Reviews (AU)

ANZ First Credit Card: Effortless Financial Control!

Your pathway to convenience starts with the ANZ First Credit Card! Learn more details about hassle-free transactions, comprehensive security features, and the enticing $100 intro bonus offer!

Advertisement

Experience the ease of managing your finances with a card designed for simplicity!

Whether you’re a seasoned credit card user looking to maximize your benefits or a newcomer eager to explore responsible spending, the ANZ First Credit Card has something to offer for everyone.

Designed to cater to the needs of modern consumers, this card offers a gateway to a world of convenience and financial peace of mind.

Explore the ANZ First Credit Card’s benefits and features, ensuring that you’re not only in control of your finances but also reaping the rewards of responsible spending! Check out everything you need to know!

- Credit Score: Typically falls within the 600-700 range and higher.

- Annual Fee: You won’t be charged an annual fee in the first year.

- Intro offer: As a welcome offer, new cardholders can earn $100 cashback by spending a minimum of $750 in the initial 3 months.

- Rewards: No rewards program available.

- P.A.: 20.49 % p.a. interest rate.

ANZ First Credit Card: What can you expect?

With the ANZ First Credit Card, you can enjoy financial simplicity and ensure that your transactions are smooth and trouble-free.

Moreover, ANZ prioritizes your financial safety with security features, so you can shop with peace of mind.

You get the added perks of Purchase Protection and Extended Warranty Insurance. Plus, ANZ provides user-friendly tools! You can access your accounts online, set spending limits, and more.

Newly approved applicants, here’s a special treat for you! Unlock an exhilarating $100 introductory bonus when you spend a mere $750 on qualifying purchases within your first 3 months of using this credit card.

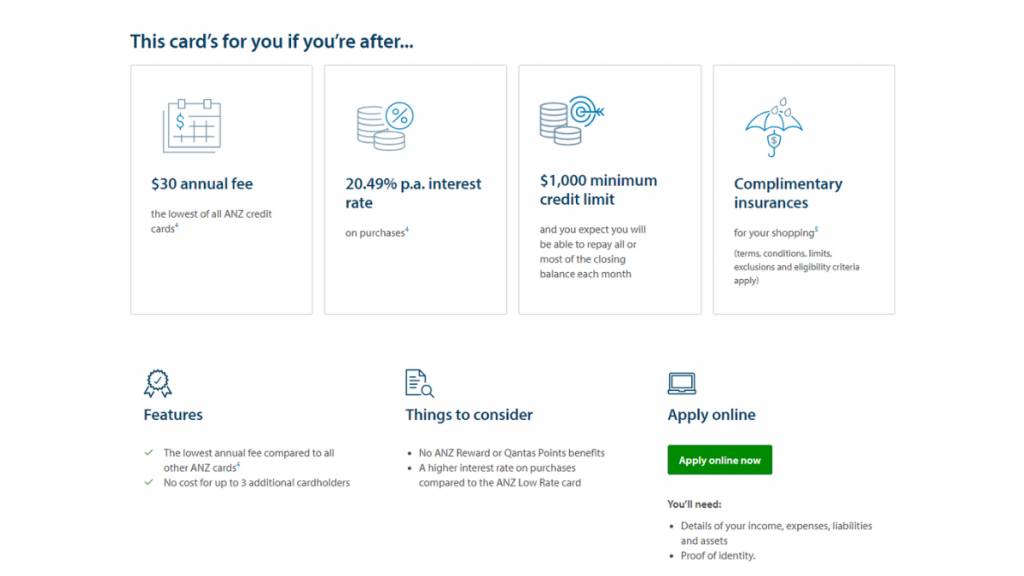

Keep in mind that your first year includes a wonderful $0 annual fee, with a modest $30 annual fee starting in year two. This is the lowest annual fee of all the ANZ cards, making it a nice option to consider.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

Exploring the ANZ First Credit Card in-depth means taking a close look at its limitations. Check the features of this card while also shedding light on the aspects that might give you pause.

Whether you’re considering applying or are already a cardholder, understanding both the benefits and drawbacks is essential for making informed financial decisions. So, read below to understand more.

Pros

As previously stated, the ANZ First Credit Card offers a straightforward and uncomplicated choice for cardholders. So, the main positive feature this card offers is its intro bonus for new applicants.

The special welcome gift is an exciting $100 back, and you just need to spend $750 on eligible purchases within the first 3 months to claim it.

While there is an annual fee of $30 after the initial year, it remains the most affordable option among all ANZ credit cards. Other pros for this credit card include:

- Add up to 3 extra cardholders at no additional cost;

- You’ll have a credit limit of at least $1000;

- Purchase Protection Insurance;

- Extended Warranty Insurance;

- 24/7 Anti-fraud Protection.

Cons

Although a very simple card, the ANZ First Credit Card has its drawbacks. Firstly, please consider this card has no rewards program. If you’re looking for points and other perks, this is not the choice for you.

Besides, it’s crucial to be mindful of other significant drawbacks that should be considered before you decide on the ANZ First Credit Card:

- This card has a foreign transaction fee;

- The interest rate is quite steep (20.49% p.a.);

- Annual fee after 1 year of usage.

What are the eligibility requirements?

Securing the ANZ First Credit Card is hassle-free, but you’ll need to meet the age requirement of at least 18 years and supply adequate proof of identity.

Besides, ANZ will require financial and personal information. Then, your credit history will be analyzed to determine your creditworthiness.

Also, eligibility encompasses Australian or New Zealand citizens, permanent residents, and individuals with a visa duration of a minimum of 9 months.

Keep in mind that meeting these eligibility criteria doesn’t guarantee approval, as credit card issuers also consider other factors when evaluating applications.

Learn how to get the ANZ First Credit Card

Firstly, make sure you meet the eligibility criteria specified by ANZ to apply for this credit card. Then, gather the necessary documents and information for the application.

Lastly, you can conveniently apply for the ANZ First Credit Card right from the comfort of your home. Either use the ANZ app or access the bank’s webpage. Check a detailed step-by-step!

Apply online

Start by going to the official ANZ website using your web browser. Next, head over to the credit card section on the website and choose the ANZ First Credit Card to apply for.

Once you’ve selected the card, look for the “Apply Online Now” button and click on it to initiate the application process. Proceed by filling out the online credit card application form.

Moreover, provide up-to-date personal information, financial details, and employment information. When you’ve filled out the form and reviewed the terms, submit your application electronically.

Afterward, ANZ will review your application, and once approved, your ANZ First Credit Card will be mailed to you. It’s that easy!

Apply using the app

If you haven’t already, download and install the official ANZ mobile banking app from your device’s app store. Then, log in with your credentials or register for an account if you’re a new user.

Next, inside the app, access the credit card services or credit card applications section. Identify the application option and pick the ANZ First Credit Card.

Fill out the online form within the app with your personal, financial, and employment information. Once you’re done, submit your application. Then, you should wait for a response from ANZ.

If your application is approved, ANZ will send you your card by mail. At that point, follow the provided instructions to activate your new card!

What about a similar credit card? Check out the ANZ Low Rate Credit Card!

As evident from its features, the ANZ First Credit Card is all about simplifying your financial experience! With a host of benefits like no annual fee and robust security features, it’s your gateway to convenience.

However, if you’re you want to compare your options, why not take a closer look at the ANZ Low Rate Credit Card? This card brings amazing benefits to cardholders.

So keep reading and learn more!

See how to apply for the ANZ Low Rate Credit Card

Ready to apply for the ANZ Low Rate Credit Card? Discover how to do it in just a few simple steps, and get an answer within one minute!

Trending Topics

Australia Post Travel Platinum Mastercard® review: Make International Travel Hassle-free!

Read our Australia Post Travel Platinum Mastercard® review to know if this card is right for you and make international travel hassle-free.

Keep Reading

American Express Velocity Escape Review: up to 1.75 points on purchases!

Elevate your travel game with American Express Velocity Escape, learn more in this review! Earn points and enjoy perks.

Keep Reading

See how to apply for The American Express Essential® Credit Card

Learn how to apply for The American Express Essential® Credit Card and explore the benefits that come with being a cardholder!

Keep ReadingYou may also like

Coles No Annual Fee Mastercard review: Freedom from Pesky Credit Card Fees

Discover a credit card without an annual fee that offers rewards! Learn all about the Coles No Annual Fee Mastercard in our review.

Keep Reading

HSBC Low Rate Card Review: Low-rate Advantages!

Learn how to uncover the financial freedom you deserve with the HSBC Low Rate Credit Card in this review. Apply online in just 10 minutes!

Keep Reading

The American Express Explorer® Credit Card review

Get an in-depth review of The American Express Explorer® Credit Card and compare its features to find if it’s the right fit for you.

Keep Reading