Reviews (AU)

American Express Velocity Escape Review: up to 1.75 points on purchases!

Discover financial freedom with American Express Velocity Escape Card! Earn Velocity Points, no annual fee, and exclusive benefits. Unleash your wanderlust!

Advertisement

This is the ultimate credit card for earning and redeeming Velocity Points! Enjoy!

Unlocking the world of financial freedom and travel rewards is easier than you think. So, in this American Express Velocity Escape review, we’ll take an in-depth look at this exceptional credit card!

Whether you’re a frequent explorer or simply looking to enhance your daily spending, the American Express Velocity Escape holds the key to exciting opportunities. See the features and benefits now!

- Credit Score: Requires a good to excellent credit score for approval.

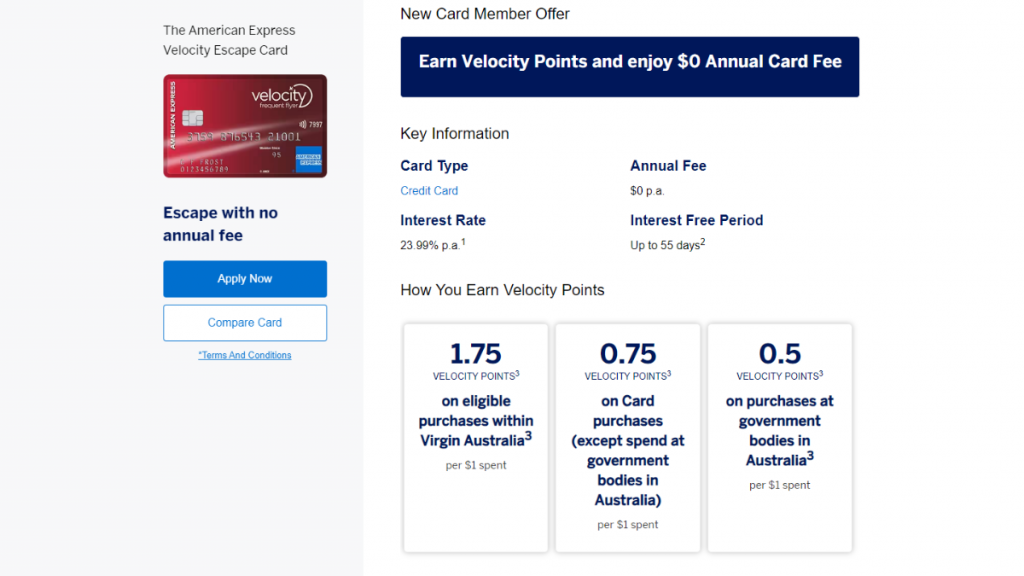

- Annual Fee: One of the standout features of this card is its $0 annual fee.

- Intro offer: N/A.

- Rewards: Earn 1.75 Velocity points per dollar on eligible purchases within Virgin Australia, 0.75 Velocity points on Card purchases (except spend at government bodies in Australia), and 0.5 points on government bodies in Australia.

- APRs: The card comes with an annual interest rate (APR) of 23.99% p.a.

- Other Fees: N/A.

American Express Velocity Escape Card: What can you expect?

Firstly, this card is your gateway to an enhanced travel experience. It’s designed for individuals who want to earn Velocity Points, which can be redeemed for flights, accommodations, car rentals, and more.

Besides, with 1.75 Velocity Points for every $1 spent on eligible purchases within Virgin Australia, you can quickly accumulate points. Additionally, you get 0.75 points for every $1 spent on general purchases.

Moreover, one of the card’s standout features to review is that the American Express Velocity Escape allows you to share the benefits with your family by adding up to four additional cards at no extra fee.

So as you can see, with this card, you can expect a seamless blend of travel rewards, financial freedom, and valuable benefits that enrich your journey.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

In this American Express Velocity Escape review, we’ll embark on a journey to unveil the advantages and potential drawbacks of this card, providing you with insights to make an informed financial decision.

Pros

- Straightforward approach to accumulating rewards;

- What sets this card apart is the absence of an annual fee;

- Up to four supplementary cards, free of extra charges;

- Versatile travel experiences;

- Card Purchase Cover and Card Refund Cover.

Cons

- A higher annual interest rate;

- Eligibility criteria;

- Foreign transaction fee.

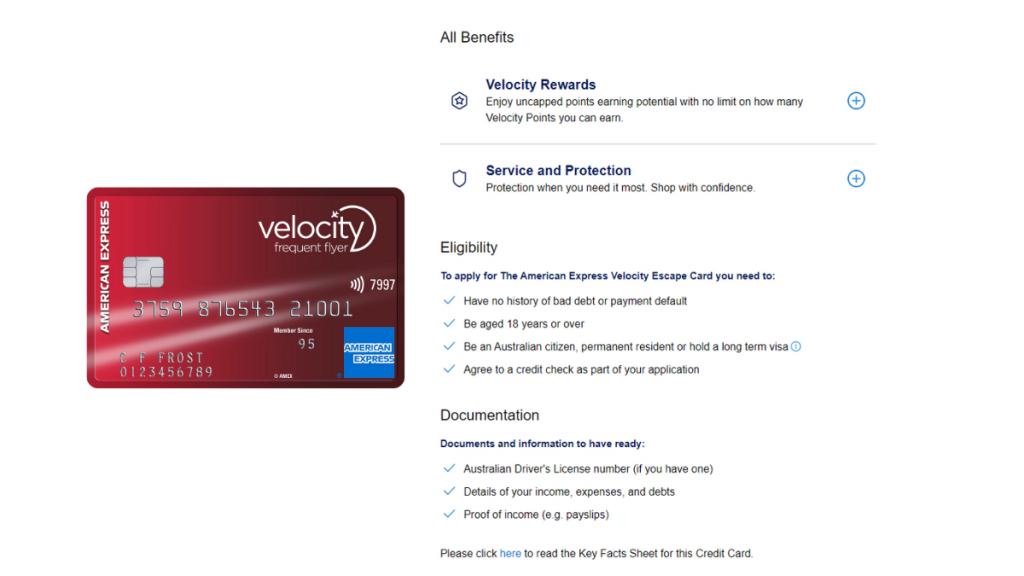

What are the eligibility requirements?

Moreover, to be eligible for the American Express Velocity Escape Card, you should typically have a clean financial track record with no history of bad debt or payment defaults.

Additionally, applicants need to be at least 18 years old and either an Australian citizen, permanent resident, or hold a long-term visa

Learn how to get the American Express Velocity Escape

Are you ready to set your financial compass on a course toward exciting rewards and travel adventures? The American Express Velocity Escape Card can be your perfect companion.

Apply online

So, all you need to do is review this easy step-by-step guide on how to apply for the American Express Velocity Escape and fill out your application!

- Navigate to the American Express website: Firstly, begin your journey by visiting the official American Express website. Then, explore the array of credit card offerings and pinpoint the “American Express Velocity Escape Card.”

- Click “Apply Now”: When you’re ready to proceed, look for the “Apply Now” button and give it a click to initiate your application.

- Complete the form: You’ll input essential personal information, details about your finances, and employment specifics.

- Review and submit: Take a moment to meticulously review the information you’ve entered on the application form. Only when you’re satisfied with its accuracy should you hit the “Submit” button.

- Welcome your card: Upon approval, American Express will send the American Express Velocity Escape Card to your specified mailing address!

What about a similar credit card? Check out the American Express® Green Card!

But, if you’re seeking an alternative credit card with a more unique set of features, the American Express® Green Card is your gateway to a world of flexible and robust rewards.

While the Velocity Escape Card is designed for avid travelers, the American Express® Green Card offers a broader range of benefits. With it, you can earn Membership Rewards points that are highly versatile!

For a more in-depth look into what the American Express® Green Card has to offer and how it stacks up against the American Express Velocity Escape Card, we invite you to explore a detailed review.

American Express® Green Card review

See how to apply for the American Express® Green Card in this review, elevate your rewards and premium perks – up to 3 points on purchases!

Trending Topics

How to apply for The Qantas American Express Ultimate Card

Ready to take the plunge and apply for your Qantas American Express Ultimate Card? Get lounge passes, travel insurance, and more.

Keep Reading

St. George Vertigo Card Review: Everyday Value!

Discover financial freedom in this St. George Vertigo Card review. Enjoy low rates on purchases and enticing cashback rewards.

Keep Reading

See how to apply for the Citi PayAll rewards program

Learn how to apply for the Citi PayAll and earn rewards on every payment you make, including electricity bills, education costs, and more.

Keep ReadingYou may also like

The 5 Best Prepaid Travel Cards for Australians

Don't get caught out abroad! Check out our list of the five best prepaid travel cards for Australians and find the one that suits your needs.

Keep Reading

Citi PayAll review: pay your bills and earn rewards

Read this Citi PayAll review to learn how it works and how you can earn rewards while paying your regular bills like taxes, rent, and more.

Keep Reading

Citi Rewards Card review: Earn points for travel!

Read our Citi Rewards Card review and uncover all the details about its benefits, drawbacks, rates, and fees!

Keep Reading