Read on to see how to get your hands on money in a simple way!

Nedbank Personal Loan – Get a a loan and choose your repayment period!

Advertisement

Are you looking for a way to finance a big purchase or consolidate existing loans? Consider taking out a Nedbank personal loan. It’s easy, convenient and can help you save money in the long run. With flexible repayment options, individualized interest rates and no collateral needed, it’s one of the most affordable ways to get what you need without breaking the bank.

Are you looking for a way to finance a big purchase or consolidate existing loans? Consider taking out a Nedbank personal loan. It’s easy, convenient and can help you save money in the long run. With flexible repayment options, individualized interest rates and no collateral needed, it’s one of the most affordable ways to get what you need without breaking the bank.

You will remain in the same website

If you're thinking of applying for a Nedbank Personal Loan but don't know much about them yet – read on!

You will remain in the same website

With a Nedbank Personal Loan, you can bring your dreams to life – whether it be for an emergency or something more fun like taking the trip of a lifetime. It’s designed to help make those unexpected costs easy and manageable so that you’re able to enjoy all opportunities with confidence!

Nedbank takes more than just a credit score into consideration when you apply for a loan. Regardless of whether or not you are an existing client, your ability to make payments and manage loans with other providers is taken into account. So even if your credit score may be lower than expected, that doesn’t necessarily disqualify you from getting the loan!

Every month, you’ll pay off a portion of the amount borrowed, plus interest and fees. If insurance coverage is taken out with Nedbank, your monthly premium should also be included in what you owe!

Whether you’re looking to purchase a car, consolidate your debts, take a vacation, or something else entirely, a Nedbank Personal Loan can help.

Not only is it fast and convenient to apply for one directly with Nedbank online, but they also offer competitive interest rates so you don’t have to worry about breaking the bank. Learn how to apply below.

How to apply for the Nedbank Personal Loan?

Learn how to apply for a Nedbank personal loan and how this solution can help to cover all of your expenses.

The Woolworths Personal Loan is an incredibly flexible finance option that could be perfect for you if you’re looking for a convenient borrowing solution.

You can choose from loan amounts between R2,000 and R120,000 with repayment terms2 to 60 months. The best part is that the interest rate won’t change during the life of your loan, so you can plan your finances more effectively.

Follow the link below and learn how to apply now!

How to apply for the Woolworths Personal Loan

Learn more about how to apply for a Woolworths Personal Loan. And find the perfect solution for some extra cash fast.

Trending Topics

See how to apply for the TymeBank Credit Card

Find out everything you need to know about how to apply for a TymeBank Credit Card from TymeBank, including benefits and features offered.

Keep Reading

FNB Private Wealth Credit Metal Card review

Ready to take your credit card game up a notch? Check our FNB Private Wealth Credit Metal Card review, exclusive rewards and more.

Keep Reading

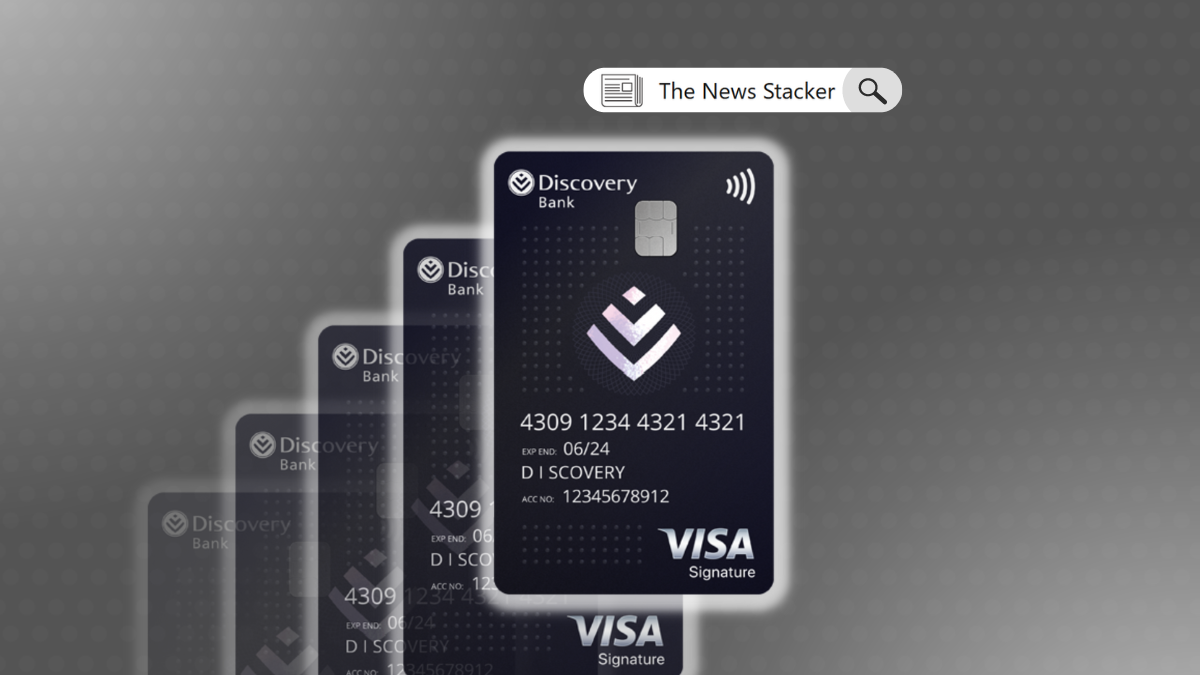

The Discovery Bank Black Card review

Ready to take your financial management to the next level? Check out this The Discovery Bank Black Card review.

Keep ReadingYou may also like

See how to apply for the FNB Gold Business Card

Applying for the FNB Gold Business Card is easy - follow this easy guide and you could be enjoying its benefits in no time!

Keep Reading

See how to apply for the FNB Private Wealth Credit Metal Card

Uncover a world of exclusive experiences with this card. Learn more about how you can apply for the FNB Private Wealth Credit Metal Card!

Keep Reading

Woolworths Black Credit Card review: Exclusive offer for high earners

Find everything you need to know about the Woolworths Black Credit Card in our review. This card offers great rewards and benefits

Keep Reading