Credit Cards (US)

Merrick Bank Secured Visa® review: Rebuild your credit the smart way

Looking to improve your credit score and take control of your financial future? Read this comprehensive review of the Merrick Bank Secured Visa® credit card and learn how to unlock a new level of financial freedom today.

Advertisement

Merrick Bank Secured Visa®: Get a secured line of credit up to $3000

Ready to repair or restore your credit? Read through this informative Merrick Bank Secured Visa® review today and take a step toward rebuilding your credit history!

See how to apply for the Merrick Bank Secured Visa

Are you looking for ways to rebuild your credit and get back on track? Read this post to learn how to apply for a Merrick Bank Secured Visa®.

- Credit Score: No Credit History is required

- Annual Fee: $36

- Intro offer: N/A

- Rewards: N/A

- APRs: 22.20% Variable

- Other Fees: 2% foreign transaction fee

Ready to rebuild your credit? Look no further than the Merrick Bank Secured Visa®!

With their specialized card, they understand that getting back on track with a poor history can be challenging – and they are here to help.

This Merrick Bank Secured Visa® review will provide more information so you can make an informed decision about how best to achieve financial stability in the long term.

Merrick Bank Secured Visa®: What can you expect?

Merrick Bank’s secured credit card is a smart choice for those looking to build or rebuild their credit.

With the option to choose your own line of credit ranging from $200 to $3000, you have the flexibility to manage your spending and payments.

Not only that, but this Visa also offers low-interest rates compared to other cards on the market, making it an excellent choice for money-savvy individuals.

Moreover, the worldwide ATM access and exclusive deals on travel, entertainment, and shopping provide added convenience and excitement in your daily life.

The cherry on top? Merrick Bank also protects its users against fraud liability and provides free monthly updates of your FICO score.

With all these perks, the Merrick Bank secured credit card is undoubtedly a great tool for building a solid credit history.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

With just a security deposit, you can have access to Visa privileges and the ability to create a positive credit history. It’s an exciting opportunity.

But will it be worth your while? Evaluate the pros and cons before taking advantage of this card in our Merrick Bank Secured Visa® review

Pros

- It helps you build or rebuild credit history since it reports to all three major credit bureaus;

- It offers access to FICO® Score each month for free;

- Also, it charges competitive and fair interest rates;

- It provides you with $0 Fraud Liability;

- It features exclusive deals on travel, shopping, and entertainment, offered by Visa;

- The credit line can be reviewed as the card is used responsibly.

Cons

- As a secured card, a security deposit is required;

- It charges a 2% foreign transaction fee;

- It charges an annual fee.

What are the eligibility requirements?

Having good credit is essential in today’s world, but it doesn’t have to be perfect! You can still apply for the Merrick Bank Secured Visa® even if you have bad credit or mistakes on your record.

But keep an eye out. Make sure not to start any new bankruptcies while working towards building up your history.

Learn how to request the Merrick Bank Secured Visa®

Reclaiming your financial future is possible with the Merrick Bank Secured Visa®, especially after this review! With this card, you can take control of rebuilding credit and start building a secure foundation for yourself.

Start pursuing sustainable long-term success – find out how to apply now!

See how to apply for the Merrick Bank Secured Visa

Are you looking for ways to rebuild your credit and get back on track? Read this post to learn how to apply for a Merrick Bank Secured Visa®.

Trending Topics

10 Tips on How to Choose The Perfect Eyelashes!

Take your beauty look to the next level! Learn tips to choose the perfect eyelashes for any look, from cute and natural to bold and dramatic.

Keep Reading

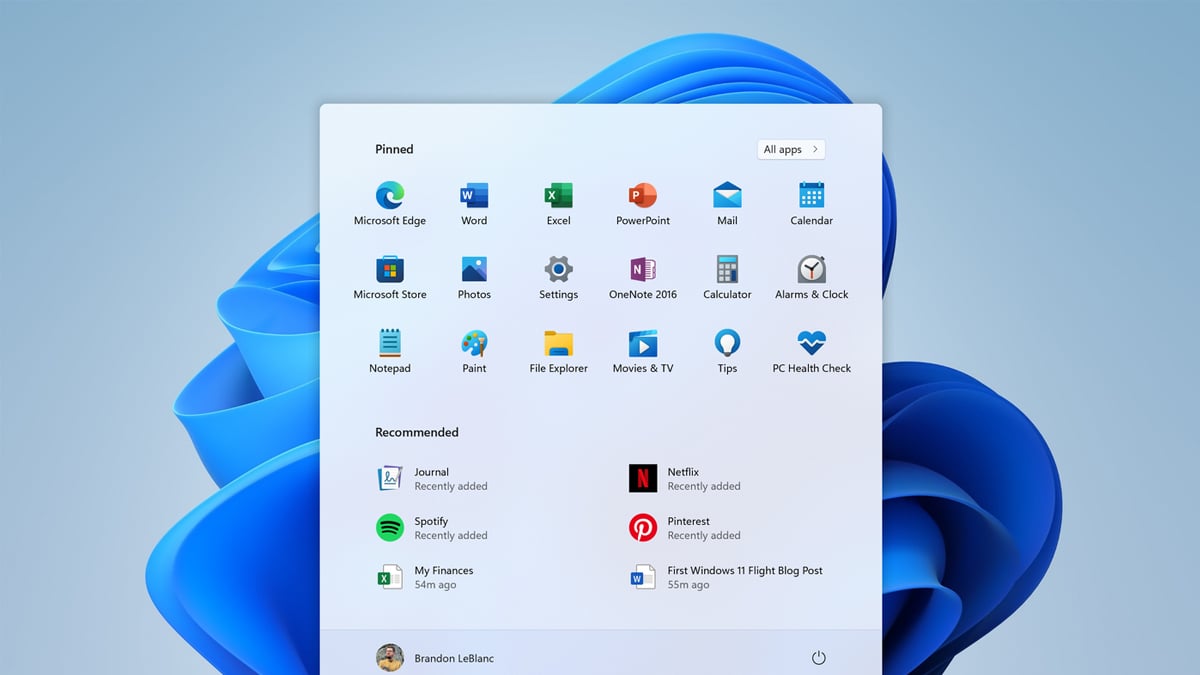

Change these Windows 11 settings to optimize your PC

Learn how to change a few Windows 11 default settings to optimize your computer’s potential, improve your security, and much more!

Keep Reading

World Bank “easier of doing business” ranking

Here are the top 10 countries with the best environment for businesses, according to the World Bank easier of doing business rankings.

Keep ReadingYou may also like

Youtube channels for gamers: the TOP 10

So you're looking for a great new youtube gaming channel to subscribe to?! We've got the top 10 youtube channels for gamers here.

Keep Reading

Ticketmaster under scrutiny after Taylor Swift’s tour tickets fiasco

The announcement of Taylor Swift’s “Eras Tour” exposed a number of issues regarding Ticketmaster and their ticketing system.

Keep Reading

What are the best foods for brain health?

Learn what are the best foods for good brain health to include in your diet that will improve your memory, reduce stress and more!

Keep Reading