Credit Cards (US)

Upgrade OneCard Review: New Level of Financial Freedom!

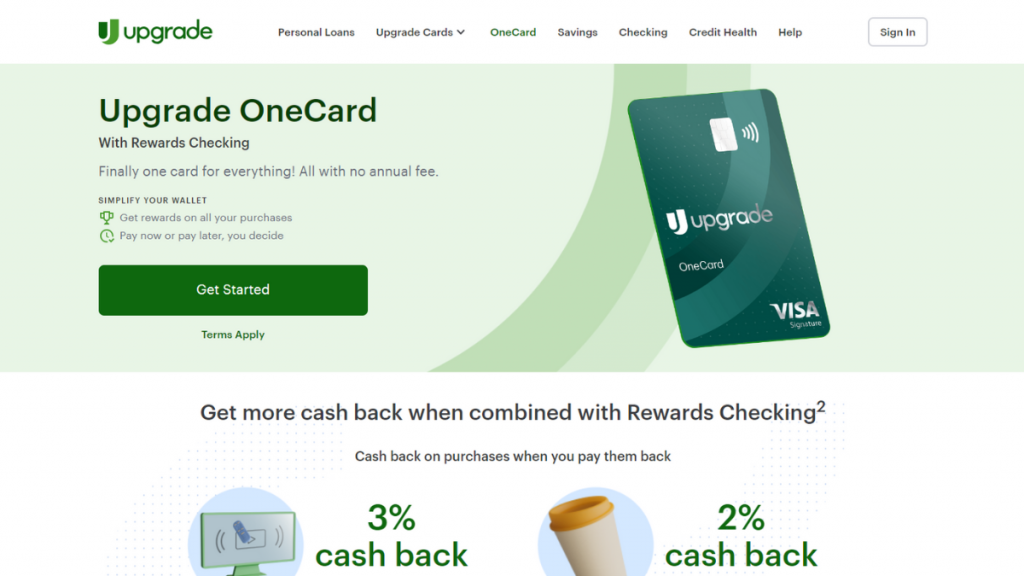

Your all-in-one solution for personalized spending is the Upgrade OneCard! Control your payments with Pay Now or Pay Later options and get extra spending power with chip-enabled contactless payment!

Advertisement

Enjoy up to 3% cash back, a $200 welcome bonus, and control over your spending!

If you’re on the lookout for a credit card that adapts to your financial lifestyle, then meet the Upgrade OneCard and learn how it can change the future of banking in this review.

When it comes to a personalized experience, the Upgrade OneCard brings a range of benefits to the table! So, keep reading and find out how you can unlock financial control with this credit card!

- Credit Score: Approval is possible for individuals with various credit histories.

- Annual Fee: This card stands out with its no annual fee feature.

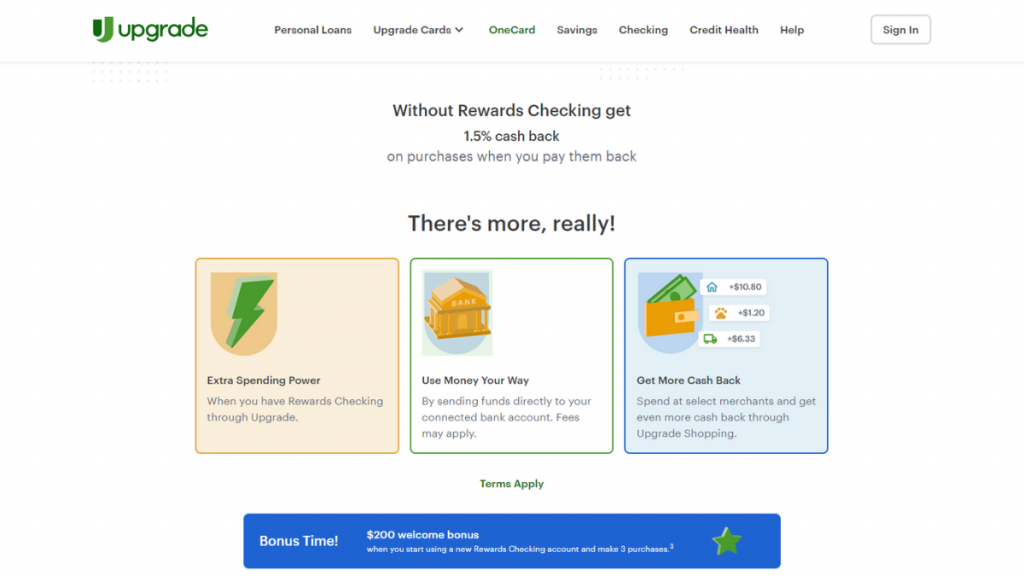

- Intro offer: Begin your experience with a generous $200 welcome bonus. Simply start using your new Rewards Checking Plus account and make 3 purchases within 60 days to claim this exciting offer.

- Rewards: This card offers 3% cash back for everyday purchases. Besides, you get a 2% cash back on other eligible purchases.

- APR: When you choose to Pay Later, the current APR for the Secured OneCard is 19.99%.

- Other Fees: N/A.

Upgrade OneCard: What can you expect?

Firstly, the Upgrade OneCard is designed to provide users with unparalleled flexibility and control over their spending, and you’ll learn all the features this card has to offer in this review.

With no annual fee, it offers a cost-effective solution for a diverse range of credit scores, making it accessible to a broad audience.

Moreover, the unique feature of Upgrade OneCard lies in its dual payment options: Pay Now and Pay Later. With Pay Now, you can make purchases without incurring any interest.

This provides a convenient way to handle short-term expenditures. On the other hand, the Pay Later option allows you to pay off your balances at a fixed rate over a fixed repayment term.

Moreover, this card goes beyond the conventional credit card by offering up to 3% cash back for everyday purchases. And, for all other transactions, you get 2%.

By linking your card to a Rewards Checking account, you unlock extra spending power and gain access to a higher rewards program.

Furthermore, the card’s compatibility with Upgrade Shopping powered by Dosh® enables users to earn up to 10% additional cash back on qualifying purchases, making every transaction more rewarding.

When it comes to convenience, the Upgrade OneCard features a chip-enabled, contactless design, allowing for fast, safe, and hassle-free payments. With these features, it stands as a versatile financial tool!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Although the Upgrade OneCard offers a wide range of benefits, it’s essential to review possible drawbacks as with any other financial tool. This will ensure you make an informed decision!

Pros

- Offers a unique and flexible payment system;

- Users can enjoy cashback rewards;

- Generous welcome bonus for new Rewards Checking Plus accounts;

- Extra cash back with Upgrade Shopping powered by Dosh®;

- Compatibility with Apple Pay® or Google Pay™.

Cons

- Pay Later option comes with an APR of 19.99%;

- Linking the Pay Now feature to an external deposit account may result in lower cash back rewards.

What are the eligibility requirements?

So, as you can see in this review, the Upgrade OneCard was designed to be inclusive, considering a diverse range of users for eligibility.

However, applicants should have a steady source of income and must be at least 18 years old. Besides, legal U.S. residency and a valid Social Security Number are also prerequisites.

Learn how to get the Upgrade OneCard

The application for the Upgrade OneCard is a seamless process that puts the power of choice and control back into your hands. So, keep reading to see a complete guide to apply online!

Apply online

Get ready to experience a credit card that adapts to your needs, offering flexibility and rewarding choices! Review this simple step-by-step and get your very own Upgrade OneCard!

- Visit the Upgrade website: Firstly, access the official website and click on “Upgrade Cards” on the main menu. Next, select the Upgrade OneCard.

- Start the application process: When the page loads, simply click on “Get Started”. will direct you to the secure application page where you can begin the process of obtaining your Upgrade OneCard.

- Provide information: Fill out the online application form with accurate and up-to-date information. This typically includes personal details, contact information, financial information, and, if desired, the option to open a Rewards Checking account for additional benefits.

- Submit the form: Once satisfied, submit your application. Then, await approval from Upgrade. Once approved, you can expect to receive your physical Upgrade OneCard within 7-10 business days.

What about a similar credit card? Check out the Pelican Pledge Visa Card!

When it comes to transparency and ease of use, the Pelican Pledge Visa Card is the right choice for your lifestyle. So, if you’re looking for an alternative to Upgrade OneCard, review this compelling option!

This card boasts a straightforward rewards program, offering cash back on all purchases without the need for complex calculations or rotating categories. Explore this alternative in a complete review.

Pelican Pledge Visa Card Review: Build Your Credit

Discover a smart way to build your credit while using your savings as collateral in this Pelican Pledge Visa Card review!

Trending Topics

See how to apply for the U.S. Bank Cash+® Visa Signature® Card

Learn how you can apply for the Cash+® Visa Signature® Card online and take advantage of an exclusive welcome bonus!

Keep Reading

See how to apply for the Delta SkyMiles® Reserve American Express Card

Looking to get more rewarding flights? Get your rewards faster and travel further when you apply for the Delta SkyMiles® Reserve Card.

Keep Reading

See how to apply for the Citi Premier® Card

Learn how to apply for the Citi Premier® Card and get all of the benefits that come with it, like bonus points and great travel rewards.

Keep ReadingYou may also like

Homeowners might have a tough time in 2023

Inflation and the high living costs are forcing many homeowners to consider downscaling or selling their homes altogether.

Keep Reading

What are the 4 most popular types of investments?

Want to invest but don't know where to start? Here are the four most popular types of investments and what makes them so great.

Keep Reading

Credit Card red flags you should steer clear of

Get the lowdown on the credit card red flags you should avoid at all costs when you’re in the market for a new plastic. Read on for more!

Keep Reading