US

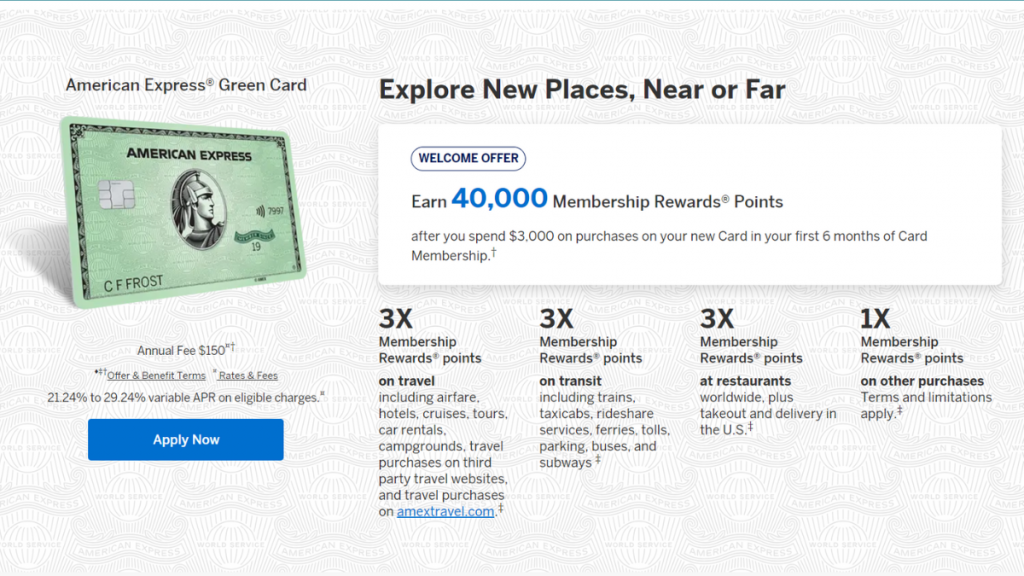

American Express® Green Card: Earn 40K bonus points!

Adventure awaits with the new American Express® Green Card! Experience culinary delights and exclusive rewards like never before! You can apply online now!

Advertisement

Travel Bliss: get 3x points on dining and travel and make your journeys more rewarding than ever!

Unlock a world of possibilities! Whether you’re a seasoned traveler or someone looking to elevate your spending, the American Express® Green Card offers a wealth of benefits we’ll show you in this review.

In today’s fast-paced world, having the right financial companion can make all the difference in how you experience life’s opportunities, especially if you’re a frequent traveler looking for perks.

- Credit Score: Generally, you need a score of 670 or higher.

- Annual Fee: To enjoy all of American Express® Green Card’s features and benefits, you’ll have to pay a $150 annual fee;

- Intro offer: Get 40,000 Membership Rewards® points after spending at least $3,000 within the initial 6 months of card usage;

- Rewards: 3x points on travel and transit services, 3x points when dining at restaurants, 1x points on other purchases, and more;

- APRs: 21.24% – 29.24% variable;

- Other Fees: This card charges a 10% fee (or 5% of the amount of cash) for cash advances. Plus, expect a fee of $40 on late payments.

Find out all the exclusive benefits this credit card can give you in this complete review, and understand its drawbacks before you decide to apply for the American Express® Green Card.

American Express® Green Card: What can you expect?

This credit card opens doors to a world of exclusive perks, from airport lounges to premium rewards. With 3x points on dining and travel, it makes exploring the world more rewarding than ever.

Plus, there’s a generous 40,000 Membership Rewards® points bonus for new card members and up to $189 annual CLEAR® credit. You can check for approval without interfering with your credit score!

As we delve deeper into this review, you’ll discover the myriad benefits that the American Express® Green Card offers frequent travelers.

But, if this is not your case, you may find its rewards program not so fitting for your lifestyle.

Moreover, the American Express® Green Card includes a noteworthy annual fee of $150. It’s important to review the terms and conditions and the pros and drawbacks before you decide to apply.

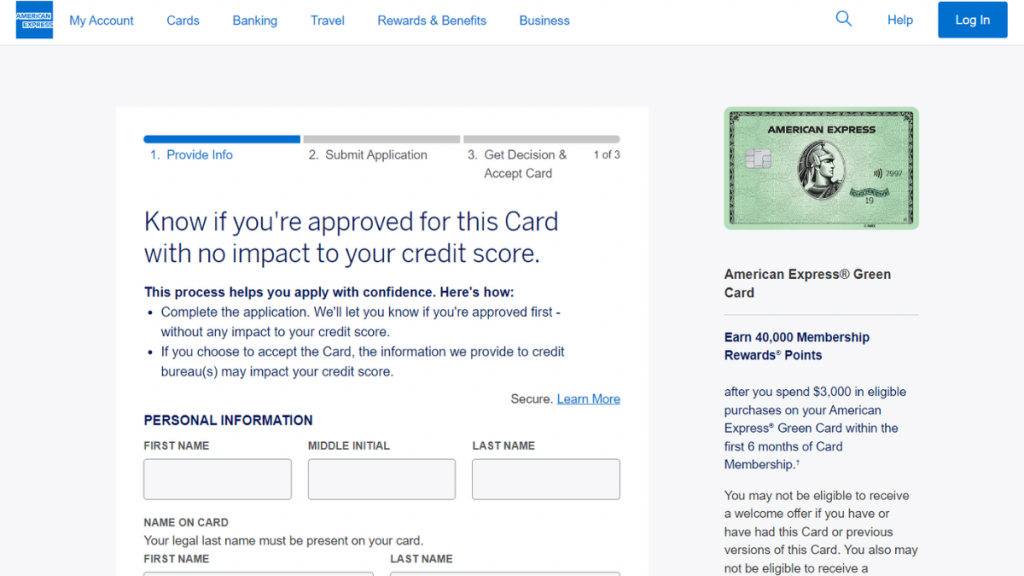

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Throughout this review of the American Express® Green Card, we’ll uncover the remarkable benefits that await if you choose to apply.

But, it’s important to be aware of the drawbacks, as they may impact your final decision.

So, if you’re considering the American Express® Green Card for your wallet, make sure you check out the complete list of terms and conditions. This will help you make an informed decision.

Pros

Besides the intro bonus of 40,000 Membership Rewards® points, this card also features amazing benefits for travelers:

- 3x points on travel (flights, hotels, cruises, car rentals and more);

- 3x points on transit services;

- No foreign transaction fees;

- Travel Insurance;

- Baggage Insurance;

- Global Assist.

Additionally, the card’s environmentally conscious design, crafted from reclaimed ocean plastic, appeals to eco-conscious consumers. And if you’re a frequent shopper, you might also enjoy other perks.

For example, you get 1x points on eligible purchases, 3x points on restaurants, Purchase Protection, Extended Warranty, and more!

Cons

As previously noted in this American Express® Green Card review, the card provides appealing incentives, particularly tailored to individuals who enjoy travel and entertainment.

But everything comes with a price. Check out some of the cons:

- Annual fee;

- High APR of 21.24% to 29.24% variable;

- Needs a high credit score for approval.

What are the eligibility requirements?

To successfully apply for the American Express® Green Card, it’s essential to review your credit score since it’s not easily attainable. Generally, you’ll need a good or excellent score for approval.

Besides, American Express typically considers various factors in addition to your credit score when evaluating your application, such as your income, payment history, and overall creditworthiness.

Learn how to get the American Express® Green Card

Looking to enhance your financial arsenal? If you’ve followed this review with interest, you’re probably eager to apply for the American Express® Green Card.

With its array of exclusive perks and rewards, this card is your ticket to a world of luxury. So, read on to learn more about the application process for this amazing credit card and enjoy life’s luxuries.

Apply online

To begin, start by visiting the American Express website. Next, navigate to the main menu and click on ‘Cards.’ Then, select ‘View All Credit Cards.’ Continue scrolling down until you spot the American Express® Green Card.

Hit the “Apply Now” button and fill out the online application form with your personal information, including your full name, contact details, date of birth, and Social Security Number.

Make sure your details are accurate to avoid any processing delays. Next, provide your financial information, including your annual income, employment status, and housing details.

After submitting your application for the American Express® Green Card, American Express will review it. Then, if you’re approved, you’ll get your card in the mail.

Apply using the app

Start by downloading the official American Express mobile app from your device’s app store. It’s available for both iOS and Android! Then, log in to your account or create one if you’re new to Amex.

Look through the app and find information about the American Express® Green Card and review it to find the “Apply Now” or “Get Started” option. Fill out the form with your personal and financial information.

Once you’re done, submit the application and wait for a decision. You’ll further instructions on the app regarding your application status.

Not entirely certain if the American Express® Green Card aligns with your needs after reading our review? It’s time to meet the Amex EveryDay® Credit Card and unlock your potential for savings!

Say goodbye to annual fees and enjoy points on groceries and other everyday purchases! Besides, with the Amex EveryDay® Credit Card, you’ll get 0% APR for the first 15 months of use!

So, want to know all the positive features and drawbacks this credit card has to offer before you decide to apply? All you need to do is click below for a complete review of the Amex EveryDay® Credit Card!

How to apply for the Amex EveryDay® Credit Card?

Here's your step-by-step guide on how to apply for the Amex EveryDay® Credit Card. Learn about the eligibility requirements and more!

Trending Topics

Learn the different gears and gadgets in which you can access Spotify

Learn how you can easily access Spotify through multiple devices. From a cozy night in to when you’re on-the-go – Spotify’s got you covered.

Keep Reading

Quicksilver Rewards for Students Credit Card review

Are you looking for a student credit card with great rewards? Check out our Quicksilver Rewards for Students Credit Card review.

Keep Reading

What are the best dog food delivery services of 2022?

Learn the best dog food delivery services of 2022 so you can have the best quality food for your pooch delivered right to your door.

Keep ReadingYou may also like

10 best cheap stuff to buy online

When you're on a budget, it can be hard to buy things. But with this list of cheap stuff to buy online, you don't have to suffer!

Keep Reading

How does pet insurance work? Here’s everything you need to know

Wondering how does pet insurance work? Here's a breakdown of everything you need to know, including what it covers and how much it costs.

Keep Reading

Best options trading book: top 5 readings to trade like a pro

Options trading doesn’t have to be complicated. With this list of the best options trading book, you’ll become an expert!

Keep Reading