial landscape!

- Credit Score: A favorable credit history is typically advisable.

- Annual Fee: This card comes with a yearly fee of $149.

- Intro offer: N/A.

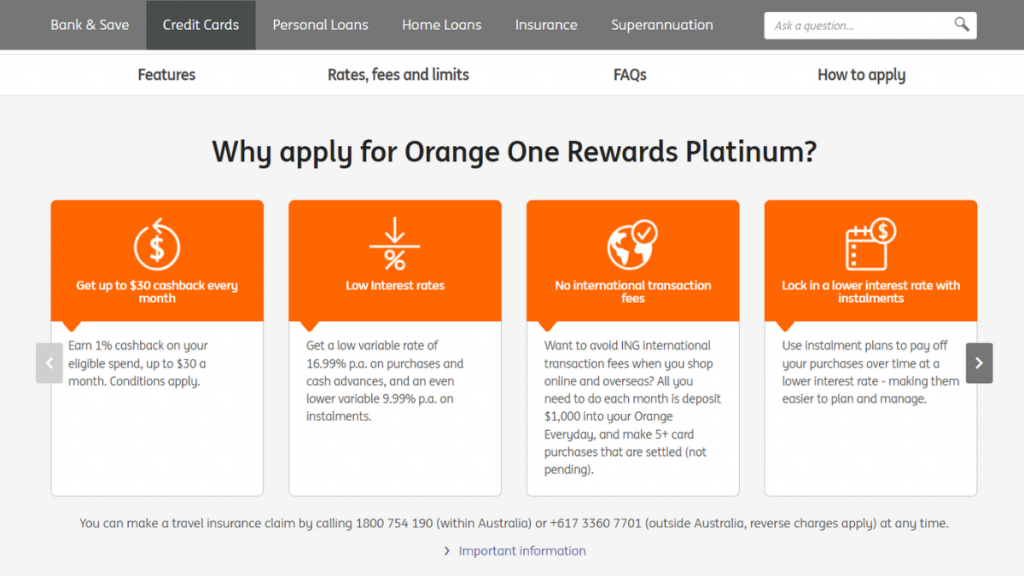

- Rewards: Accumulate a yearly cashback of up to $360 through a simple 1% cashback on qualifying expenditures. No complicated points systems or redemption hassles.

- P.A.: Benefit from a modest variable rate set at 16.99% p.a. for both purchases and cash advances. Plus, you get an even more attractive variable rate of 9.99% p.a. for installments.

- Other Fees: While a cash advance fee applies, the card ensures clarity with a straightforward structure.

ING Orange One Rewards Platinum: What can you expect?

Embrace a credit card experience like no other in this review of the ING Orange One Rewards Platinum. This financial companion goes beyond the conventional!

Firstly, this card not only rewards you with up to $360 cashback annually but also opens the door to a world of travel benefits and a competitive 1% cashback on eligible purchases.

Whether you’re making everyday purchases or opting for installment plans, the ING Orange One Rewards Platinum ensures that your financial journey unfolds at your own pace.

This card highlights an attractive variable rate of 16.99% p.a. This goes for both purchases and cash advances.

Besides, coupled with an even more appealing 9.99% p.a. for installments, it offers the flexibility essential for efficient financial management.

You will be redirected to another website

Additional Features

Although the card allows you to shop online and overseas without international transaction fees, you need to deposit $1,000 into your Orange Everyday account monthly to enjoy this benefit.

Moreover, to unlock the benefit of fee-free international transactions, you must also complete 5 or more settled card purchases.

Furthermore, you receive complimentary international travel insurance when approved for a credit limit of $6,000 or more.

While the card does come with a $149 annual fee, its objective is to ensure a fee-friendly financial experience for users.

Do the pros outweigh the cons?

Though the ING Orange One Rewards Platinum provides a clear and hassle-free financial journey, it’s essential to review its advantages and disadvantages. This way, you can make the right decision!

Pros

- Earn up to $360 annually with a generous 1% cash back on eligible spending;

- Competitive variable rate of 16.99% p.a. on both purchases and cash advances;

- International Travel Insurance;

- Convenient mobile payments;

- Simplify your financial management with autopay.

Cons

- One consideration is the annual fee;

- Minimum monthly spending for a fee waiver;

- Cash advance fee;

- This card is currently unavailable for individuals who are self-employed.

What are the eligibility requirements?

Individuals aged 18 or older must present valid identification, encompassing items such as a driver’s license, passport, or Medicare card.

Besides, there’s an annual income requirement of $36,000 (before tax). Moreover, eligibility extends to Australian citizens, New Zealand citizens, or Australian permanent residents.

Learn how to get the ING Orange One Rewards Platinum

So, if you’ve decided the ING Orange One Rewards Platinum card is right for you, it’s time to review the steps necessary to apply for one.

This step-by-step guide will walk you through the seamless application process.

Apply online

Get ready to reimagine your credit card experience as we guide you through each step towards financial empowerment!

- Open an account: Firstly, if you don’t currently have an Orange Everyday account, you can easily begin the process of opening one as an essential component of your credit card application.

- Access the official website: Navigate to the official ING website to access the credit card application portal. Look for the ING Orange One Rewards Platinum card and click on the “Apply Now” button.

- Complete the form: Fill out the online application form with accurate and up-to-date information. Provide details such as personal information, financial status, and employment details.

- Review and submit: Once you’re done, submit your application and patiently await the bank’s approval.

- Receive your card: Upon approval, anticipate the arrival of your ING Orange One Rewards Platinum card in a few business days.

What about a similar credit card? Check out the American Express Velocity Escape Card!

So, for those seeking a unique and travel-centric alternative to the ING Orange One Rewards Platinum card, review the features and benefits of the American Express Velocity Escape!

With the Velocity Escape, your spending isn’t just about cashback, it’s about unlocking a world of travel possibilities. Explore the world of travel rewards and exclusive perks that await you.

American Express Velocity Escape Review

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Trending Topics

HSBC Low Rate Card Review: Low-rate Advantages!

Learn how to uncover the financial freedom you deserve with the HSBC Low Rate Credit Card in this review. Apply online in just 10 minutes!

Keep Reading

ANZ Rewards Black Credit Card review

Our ANZ Rewards Black Credit Card review has all you need to know about this extraordinary rewards program, from features and benefits.

Keep Reading

Citi Rewards Card review: Earn points for travel!

Read our Citi Rewards Card review and uncover all the details about its benefits, drawbacks, rates, and fees!

Keep ReadingYou may also like

ANZ Low Rate Credit Card review: No annual fee in the first year

Looking for a budget-friendly credit card with no hidden fees? Read our detailed ANZ low rate credit card review to learn more.

Keep Reading

St George Vertigo Card review: Get Savvy About Your Spending

Looking for a card that has a low rate on purchases and a low annual fee? This St George Vertigo Card review is worth looking into.

Keep Reading

ING Personal Loan Review: Make Your Dreams a Reality!

Enjoy a low fixed interest rate, no ongoing fees, and the freedom to pay it off faster. Discover the ING Personal Loan in this review!

Keep Reading