Uncategorized

Household Capital Loans review: Get the financing you need – no matter your age

Uncover why Household Capital Loans are the perfect solution for your high-interest rates. Get ready to unlock flexible loan options and take advantage of low-interest rates! Read our review today and upgrade your home loan game.

Advertisement

Household Capital Loans: Flexible payment options to suit every individual

Get ready to have your home loan game upgraded! Our Household Capital Loans review is the perfect way for you to take advantage of low-interest rates and unlock flexible loan options.

See how to apply for the Household Capital Loans

Looking to purchase your dream home? Here's how to apply for a Household Capital Loans and get the best interest rate possible.

Let’s kick those sky-high interest rates goodbye and find a new, more affordable home solution today!

- APR: 7.70% p.a. and a 7.73% p.a. comparison rate.

- Loan Purpose: Household loans, home equity, and other related purposes.

- Loan Amount: The loan amount depends on your home value, address, financial situation, etc.

- Credit Needed: N/A

- Terms: This loan offers flexible terms.

- Origination fee: You’ll need to pay an establishment fee (that includes conveyancing) of $950.

- Late Fee: A late fee will be charged if you don’t pay on time.

- Early Payoff Penalty: N/A

Get ready to take advantage of some remarkable products – Household Capital Loans offers low-interest rates and flexible loan options you won’t find anywhere else!

Moreover, these loans can easily be tailored to your needs – from those 60+ who are looking for a new home loan all the way up to investors searching for financial freedom.

With below-average interest compared to other lenders in their field, it’s no wonder why so many people choose them when they’re looking at taking out a mortgage or any type of substantial investment.

If this sounds like something right up your alley, check out our complete Household Capital Loans review!

Household Capital Loans: What can you expect?

Household Capital Loans offers an incredible option for retirees aged 60 and up to access the funds they need for their golden years with a reverse mortgage. One of the most popular equity release products!

Household Capital Loans provide incredibly good rates, such as a 7.70% variable p.a. and 7.73% p.a. comparison rate.

Along with personalized services and flexible terms for loan repayment tailored to your financial situation and other factors.

With these great features from Household Capital Loans, you can start setting up a secondary source of income, renovate the house, so it’s ready for retirement, or put aside some savings for emergencies.

All while enjoying the security that comes with this powerful equity release product! Read Household Capital Loans’ review to discover even more great options to ensure a comfortable retirement!

You will be redirected to another website

Do the pros outweigh the cons?

Are you looking for an awesome way to finance your needs? Household Capital Loans have covered you with personalized loan options and customized services!

So why not check out our pros & cons list below today and find out how this could be a great opportunity for you?

Pros

- You can find flexible terms and low-interest rates;

- Customized service is available;

- Easy online application.

Cons

- You’ll need to pay some establishment fees to use this lending service;

- There is no information about the credit score needed.

What are the eligibility requirements?

Not sure how good your credit score needs to be? While the lender won’t tell you exactly what number they’re looking for, having a higher one could get you access to much better rates and terms. So aim high if possible!

Learn how to request Household Capital Loans

Are you 60+ and looking to get a Household Capital Loan? Look no further! Applying is quick, easy, and can be done right from the comfort of your own home. Let us tell you all about it – read on for more info!

See how to apply for the Household Capital Loans

Looking to purchase your dream home? Here's how to apply for a Household Capital Loans and get the best interest rate possible.

Trending Topics

The American Express Explorer® Credit Card review

Get an in-depth review of The American Express Explorer® Credit Card and compare its features to find if it’s the right fit for you.

Keep Reading

Citi PayAll review: pay your bills and earn rewards

Read this Citi PayAll review to learn how it works and how you can earn rewards while paying your regular bills like taxes, rent, and more.

Keep Reading

The Low Rate Credit Card from American Express® review: An Easy Way To Save Money

Check out our in-depth The Low Rate Credit Card from American Express® review to see if it works for you. Learn more here.

Keep ReadingYou may also like

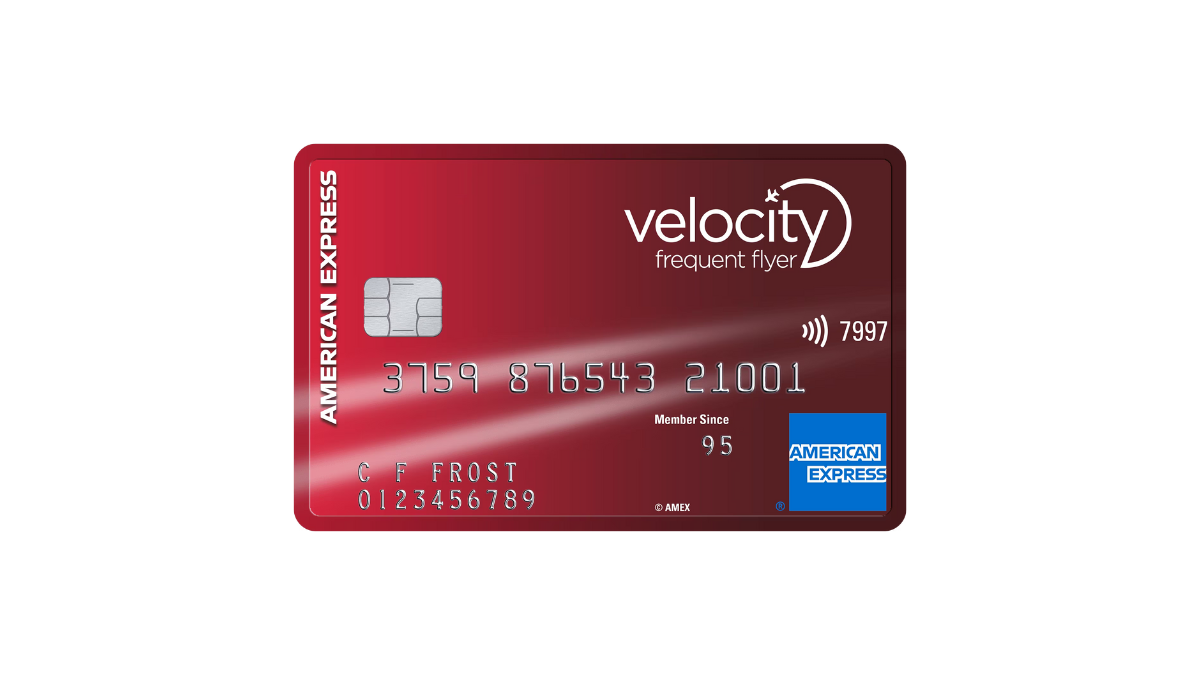

American Express Velocity Escape Review: up to 1.75 points on purchases!

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Keep ReadingThe News Stacker recommendation – Citi Rewards Card review

Unlock exclusive rewards and discounts when you sign up for a Citi Rewards Card. Find out how to get more from your spending today!

Keep Reading

ANZ Personal Loans Review: Get the Funds You Need!

Discover the flexibility of ANZ Personal Loans in this review! From tailored interest rates to same-day cash for in-branch applications.

Keep Reading