Credit Cards (SA)

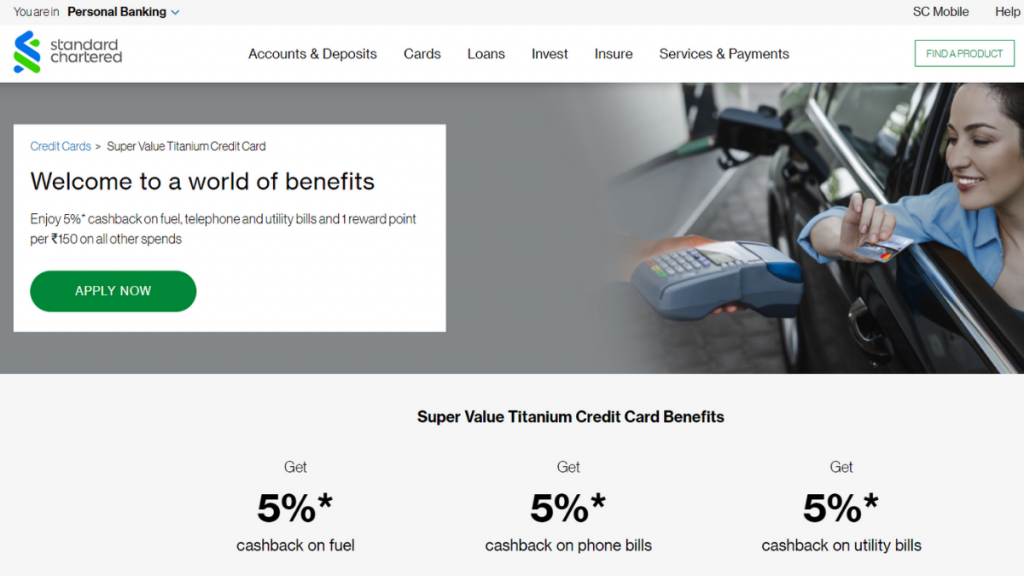

Super Value Titanium Card Review: Fuel Your Savings!

From 5% cashback on fuel to rewarding utility payments, discover why the Super Value Titanium Card is your key to smart spending! Experience the power of financial convenience!

Advertisement

Dive into a realm of cashback on essential expenditures, coupled with an amazing rewards program!

When choosing your next credit card, it’s essential to explore features, benefits, and unique propositions. So, if you’re interested in applying for the Super Value Titanium Card, get ready for a full review!

Whether you seek to save on everyday expenses, explore a world of rewards, or indulge in the exclusive benefits reserved for Premium Banking Customers, this card is as a key to financial empowerment.

- Credit Score: As this is a premium card, it’s recommended to have a good to excellent score to apply.

- Annual Fee: INR 750.

- Intro offer: N/A.

- Rewards: Enjoy a robust 5% cashback on fuel, phone bills, and utility payments. This feature transforms the card into a practical choice for your everyday expenses. Moreover, each expenditure of INR 150 on non-specified purchases earns you 1 reward point.

- P.A.: N/A.

- Other Fees: N/A.

Super Value Titanium Card: What can you expect?

Firstly, when you review the Super Value Titanium Card from Standard Chartered you might find the answer to substantial savings on daily expenses. So, let’s delve into its standout features.

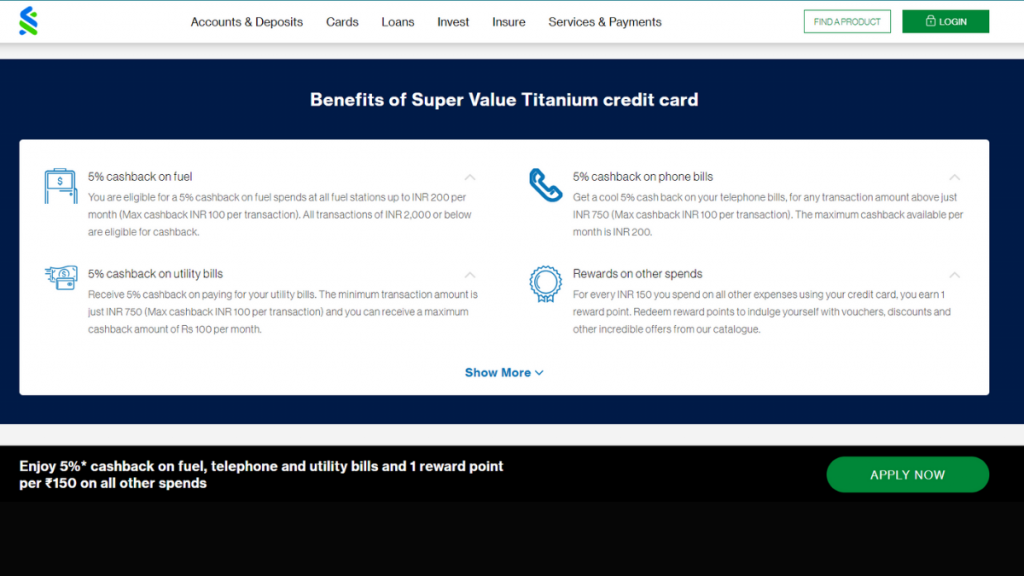

At the forefront is its cashback program, offering an enticing 5% return on fuel expenditures. This extends beyond mere fuel benefits, also encompassing cashback on phone bills and utility payments.

But, it’s crucial to note that these cashback benefits apply to fuel transactions of INR 2,000 or below, utility bills surpassing INR 750, and phone bills exceeding the same threshold.

Moreover, immerse yourself in a rewarding program. For every INR 150 spent on miscellaneous purchases, you accumulate 1 valuable reward point.

These points, later redeemable for a diverse array of options, add an extra layer of value to your spending.

While it incorporates modern conveniences like contactless payments, it also offers the flexibility of balance transfers up to INR 5,00,000 into convenient EMIs with zero fees.

You will be redirected to another website

Do the pros outweigh the cons?

As we journey through the myriad details of the Super Value Titanium Credit Card, it becomes evident that it transcends the conventional realms of credit card offerings.

However, you should carefully weigh the pros and drawbacks before applying, in order to make an informed decision.

Pros

- Enjoy a solid 5% cashback on fuel transactions;

- Extend the benefits to your routine expenses with 5% cashback on both phone bills and utility payments;

- Rewarding program where every INR 150 spent on miscellaneous purchases earns you 1 valuable reward point;

- Experience the convenience of contactless payments;

- If you’re a Premium Banking Customer, enjoy a complimentary Priority Pass membership.

Cons

- Be mindful of the specified thresholds for cashback rewards;

- Income eligibility requirement;

- Exercise caution regarding the annual fee, set at INR 750.

What are the eligibility requirements?

So, to be eligible for the Super Value Titanium Card, the primary applicant must fall within the age range of 21 to 65 years, and the minimum age for an add-on cardholder is 18 years.

Besides, a crucial criterion is a stable monthly income, with a minimum requirement of INR 55,000.

Learn how to get the Super Value Titanium Card

So, the journey to financial empowerment begins with a strategic and user-friendly application process. Ready to review a simple guide to apply for the Super Value Titanium Credit Card?

Moreover, this card is a gateway to savings, rewards, and digital convenience! While the application happens online, it’s important to review each step to ensure a seamless process carefully.

Apply online

From navigating the website to receiving your card at home, find out the details of this application process now!

- Access the official website: Firstly, go to the bank’s official website. Once you’re there, look for the “Cards” section and find the Super Value Titanium Card. Then, click to see all the details about it.

- Begin your application process: If you decide this card is the right one for you, click on “Apply Now”. The bank will ask for some basic information such as your name, contact details, birthday, and where you live.

- Share documents: Next, the bank might request some documents. For example, proof of who you are, where you live, and how much you earn. So, upload them online as requested.

- Wait for your answer: Once you’re done, submit your application and wait for a response. If you’re approved, the bank will issue you the Super Value Titanium Credit Card.

What about a similar credit card? Check out the Standard Bank World Citizen Card!

With no foreign transaction fees and exclusive travel perks, the Standard Bank World Citizen Card is a great alternative to the Super Value Titanium Credit Card, and you can review all of its features now!

From airport lounge access to concierge, this card brings a touch of luxury to your travels. Whether you’re a frequent flyer or value global financial flexibility, find out more about this premium card!

How to apply for the World Citizen Credit Card

Learn how to apply for the World Citizen Credit Card! This card is perfect for travelers who want to enjoy luxurious experiences.

Trending Topics

See how to apply for the FNB Private Wealth Credit Metal Card

Uncover a world of exclusive experiences with this card. Learn more about how you can apply for the FNB Private Wealth Credit Metal Card!

Keep Reading

African Bank Personal Loan review

Check out our African Bank Personal Loan review to find out what this loan has to offer and how it could benefit you financially!

Keep Reading

See how to apply for the Capfin Loan

Looking for a reliable and transparent loan service? Apply for Capfin Loan! This guide will show you how to get started.

Keep ReadingYou may also like

Spot Money Debit Card review

Are you looking for a convenient and fee-free way to manage your money? With the Spot Money Debit Card you can do that and more!

Keep Reading

World Citizen Credit Card review: The perfect card for passionate travelers

Are you looking for a credit card that rewards your love of travel? Check out our World Citizen Credit Card review.

Keep Reading

Diners Club International Beyond Card review

Are you looking for a premium credit card with global benefits and exclusive rewards? Check out the Diners Club International Beyond Card!

Keep Reading