Credit Cards (AU)

St. George Vertigo Card Review: Everyday Value!

Explore a world of benefits with the St. George Vertigo Card! From low minimum credit limits to secure payment options and exclusive Visa perks. Elevate your financial experience!

Advertisement

This card offers a blend of financial flexibility and savings!

Whether you’re drawn to the allure of seeking a strategic approach to managing existing balances or simply aiming for financial flexibility, this review of the St. George Vertigo Card is for you!

Tailored to cater to a variety of financial objectives, the St. George Vertigo Card unquestionably offers a diverse array of advantages. So, are you ready to elevate their credit experience?

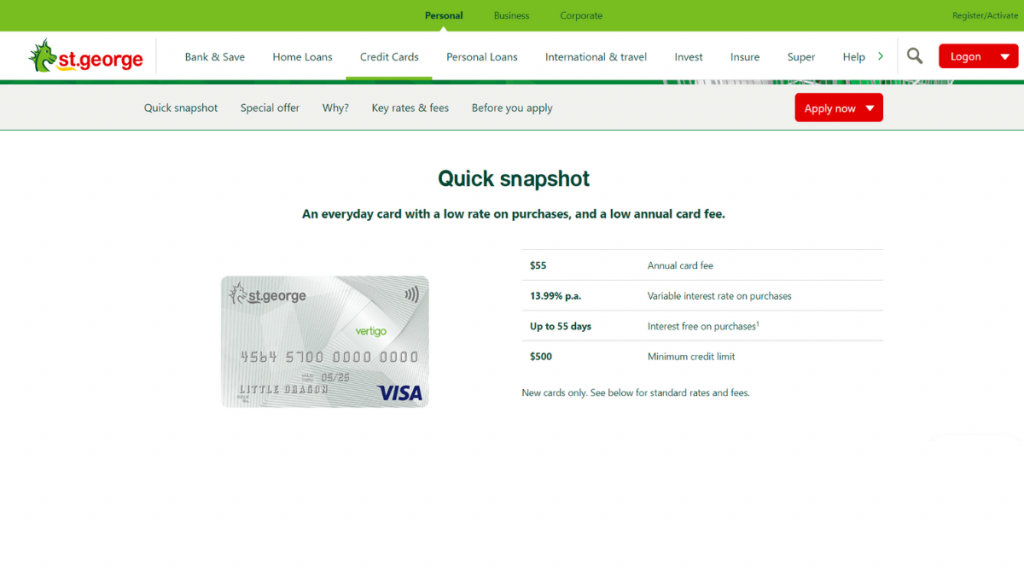

- Credit Score: N/A;

- Annual Fee: This credit card comes with a modest annual fee of $55, making it an attractive option for those seeking value without sacrificing essential features;

- Intro offer: Cardholders can choose between up to $400 cashback on eligible supermarket and petrol spending or 0% p.a. interest on balance transfers for an extended period, providing a strategic advantage for managing existing credit card balances;

- Rewards: Users can enjoy up to $400 cashback on specific spending categories, turning everyday expenses into opportunities for savings. Additionally, the card offers exclusive benefits through Visa Offers and Perks, personalized discounts, and access to the My Offers Hub, enhancing the overall cardholder experience;

- P.A.: 13.99% p.a. on purchases;

- Other Fees: A 3% fee is applied for each cash advance amount, and a $15 fee is incurred for each late payment or missed payment.

St. George Vertigo Card: What can you expect?

In exploring the St. George Vertigo Card, this comprehensive review unveils a versatile financial tool designed to cater to a spectrum of consumer needs.

It’s an appealing choice for individuals seeking cost-effectiveness without compromising on essential features.

Besides, cardholders can opt for up to $400 cashback on eligible supermarket and petrol spending. Or, leverage the advantage of 0% p.a. interest on balance transfers for an extended 32-month period.

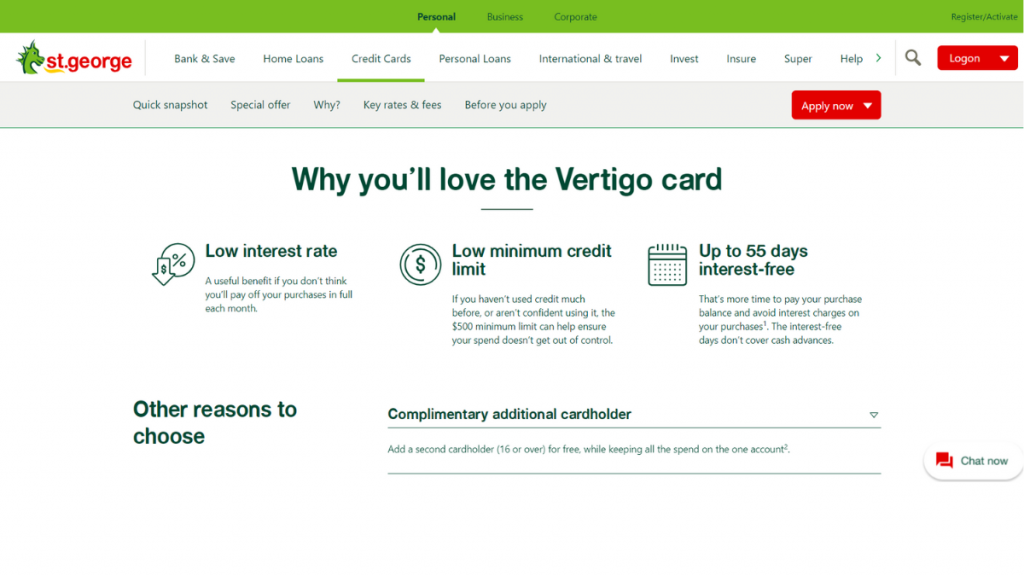

The allure of up to 55 days interest-free on purchases further enhances the card’s appeal, offering users ample time to manage and repay their balances without incurring additional costs.

Additionally, the card distinguishes itself through its unwavering dedication to security.

It incorporates round-the-clock fraud monitoring, a secure online shopping service, and the St. George Fraud Money Back Guarantee.

However, responsible credit management is key, especially considering potential fees. Overall, the St. George Vertigo Card positions itself as a well-rounded financial companion!

You will be redirected to another website

Do the pros outweigh the cons?

While the St. George Vertigo Card brings forth a plethora of benefits, it’s essential to navigate the terrain with awareness and review both advantages and disadvantages before you apply.

Furthermore, don’t underestimate the importance of understanding the terms and conditions, enabling you to maximize the benefits of this card while mitigating potential drawbacks.

Pros

- Enticing introductory offers;

- Flexible rewards;

- 55 days with no interest on your purchases;

- Robust security features;

- Users can add a second cardholder;

- Cardholders unlock entry to the exclusive My Offers Hub;

- Access to Visa perks.

Cons

- The card comes with a 21.49% p.a. variable cash advance interest rate;

- Late payment penalties;

- Overseas transaction fees;

- Annual fee.

What are the eligibility requirements?

First and foremost, applicants must be at least 18 years old, reflecting a legal age requirement for credit card ownership.

Additionally, the card is available to individuals with permanent residency in Australia or New Zealand.

Non-residents or migrants are also eligible, provided they hold an acceptable visa with a minimum of one year before expiry.

Finally, financial stability is a key consideration for approval, and applicants are required to have a regular, verifiable Australian taxable income.

Learn how to get the St. George Vertigo Card

Embarking on the journey to acquire the St. George Vertigo Card begins with a thoughtful consideration of its features and benefits, as outlined in this review.

Once you’ve decided that this credit card aligns with your financial goals, the online application process offers a convenient and efficient way to secure this versatile financial tool.

Apply online

So, follow these steps to apply for the St. George Vertigo Card seamlessly. You can do it in just a few minutes!

- Visit the website: Firstly, navigate to the official St. George Bank website and select “Credit Cards” on the menu. Then, find the Vertigo Card and familiarize yourself with the features, benefits, and any additional details.

- Access the application page: Within the credit card section, find the application page specifically tailored for the St. George Vertigo Card. Fill in the required fields with accurate personal and financial information.

- Submit documents: To verify the information provided, be prepared to submit supporting documents.

- Review and submit: Once you’ve completed the application, submit it online. The bank will then assess your eligibility.

- Approval and card issuance: Upon successful approval, you can anticipate receiving your new St. George Vertigo Card. It’s that easy!

What about a similar credit card? Check out the ING Orange One Low Rate Credit Card!

With a competitive interest rate on purchases and a straightforward fee structure, the ING Orange One Low Rate Credit Card caters to individuals who prioritize simplicity and cost-effectiveness.

This makes it an excellent alternative to the St. George Vertigo Card, and you can review it now. So just click the link below and explore a full review on the ING Orange One Low Rate Credit Card today!

ING Orange One Low Rate Review

Discover financial freedom in this ING Orange One Low Rate review. Enjoy zero ING fees on international transactions for eligible users.

Trending Topics

The News Stacker recommendation – Bankwest Breeze Classic Mastercard Credit Card review

Learn how the Bankwest Breeze Classic Mastercard Credit Card can increase your purchasing power and help you save money!

Keep Reading

Qantas Premier Platinum Credit Card review: Enjoy Premium Travel Benefits

Discover all the perks and potential savings of the Qantas Premier Platinum Credit Card in our review. Get a full breakdown here.

Keep Reading

CommBank Neo Card review: Get cashback with zero hidden fees

Are you looking for a straightforward card? Check out the CommBank Neo Card review, which offers cashback with zero hidden fees.

Keep ReadingYou may also like

See how to apply for the Citi Rewards Card

Follow this easy guide and learn how to apply for the Citi Rewards Card. Save money, earn rewards, and have control over your finances!

Keep Reading

See how to apply for the HSBC Premier Credit Card

Take your finances to the next level and learn how you can apply for the HSBC Premier Card to discover its rewards and benefits today.

Keep Reading

Quick Cash Loans review: Quick & Easy Access to the Funds You Need Online

Unexpected expenses can pop up out of nowhere. Get informed and decide if Quick Cash Loans are the right online lending option - up to $5K!

Keep Reading