Credit Cards (US)

Boost Platinum Credit Card review: Your Ticket to Financial Freedom!

Elevate your financial strategy with our Boost Platinum Credit Card! Our review dives deep into its offerings, ensuring you're in the driver's seat of your money journey. Discover why this card might be your financial game-changer!

Advertisement

Empower your wallet with insights from this credit card and get ready to supercharge your finances!

In this review of the Boost Platinum Credit Card, you’ll unravel a financial tool that breaks the mold. If you’ve been searching for a credit card experience that stands apart, you’re in for a treat.

Embark on a journey to explore the unique features, potential advantages, and any considerations to keep in mind when it comes to the Boost Platinum Credit Card.

Whether you’re a seasoned credit card pro or someone stepping into the world of plastic for the very first time, understanding what this card offers can be a pivotal moment in shaping your financial future!

- Credit Score: The Boost Platinum Card offers an opportunity for individuals with varying credit histories, even bad ones.

- Annual Fee: $177.24.

- Intro offer: None.

- Rewards: Rewards include discounts at My Universal Rx and privileges in Credit Hawk, My Roadside Protection, and My Legal Assistance.

- APRs: None.

- Other Fees: N/A

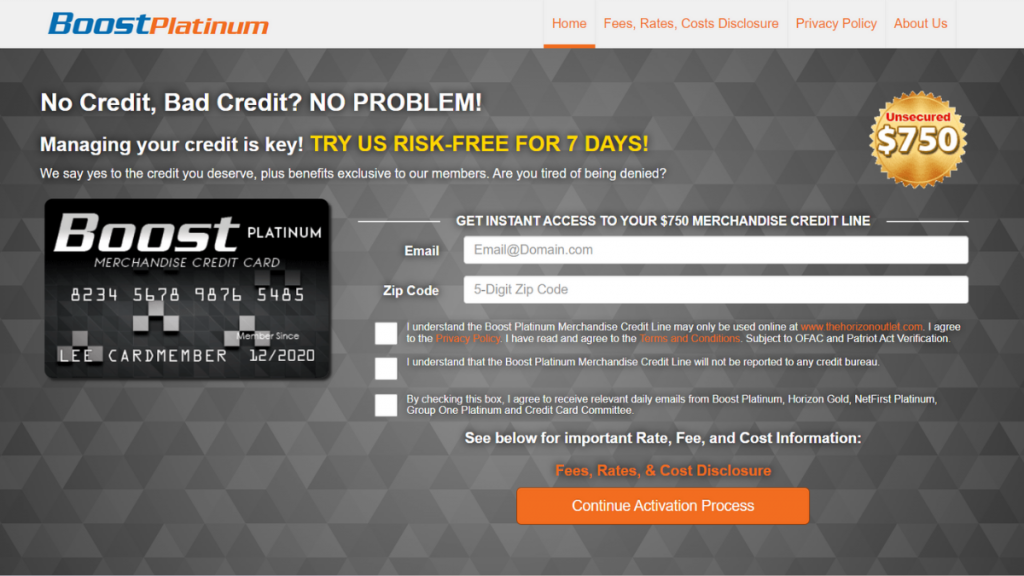

Boost Platinum Credit Card: What can you expect?

The Boost Platinum Credit Card is a financial tool that can empower individuals who may have limited or less-than-perfect credit histories.

With a focus on accessibility, the Boost Platinum Credit Card offers a remarkable feature and doesn’t require a specific credit score for approval, as you can see in the review.

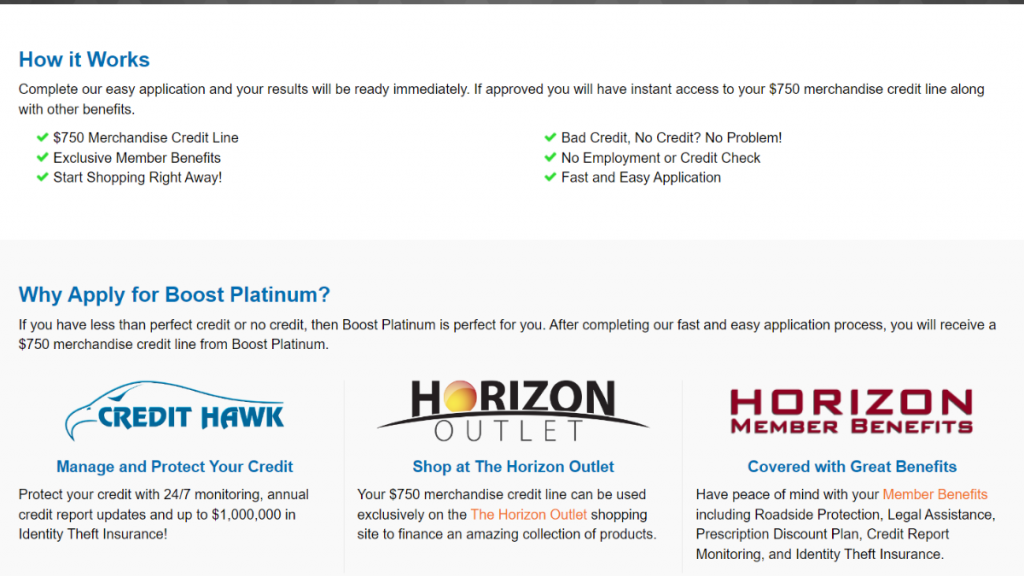

However, upon activation of your membership, the card provides a line of credit exclusively for purchases available through the Horizon Outlet Website.

So, it’s important to note that this line of credit is exclusive to this particular website, and you can’t use it elsewhere.

Moreover, the card also comes with a commitment to customer advocacy, ensuring you receive the care and attention you deserve.

In addition, it extends privileges in areas such as the Credit Hawk, My Universal RX Prescription Discount Plan, and My Roadside Protection Plan.

In summary, the Boost Platinum Credit Card is not just a credit card but a financial ally for those seeking to improve their credit standing or embark on their credit journey.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

So, are you considering this card for your financial journey? In this exploration beyond our Boost Platinum Credit Card review, we’ll delve into the advantages and drawbacks of this unique financial tool.

Then, by the end of this discussion, you’ll have a comprehensive understanding of whether this card aligns with your financial goals and lifestyle. See the pros and cons below!

Pros

- Credit accessibility;

- $750 merchandise credit line upon activation;

- Exclusive member privileges, including credit monitoring and prescription discounts;

- Hassle-free application process;

- Dedicated Customer Advocacy department.

Cons

- Annual membership fee;

- Exclusive usage on the Horizon Outlet Website;

- Limited credit line;

- Specific terms, conditions, and features of the card can change over time.

What are the eligibility requirements?

So, are you interested in applying for the Boost Platinum Credit Card after this review? Firstly, you should be at least 18 years old and a U.S. resident with a valid Social Security Number.

While this card is designed to cater to individuals with limited or less-than-perfect credit, certain credit-related criteria may still apply during the application process.

Learn how to get the Boost Platinum Credit Card

Ready to embark on your financial journey with this card? See the step-by-step to secure this unique financial tool, offering a glimpse into what you can expect after our Boost Platinum Credit Card review.

Apply online

This is a straightforward process that allows you to get the Boost Platinum Credit Card from the comfort of your home!

- Visit the website: Start by visiting the official Boost Platinum Credit Card’s website. This is your gateway to the online application.

- Personal particulars: You’ll be asked to furnish your personal details, such as your email and Zip Code.

- Activation process: Check the boxes to agree with Privacy Policies and Terms and Conditions. Once you’re done, click on “Continue Activation Process”.

- Activate your power card: Once your application is approved, your very own Boost Platinum Credit Card will find its way to your mailbox.

What about a similar credit card? Check out the Milestone® Mastercard® Credit Card!

Although the Boost Platinum Credit Card is your gateway to credit without the usual barriers, you should review the Milestone® Mastercard® Credit Card as this is another compelling credit card choice.

After all, it also provides a pathway to credit access, but with a myriad of benefits and rewards. Plus, as this is a Mastercard, it grants you the flexibility to use it extensively for your shopping needs!

So, what are you waiting for? Explore our comprehensive Milestone® Mastercard® Credit Card review below! It’s a chance to weigh your options and make an informed decision about your credit card choice.

How to apply for the Milestone® Mastercard® Credit

Ready to get a credit card that can help you build your credit? Check out how easy it is to apply for the Milestone® Mastercard® Credit Card!

Trending Topics

The pathway to success: 8 steps to get where you want

If you have a goal to reach, you'll need to work for it. This post will teach you 8 steps to walk the pathway to success and accomplish it.

Keep Reading

See how to apply for the Discover it® Cash Back Card

Learn how to apply for the Discover it® Cash Back Card in a few easy steps and start earning cash back on every purchase you make!

Keep Reading

Analyze your Spotify data with these websites

Do you really know your music taste? Check out these websites that analyze your Spotify data to see what your favorite music says about you.

Keep ReadingYou may also like

What is the best type of loan for you?

If you are considering taking out a loan, it can be overwhelming to navigate the options. This blog post will show you the best type of loan.

Keep Reading

8 best credit cards for traveling: upgrade your trip with awesome perks!

Looking to get more out of your next trip? Check out our list of the best credit cards for traveling with rewards and perks.

Keep Reading

See how to apply for the Citi Custom Cash℠ Card

If you’re ready to enter a new world of cash back rewards, check out how you can easily apply for the Citi Custom Cash℠ Card online!

Keep Reading