Credit Cards (AU)

ANZ Rewards Black Credit Card review

Ready to experience an incredible rewards program? Read our review of the ANZ Rewards Black Credit Card and find out all the features included in being a cardholder.

Advertisement

ANZ Rewards Black Credit Card: Unlock 2 points per $1 up to $5,000 and 1 point thereafter.

Ready to enjoy an amazing rewards program on your credit card? In this ANZ Rewards Black Credit Card review, we’ll go over all the features included in being a cardholder.

How to apply ANZ Rewards Black Credit Card

Learn how to apply for the ANZ Rewards Black Credit Card in our simple step-by-step guide and start reaping valuable rewards today!

- Credit Score: A good credit rating is necessary.

- Annual Fee: $375

- Intro offer: 180,000 extra points and $150 back on your new card when you spend $3,000 on eligible purchases within three months of card approval. Spend your bonus cash however you please.

- Rewards: Earn 2 Reward Points for every $1 spent on eligible purchases up to $5,000 in each statement period. After that, earn 1 Reward Point per $1 spent on eligible purchases above $5,000 per statement period.

- APRs: Purchase rate: 20.24% and Cash advance rate: 21.24%

- Other Fees: Cash advance fee Consumer: 3% (in Australia); 3% of the amount or $4, whichever is greater (for overseas); Commercial: 1.50% or $1.50, whichever is greater. A foreign transaction fee of 3% and minimum repayment of 2% or $25, whichever is greater.

If you’re looking for a way to take your credit card rewards to the next level, then this card might be what you’re after.

Combining exceptional value with many features and perks, this reliable credit card offers frequent flyers and customers who regularly spend the chance to make their spending work for them with exclusive rewards.

Read on for an ANZ Rewards Black Credit Card review to find out if this card is right for you!

ANZ Rewards Black: What can you expect?

Upgrade your card game with ANZ Rewards Black. Enjoy a generous sign-up bonus of 180,000 ANZ Reward Points and $150 back when you spend $3,000 on eligible purchases within the first 3 months.

Earn a remarkable 2 points per $1 up to $5,000 and 1 point per $1 thereafter. Redeem your points for flights, merchandise, gift cards, cash back, and more.

Plus, receive complimentary travel insurance, rental vehicle excess insurance, extended warranty insurance, and purchase protection insurance.

With 55 days interest-free on purchases and compatibility with your favorite payment systems, this card will impress. ANZ Rewards Black review? More like ANZ Rewards Black rave!

You will be redirected to another website

Do the pros outweigh the cons?

Explore our ANZ Rewards Black Credit Card review to determine whether the benefits outweigh potential drawbacks. Gain valuable insights and make an informed decision.

Pros

- 180,000 Reward Points and $150 cashback when meeting the spending requirements;

- 2 points per $1 up to $5,000 and 1 point per $1 thereafter;

- Uncapped ANZ Reward Points;

- Complimentary International and Domestic Travel Insurance;

- Up to 55 days interest-free on purchases.

Cons

- There is a $65 annual fee for additional cardholders;

- High annual fee.

What are the eligibility requirements?

To apply for this card, you must meet certain criteria. You must be at least 18 years old and have good credit without recent applications for multiple credit cards.

Additionally, you must be a permanent Australian or non-permanent resident with more than 9 months remaining on your visa.

Before applying, make sure you have your personal details on hand to complete the online application.

Learn how to request the ANZ Rewards Black Credit Card

In our upcoming post, discover how to apply for the ANZ Rewards Black Credit Card easily! Simply click on the link below to learn more.

How to apply ANZ Rewards Black Credit Card

Learn how to apply for the ANZ Rewards Black Credit Card in our simple step-by-step guide and start reaping valuable rewards today!

Trending Topics

Qantas Premier Platinum Credit Card review: Enjoy Premium Travel Benefits

Discover all the perks and potential savings of the Qantas Premier Platinum Credit Card in our review. Get a full breakdown here.

Keep Reading

See how to apply for the ANZ Rewards Black Credit Card

Get all the information you need to know n how to apply for the ANZ Rewards Black Credit Card. Find out how easy it is to apply now!

Keep Reading

Citi Rewards Card review: Earn points for travel!

Read our Citi Rewards Card review and uncover all the details about its benefits, drawbacks, rates, and fees!

Keep ReadingYou may also like

ANZ Low Rate Credit Card review: No annual fee in the first year

Looking for a budget-friendly credit card with no hidden fees? Read our detailed ANZ low rate credit card review to learn more.

Keep Reading

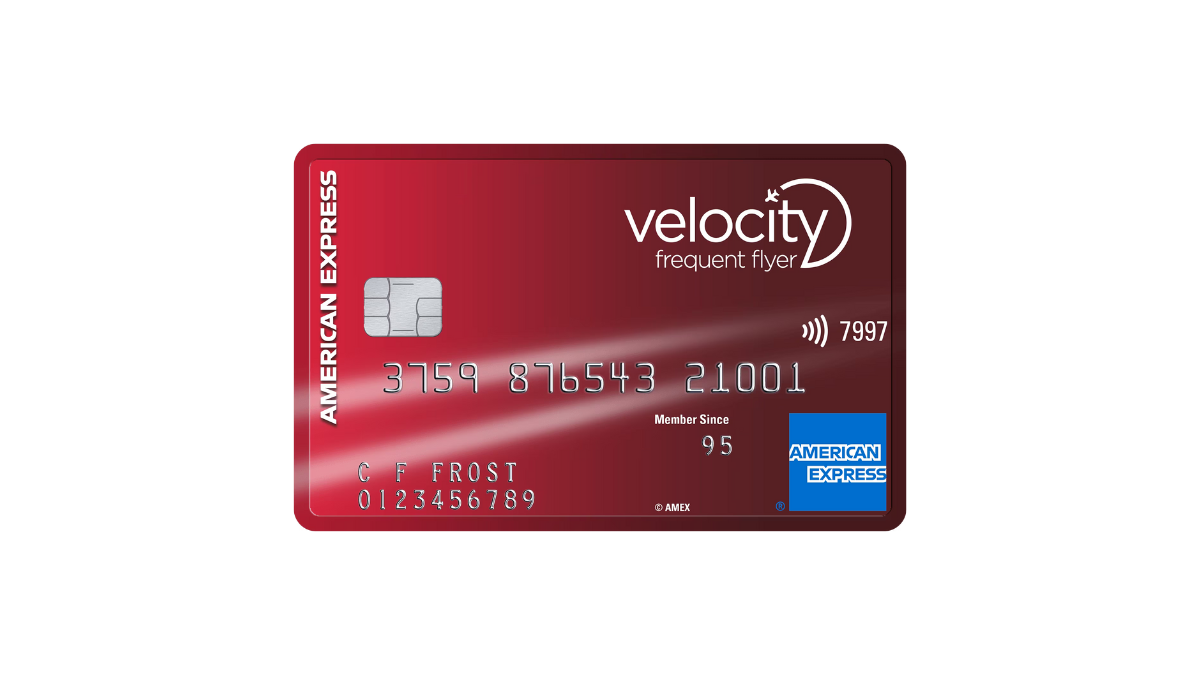

American Express Velocity Escape Review: up to 1.75 points on purchases!

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Keep Reading

How to apply for The Qantas American Express Ultimate Card

Ready to take the plunge and apply for your Qantas American Express Ultimate Card? Get lounge passes, travel insurance, and more.

Keep Reading