Debit Cards (US)

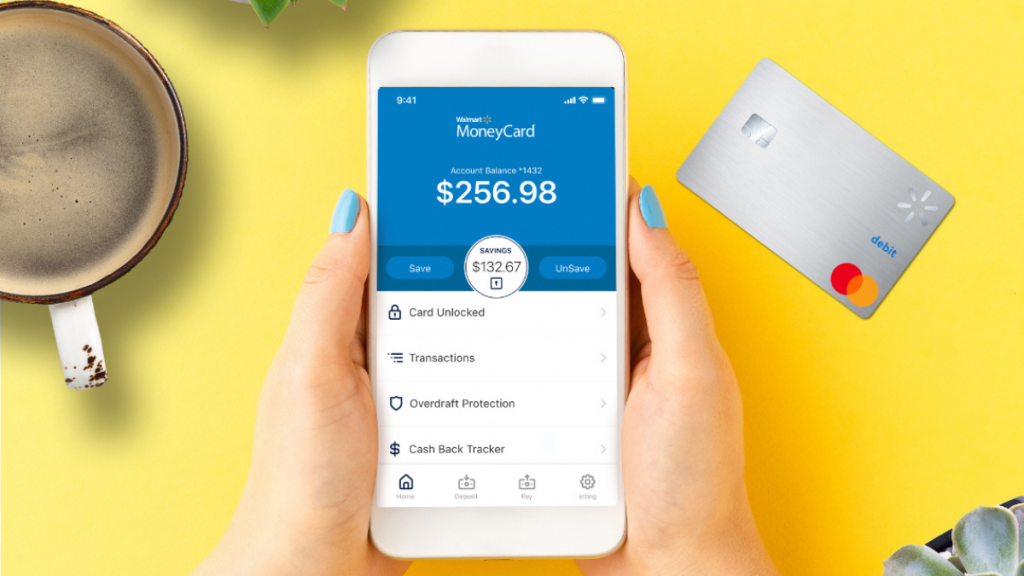

Walmart MoneyCard Review: Manage Your Money Hassle-free!

This prepaid card offers flexibility and savings. Learn how to register, deposit, and make the most of your money with the Walmart MoneyCard.

Advertisement

Unlock a world of benefits from cash back rewards to no-fee ATM withdrawals!

Unlocking a new era in financial convenience, this Walmart MoneyCard review delves into the features that make this prepaid debit card a game-changer for savvy shoppers.

Offering a unique blend of rewards, security, and flexibility, the Walmart MoneyCard stands out as the go-to choice for those seeking a seamless and efficient way to manage their money.

- Credit Score: None.

- Annual Fee: Embrace the perks of the card with a monthly fee of $5.94, a fee that gracefully bows out with a qualifying direct deposit of $500 or more every month.

- Intro offer: None.

- Rewards: By providing cash back percentages on transactions at Walmart.com, Walmart fuel stations, and Walmart stores, the card presents a clear and tangible avenue for users to accrue savings on their everyday expenditures.

- APR: Doesn’t operate with an APR.

- Other Fees: N/A.

Walmart MoneyCard: What can you expect?

Embark on a financial journey with the Walmart MoneyCard, review this prepaid debit card that redefines convenience and flexibility. This card caters to a broad audience by eliminating the need for a credit check.

Upon signing up, users step into a realm of practicality, relishing a monthly fee of $5.94 that effortlessly takes a backseat when met with a qualifying direct deposit of $500 or more each month.

Besides, one of the standout features of the Walmart MoneyCard is its robust rewards program. You can earn up to 3% cash back on purchases at Walmart.com.

Moreover, you get 2% back at Walmart fuel stations, providing a tangible incentive for routine spending. Want more? Then, you can get 1% at Walmart stores!

The cash back, up to $75 per year, is credited at the end of the reward year. In addition to its rewards program, the Walmart MoneyCard introduces innovative financial tools.

With up to $200 overdraft protection for eligible direct deposit users, the card provides a safety net for unexpected expenses.

When it comes to managing finances, the Walmart MoneyCard offers multiple avenues for convenience.

Users can deposit cash through the Walmart MoneyCard App, Walmart Rapid Reload™, MoneyPak, or by cashing checks at Walmart. It’s that easy!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

In essence, this card transcends the boundaries of a typical prepaid debit card, offering a comprehensive suite of features that cater to various financial needs.

While it’s essential to review the fee structure, the Walmart MoneyCard is a dynamic tool for those looking to take control of their financial journey. So, weigh the pros and disadvantages below!

Pros

- Experience the thrill of earning up to 3% cash back;

- Enjoy peace of mind with up to $200 overdraft protection;

- Early access to pay with ASAP Direct Deposit™;

- No credit check, no minimum balance;

- Deposit cash with ease.

Cons

- Certain services may come with associated fees;

- Foreign transaction fee;

- Acquiring the Walmart MoneyCard involves an initial purchase fee.

What are the eligibility requirements?

Firstly, the Walmart MoneyCard is designed for individuals aged 18 and older. Besides, the card demands online access, identity verification, and either mobile or email verification.

So, carefully review the criteria and make sure you’re eligible before applying for the Walmart MoneyCard.

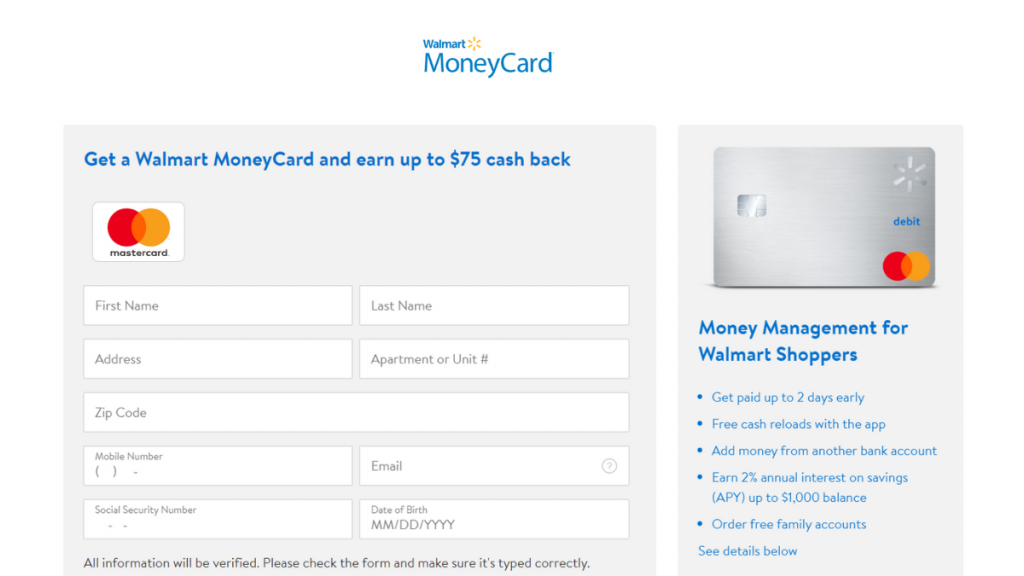

Learn how to get the Walmart MoneyCard

So, embarking on a journey towards financial convenience begins with a simple step, and that is obtaining the Walmart MoneyCard. But don’t worry! It’s a simple and straightforward process!

Apply online

Whether you’re enticed by its cash back rewards, seeking financial flexibility, or exploring a credit check-free payment solution, review the process of requesting your Walmart MoneyCard now!

- Visit the Walmart website: Firstly, go to the official Walmart website and click on the “Services” option on the main menu. Then. select “Money Services” and click on the Walmart MoneyCard option.

- Application: As soon as you access the card’s page, click on “Learn More” to start the process of requesting your personalized card.

- Provide information: To ensure a smooth request process, be prepared to provide essential information. This includes your name, address, date of birth, and more.

- Card purchase and activation: Once you’ve selected your card design and provided the necessary information, you may encounter a nominal purchase fee, typically around $1.00. This fee is a one-time cost for acquiring the Walmart MoneyCard.After purchase, you’ll need to activate your card online, which involves identity verification, including your Social Security Number (SSN).

- Loading funds: After activation, load funds onto your card using various methods like direct deposit, cash deposits, or transfers from other accounts, and enjoy!

What about a similar credit card? Check out the Brink’s Prepaid Mastercard®!

Looking for an accessible choice similar to the Walmart MoneyCard to review before you decide on the best option? The Brink’s Prepaid Mastercard® provides a long list of features to consider.

Enjoy direct deposit, mobile account management, and a fee structure designed to cater to various financial preferences. Discover if the Brink’s card aligns with your financial goals and preferences in the full review!

Brink's Prepaid Mastercard® Review

Unlock the power of Brink's Prepaid Mastercard® with this review. Get paid faster, earn rewards, and control your finances effortlessly.

Trending Topics

Is it possible to be rich being a Youtuber?

If it feels like everyone around you is becoming rich being a Youtuber, read this post to see how you can do it too.

Keep Reading

See how to apply for the Citi Clear Credit Card

Learn how to apply for the Citi Clear Credit Card! Enjoy perks such as cashback opportunities, and get access to many other privileges.

Keep Reading

Student loan debt forgiveness: Your ultimate guide!

In just a few weeks, the government will roll out a new student loan debt forgiveness program. Find out if you qualify and how to apply.

Keep ReadingYou may also like

10 Tips on How to Choose The Perfect Eyelashes!

Take your beauty look to the next level! Learn tips to choose the perfect eyelashes for any look, from cute and natural to bold and dramatic.

Keep Reading

Navy Federal Visa Signature® Flagship Rewards Review: Earn points

Chart a course to rewards by reading this Navy Federal Visa Signature® Flagship Rewards review! Earn points on travel!

Keep Reading

Get more fit with 15 minutes daily exercises

You don't need hours in the gym to see results. Check our tips to learn how to get more fit fast with just 15 minutes a day.

Keep Reading