Get 0% p.a. on purchases and balance transfers for the first 15 months with ZERO balance transfer fees!

Bankwest Breeze Classic Mastercard Credit Card – Get up to 55 interest-free days on purchases and higher transfer limits!

Advertisement

Are you searching for a credit card that gives you ultimate flexibility when it comes to managing your finances? The Bankwest Breeze Classic Mastercard Credit Card is the ticket! Offering 0% p.a on balance transfers and purchases, this is one of the best options available if you want convenience and affordability. Check our comprehensive review to learn all about it!

Are you searching for a credit card that gives you ultimate flexibility when it comes to managing your finances? The Bankwest Breeze Classic Mastercard Credit Card is the ticket! Offering 0% p.a on balance transfers and purchases, this is one of the best options available if you want convenience and affordability. Check our comprehensive review to learn all about it!

You will remain in the same website

If you’re looking for a card that rewards you with convenience and affordability, the Bankwest Breeze Classic Mastercard Credit Card is your best bet! Check its benefits below and see why this is one of the best offers in Australia right now.

You will remain in the same website

The Bankwest Breeze Classic Mastercard Credit Card is designed for individuals who are looking for a straightforward credit card with a low annual fee and a range of basic features. This card is best suited for people who want to keep their credit card costs low and do not require any fancy perks or rewards programs.

No, the Bankwest Breeze Classic Mastercard Credit Card does not offer any rewards or points programs. It is a basic credit card that is designed to offer simple features with a low annual fee. While it does not offer rewards, it does have other benefits such as a long low interest rate period, up to 55 days interest-free on purchases, and contactless payment technology.

To qualify for the Bankwest Breeze Classic Mastercard Credit Card, you need to meet the eligibility criteria set by Bankwest. These criteria include being at least 18 years old, a permanent resident of Australia or hold an eligible visa, having a regular income of at least $15,000 yearly, and not having a history of bad debt or payment defaults.

If you’d like to benefit from all that the Bankwest Breeze Classic Mastercard Credit Card can offer, check the following link to learn how to apply for it.

How to apply for the Bankwest Breeze Classic Card?

Learn how to apply for the Bankwest Breeze Classic Mastercard Credit Card and make life more rewarding with this unique card!

But if you’d like to look at an alternative and compare features, we recommend the Bank of Queensland Low Rate Credit Card.

In the following link, you’ll learn more about its features and benefits. Plus, we’ll also show you how you can apply for it.

How to get the Bank of Queensland Low Rate card?

Discover how you can easily and quickly apply for a Bank of Queensland Low Rate Credit Card with this step-by-step guide!

Trending Topics

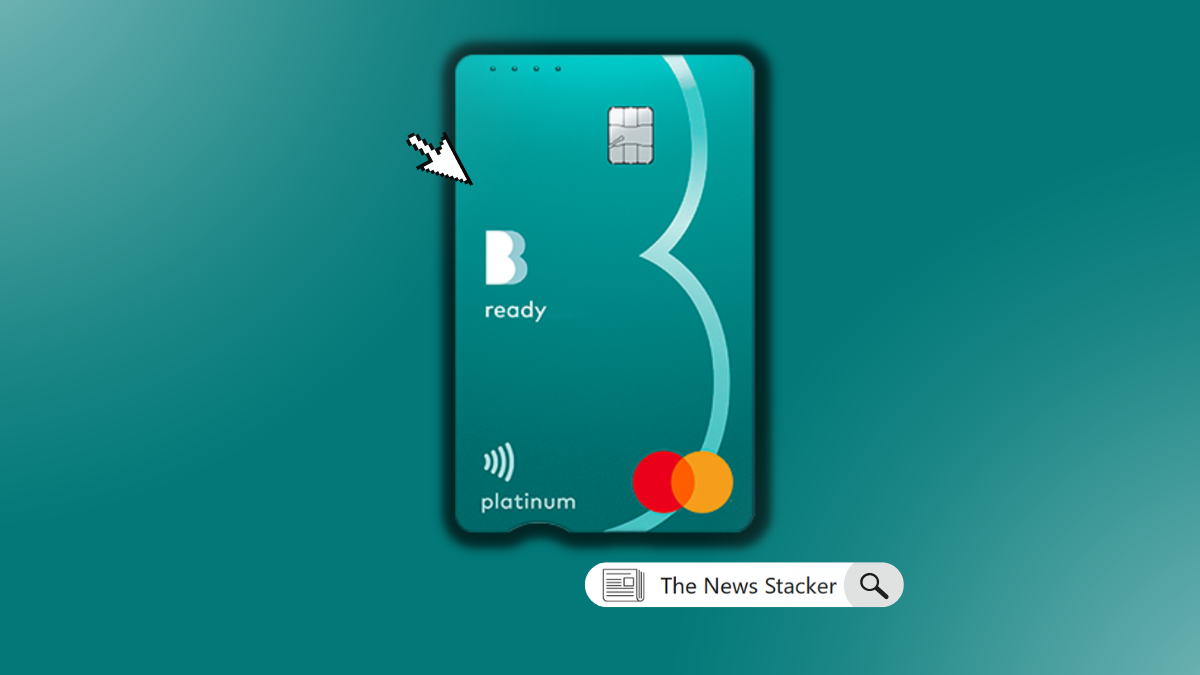

See how to apply for the Bendigo Ready Credit Card

Don't wait around - learn how to apply for the Bendigo Bank Ready Credit Card and explore all its stellar value and platinum travel perks.

Keep ReadingThe News Stacker recommendation – Household Capital Loans

If you're over the age of 60, look no further than Household Capital Loans! Enjoy low-interest rates and flexible payment options.

Keep Reading

Best Apps for Calorie Counting: The Ultimate Guide for Aussies

Dive into Australia's top picks for the best apps for calorie counting. Boost your health journey with our expert recommendations!

Keep ReadingYou may also like

The Low Rate Credit Card from American Express® review: An Easy Way To Save Money

Check out our in-depth The Low Rate Credit Card from American Express® review to see if it works for you. Learn more here.

Keep Reading

ANZ Low Rate Credit Card review: No annual fee in the first year

Looking for a budget-friendly credit card with no hidden fees? Read our detailed ANZ low rate credit card review to learn more.

Keep Reading

See how to apply for the Citi Rewards Card

Follow this easy guide and learn how to apply for the Citi Rewards Card. Save money, earn rewards, and have control over your finances!

Keep Reading