Credit Cards (US)

US Bank Altitude® Go Secured Visa® Review: Secure Your Credit!

Elevate your credit journey with the Altitude® Go Secured Visa® from U.S. Bank. Earn points on dining, groceries, and more. Benefit from a $15 streaming credit and flexible payment options.

Advertisement

Enjoy points on everyday purchases, a $0 annual fee, and a $15 streaming credit!

The Altitude® Go Secured Visa® by US Bank is a credit card designed for those who need to build credit, and in this review, you’ll find out everything it has to offer.

So, get ready to step into credit-building with rewards! The US Bank Altitude® Go Secured Visa® offers an excellent rewards program, flexible redemption options, and even streaming credit.

So, if you’re on the lookout for a credit card option to build credit that also offers a wide range of benefits, consider the Altitude® Go Secured Visa® card. Check out the below and explore its features!

- Credit Score: It caters to those with fair credit score ranges, looking to rebuild their credit.

- Annual Fee: Enjoy this credit card without the burden of an annual fee.

- Intro offer: N/A.

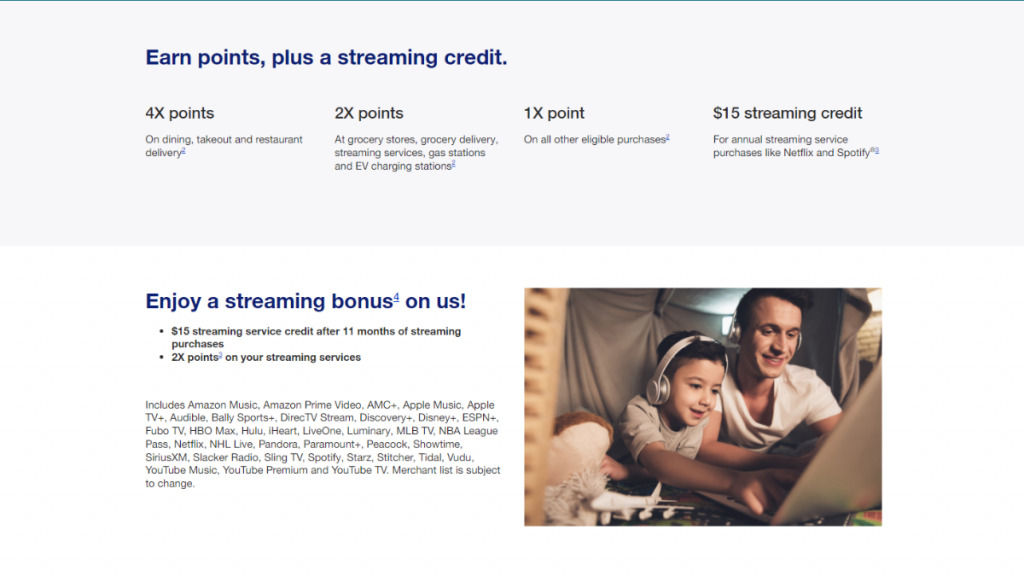

- Rewards: With this card, you get 4x points on dining. Besides, you get double the points on groceries, gas stations, and more. And finally, you get 1x point on all other eligible purchases. Additionally, if you complete 11 months of streaming purchases, you can enjoy a $15 streaming credit after.

- APR: 29.99%.

- Other Fees: This card charges 3% fees on Balance Transfers, 5% fees on Cash Advances, and up to $41 if you’re late for a payment.

US Bank Altitude® Go Secured Visa®: What can you expect?

As mentioned before in this review, the US Bank Altitude® Go Secured Visa® card is a powerful tool designed to help individuals build or rebuild their credit responsibly.

So, if you want to get this card, know that the process begins with a refundable security deposit, serving as both a commitment and collateral.

Then, a secure US Bank savings account safeguards your deposit, earning interest while you demonstrate responsible financial behavior.

Moreover, a standout feature is its $0 annual fee, liberating cardholders from unnecessary financial burdens.

Beyond its credit-building prowess, this card introduces a rewarding dimension to your everyday spending, adding delightful perks to your financial journey.

Finally, this card offers contactless payment options, customizable payment due dates, and the assurance of zero fraud liability. This makes it a holistic financial companion committed to your success.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

The journey of selecting a credit card involves careful consideration of both the advantages and disadvantages to make an informed decision.

So, this review wouldn’t be complete without presenting the main benefits and drawbacks of the US Bank Altitude® Go Secured Visa® Card. Keep reading to find out!

Pros

- Enjoy financial freedom without the burden of an annual fee;

- Turn everyday transactions into rewarding experiences with its Rewards Program;

- Freedom to choose your payment due date;

- Convenience and security with contactless payments;

- Stay informed about potential identity threats with ID Navigator.

Cons

- Credit limit is initially tied to the security deposit;

- The card’s secured nature means that it requires an upfront security deposit.

What are the eligibility requirements?

So, the Altitude® Go Secured Visa® is for individuals who are looking to build or rebuild their credit, making it more accessible to a broader range of applicants compared to traditional unsecured cards.

Learn how to get the US Bank Altitude® Go Secured Visa®

Now that you’ve explored all the details of the Altitude® Go Secured Visa® by US Bank, it’s time to learn how to apply finally. But don’t worry, the process is quite simple and you can do it in minutes!

Moreover, the application process serves as the gateway to unlocking a world of benefits, from credit-building opportunities to everyday rewards.

Apply online

So, get ready to pave the way for improved credit and financial well-being! Learn how to apply for the Altitude® Go Secured Visa® Card!

- Visit the US Bank website: Firstly, visit the US Bank website and navigate to the credit card section, where you can review the details of the Altitude® Go Secured Visa® Card.

- Start the application process: Before initiating the application, gather the necessary information, including your personal details, employment information, social security number, and financial details. Then, click on the “Apply Now” to start the process.

- Review and submit: Before submitting your application, carefully review the terms and conditions associated with the card. When you’re done, submit the form.

- Approval: You may receive an instant decision or, in some cases, a follow-up communication regarding the status of your application. If approved, await the arrival of your Altitude® Go Secured Visa® Card.

What about a similar credit card? Check out the Pelican Pledge Visa Card!

If you’re looking for an alternative credit card to US Bank Altitude® Go Secured Visa®, then review the Pelican Pledge Visa Card! This card was also crafted with a focus on aiding credit-building endeavors.

Starting with a reasonable security deposit, this card empowers users to rebuild their credit score while enjoying flexibility and other perks. So, discover more features and benefits in a complete review now!

Pelican Pledge Visa Card Review: Build Your Credit

Discover a smart way to build your credit while using your savings as collateral in this Pelican Pledge Visa Card review!

Trending Topics

Valuable things everyone might have and not know!

You may have some valuable things lying around your house and not even know it! Check out this list to see what you could be missing out on.

Keep Reading

Netflix’s ad-supported tier is coming in November

Netflix is finally rolling out its ad-supported tier plan in November! Read on to learn more about the service and how to subscribe to it.

Keep Reading

Wells Fargo Active Cash® Card review

Learn about all the perks and benefits of the Wells Fargo Active Cash® Card in our review and find out if it's the right card for you.

Keep ReadingYou may also like

See how to apply for the Amex EveryDay® Credit Card

Here's your step-by-step guide on how to apply for the Amex EveryDay® Credit Card. Learn about the eligibility requirements and more!

Keep Reading

Elon Musk is finally the official owner of Twitter

After months of “will they/won’t they”, Elon Musk finally bought Twitter. Learn more details about the deal and other important factors.

Keep Reading

Boost Platinum Credit Card review: Your Ticket to Financial Freedom!

Explore features, find hidden advantages, and see all the details about the Boost Platinum Credit Card in this review - bad credit accepted.

Keep Reading