SA

African Bank Personal Loan review

This comprehensive review of the African Bank Personal Loan covers interest rates, fees, and what you can use the loan for. Read on to find out if this product is right for you.

Advertisement

African Bank Personal Loan: Take a big step towards your financial goals!

Are you searching for a loan that meets your financial needs? Then you’ll want to take a look at this comprehensive African Bank Personal Loan review.

How to apply for the African Bank Personal Loan

Learn how to easily and quickly apply for an African Bank Personal Loan. Get the cash you need in just a few simple steps.

With its easy online application process, competitive interest rates and flexible repayment options, this personal loan has become an increasingly popular choice amongst South Africans looking to manage their debts more efficiently.

- Interest Rate: From 15% to 24.50% based on your credit risk profile.

- Loan Purpose: You can request this loan for any purpose you may have.

- Loan Amount: You can request from R2,000 to R350,000.

- Repayment Terms: Between 7 and 72 months.

- Credit Needed: You need a healthy credit score to request this loan.

- Initiation Fee: Personalised according to your loan amount and terms.

You can borrow up to R350,000 with interest rates as low as 15% and repayment terms up to 72 months. With fixed monthly installments, you’ll know exactly how much you’ll repay every month.

In this African Bank Personal Loan review, we take a look at all this provider has to offer to help you make the best decision for your finances.

So if you’re in need of cash and looking for an affordable solution with great benefits, then read on!

African Bank Personal Loan: What can you expect?

African Bank offers Personal Loans that are tailored to meet your needs. Whether you’re looking for financial assistance with a home renovation, wedding expenses or just a bit of extra cash, they could be the perfect solution.

The bank is dedicated to giving you fast and friendly service so that you can get your finances in order quickly and easily.

African Bank understands that your time is valuable, so they make their loan application process simple and straightforward.

African Bank’s personal loan is also incredibly flexible. You can choose the term of repayment that best suits you, from a few months up to six years, with the option to pay weekly, fortnightly or monthly installments.

They also offer competitive interest rates, so you can be sure that the loan you take out is affordable and manageable. African Bank’s personal loans are a great way to get the funds you need fast, and you can customize it up to R350,000!

You will be redirected to another website

Do the pros outweigh the cons?

Before signing up for the loan, it’s important to know what African Bank has to offer and if its pros outweigh the cons. Read our African Bank Personal Loan review to learn more about the loan and if it’s right for you.

Pros

- Customisable loans up to R350,000 with flexible repayment terms;

- Fixed monthly installments;

- Intuitive mobile app so you can easily manage your account;

- Easy and quick online application – get a response in minutes!

- Credit Life Insurance to protect you against life’s unexpected events.

Cons

- Depending on your credit profile risk, you could end up with a high annual percentage rate on your personal loan.

What are the eligibility requirements?

To become eligible for a personal loan with African Bank, you need a good credit record. You also need to be a South African resident over the age of 18 and have a valid ID.

You’ll need to provide proof of income (payslips and bank statements) of your last 3 salaries, and a recent proof of residence.

Learn how to request an African Bank Personal Loan

If you’ve made it this far in our African Bank Personal Loan review, now it’s time to learn how you can apply for it.

The process is simple and you can do it completely online! Check out the following link to learn how to do so and what you can expect from it.

How to apply for the African Bank Personal Loan

Learn how to easily and quickly apply for an African Bank Personal Loan. Get the cash you need in just a few simple steps.

Trending Topics

Woolworths Black Credit Card review: Exclusive offer for high earners

Find everything you need to know about the Woolworths Black Credit Card in our review. This card offers great rewards and benefits

Keep Reading

See how to apply for the Absa Flexi Core Credit Card

Unlock the potential of your finances and apply for a Absa Flexi Core Credit Card. And get added extras such as cashback.

Keep Reading

See how to apply for the Absa Student Credit Card

Learn how to apply for the Absa Student Credit Card and begin your credit-building journey on the right foot. Read on for more!

Keep ReadingYou may also like

British Airways Credit Card review: Take off on a journey of luxury and convenience

Looking for an amazing way to get exclusive bonuses? Our British Airways credit card review can help turn your travel dreams into reality.

Keep Reading

Super Value Titanium Card Review: Fuel Your Savings!

Navigate everyday expenses with ease! Discover how the Super Value Titanium Card can give access to cashback on utilities!

Keep Reading

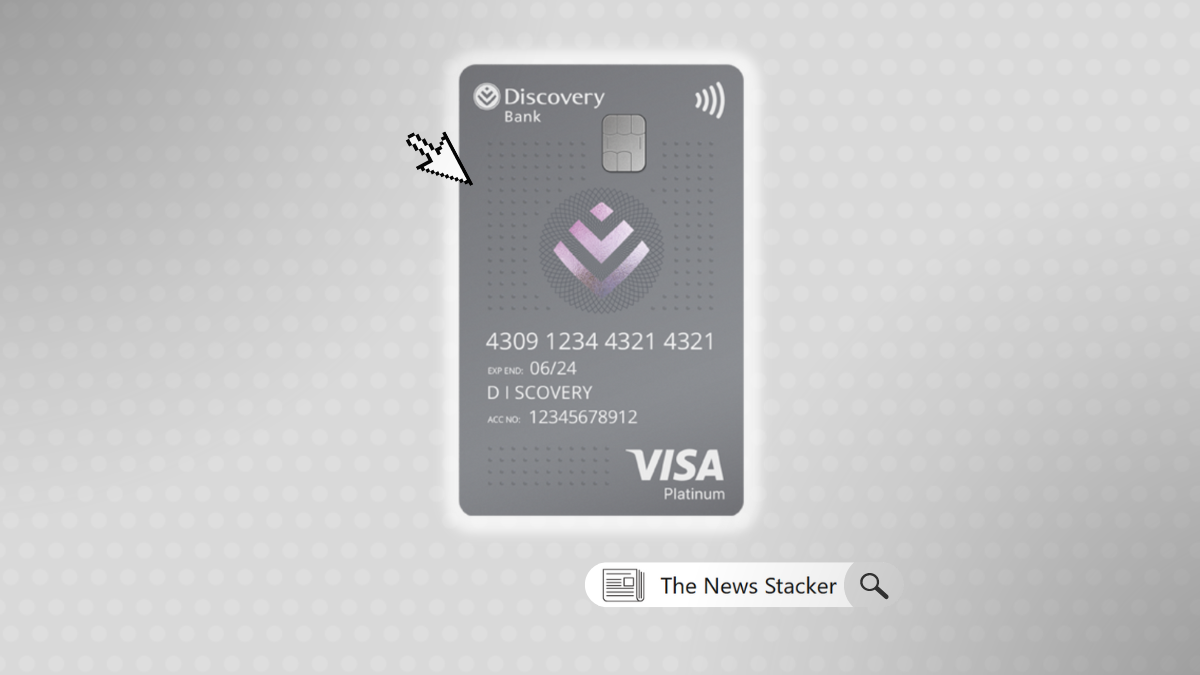

See how to apply for the Discovery Bank Platinum Card

You can now apply for the Discovery Bank Platinum Card and enjoy amazing lifestyle rewards, shopping deals, and more!

Keep Reading