Finances

Learn how to close a bank account

Unsure of the process involved in closing a bank account? This guide walks you through every step, from canceling automatic payments to returning your credit cards.

Advertisement

The process might seem difficult, but preparation is key

There are a series of reasons why you would choose to close your bank account. Maybe you received a better offer, or maybe you’re moving to another country.

Whatever the reason may be, it requires some planning.

The reason is that your bank account is probably linked to a few services such as subscriptions, automated payments and more.

Besides, you need another account to hold your savings before you go. The process itself isn’t really that difficult.

Credit Card red flags you should be aware

Learn about the red flags you should watch out for when applying for a credit card. With so many offers available, it's important to know what to look for.

See how to properly close your bank account below

Closing a bank account is much easier than you’d think. In fact, it only requires a few simple steps.

Here is what you need to do in order to close your bank account and terminate your relationship with your bank.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Open a new account before you cancel the existing one

Before you end your relationship with your previous bank, it’s important to have a new account ready.

That way you can make sure you’ll have a place to transfer your funds as well as automatic payments and direct deposits.

Do a little research beforehand to find a bank account that will meet your financial needs. Most banks nowadays offer online applications.

Have all your documentation ready before you apply since most institutions require you to write down your personal information.

Redirect all direct deposits and automatic payments

Another important step you need to take before you close your bank account is to relocate your services. Make sure all your payments and deposits are linked to your new account. These include:

- Automatic transfers;

- Bill payments;

- Credit card payments and transfers;

- Direct deposits;

- Subscription services;

- Student loan payments.

If you close your old bank account without making these changes, it could lead to a lot of headache.

For instance, your direct deposit could be sent back to your employer, or the company might cancel your subscription services.

Transfer your funds to your new account

Once you’ve taken care of the first two steps, it’s time to transfer your funds to your new account.

However, make sure there are no pending transactions before you do that.

If you have an automated payment coming up, the bank might charge you with overdraft fees.

Check your contract to see if your old bank doesn’t require a minimum balance as well.

In case it does, leave just enough money to cover it so the institution can’t charge a maintenance fee before you close the account.

Call your bank

Finally, you’ll need to contact your old bank and let them know that you want to close the account.

Make sure to have the necessary information handy, such as your account number and any other documents they might require.

Depending on the bank’s policy, you may also need to sign a form or provide additional documentation.

After you close your account, it’s important to monitor your credit report for any unauthorized activity or errors.

This will help ensure that your personal information and finances remain secure.

Taking the time to close a bank account properly can help you avoid any potential issues down the road.

Can you cancel an inactive bank account?

Yes. The first step you need to take to close an inactive bank account is to contact your bank and inform them of your decision.

Depending on the type of account you have, there may be different steps in closing it.

For most types of accounts, you’ll need to make an appointment with a customer service representative at your bank.

During the appointment, you will need to provide proof of identification and request to end the account.

The representative may also ask for additional information such as why you are closing the account or how long it has been inactive.

Once your account is officially closed, you should receive a notification from the bank.

This notification is your proof of termination and should be kept in a safe place.

How can you close an overdrawn bank account?

Closing an overdrawn bank account is not difficult and only takes a few simple steps.

The most important thing to remember when closing the account is to also end any outstanding loans associated with it.

This will ensure that you are not responsible for paying any additional fees or charges that may have accrued while your account was overdrawn.

Once you’ve cleared any outstanding loans, you can close your bank account.

It is important to contact your bank directly and inform them that you would like to close it.

This will allow them to do it properly and ensure that all outstanding charges are settled.

Depending on your bank, they may require a written statement or other documentation to close the account.

Be sure to ask your bank if there are any additional fees that you need to take care of before you close your account.

If there are, make sure that you pay all of these charges. Then, you can close the account in good standing and avoid further financial penalties or complications.

Do you have to pay to close a bank account?

Typically, it doesn’t cost anything to close a bank account. However, if you owe money on the account or have an overdraft balance, you’ll have to solve this.

You’ll need to pay any fees associated with that first before being able to end your relationship with the bank.

Additionally, many banks will charge a fee for closing an account within a certain time frame. It’s always a good idea to check with your bank before closing an account.

That way, you’ll get the most up-to-date information on any applicable fees in doing so.

Although service charges are rare, you should also make sure you’re aware of any outstanding balance or pending transactions on your account before you end it.

This way, you can avoid any penalties or extra fees associated with not having sufficient funds in the account when a payment is due.

Closing a bank account doesn’t need to be hard or cost you a lot of money.

But knowing the potential costs beforehand will help ensure that the process goes as smoothly as possible.

How to choose the best bank for you?

When it comes to selecting the right bank for your needs, there are several factors to consider.

It’s important to research different institutions and their offerings in order to determine which one is best for you.

If you’d like some insight on how you can make that decision, we can help! Check out the link below for a few useful tips on how to pick the best bank for your finances!

How to choose the best bank for you?

You deserve the best bank to take care of your money. This post will tell you how you can choose the right option. Manage your money like a pro with the help of your bank

Trending Topics

See how to apply for the Delta SkyMiles® Reserve American Express Card

Looking to get more rewarding flights? Get your rewards faster and travel further when you apply for the Delta SkyMiles® Reserve Card.

Keep Reading

What is an HCOL area? Learn what it means

An HCOL area can be good or bad, depending on your lifestyle. The first step to finding out if it works for you is to read this post.

Keep Reading

The best mobile apps to watch NBA online!

Are you a die-hard NBA fan who needs to stay connected? Check out this review of the best apps to watch NBA games live online on your mobile.

Keep ReadingYou may also like

Creative ways to get your kids to eat their veggies

Do your children turn their noses up at vegetables? Here are some fun and creative ways to get your kids to eat their veggies.

Keep Reading

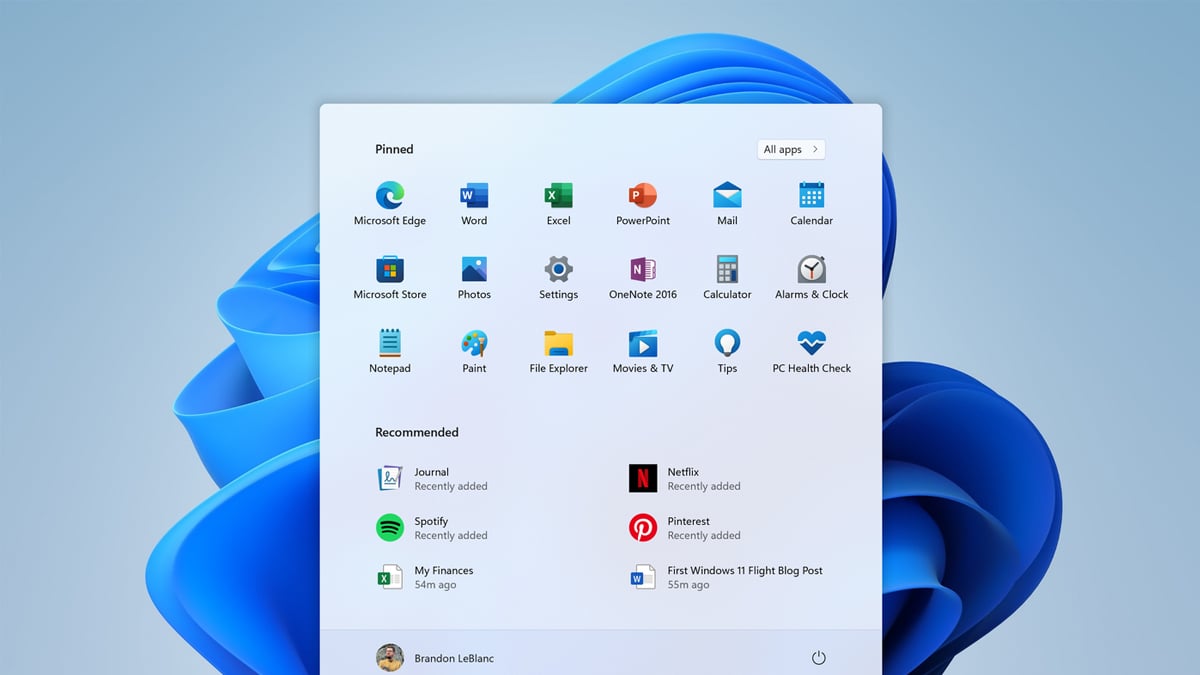

Change these Windows 11 settings to optimize your PC

Learn how to change a few Windows 11 default settings to optimize your computer’s potential, improve your security, and much more!

Keep Reading

How can you save with Evouchers?

Shopping just got smarter and more affordable! Learn how to save with evouchers and get tips and tricks to maximize your savings.

Keep Reading