Credit Cards (AU)

ANZ Rewards Platinum Credit Card: Your Ticket to Exclusive Perks!

Discover the ANZ Rewards Platinum Credit Card, your gateway to a life enriched with benefits. Dive into its features, including 80,000 bonus points, airport lounge access, and more!

Advertisement

Unleash the power of Platinum: your everyday spending just got a whole lot more rewarding!

Welcome to a world where your everyday spending transforms into unforgettable experiences. The ANZ Rewards Platinum Credit Card opens doors to privileges, perks, and endless possibilities.

If you want your travels to become more luxurious and your purchases to bring you closer to a treasure trove of rewards, then this is the right credit card for you! Explore how this card can elevate your financial game!

We’ll take you on a journey through the exciting realm of the ANZ Rewards Platinum Credit Card, where every swipe is a step toward a richer, more fulfilling lifestyle. Ready to see life in platinum? Let’s dive in!

- Credit Score: Typically, platinum credit cards are designed for individuals with good to excellent credit scores.

- Annual Fee: As of now, the annual fee is set at $95. It’s important to be aware that from November 8, 2023, a revised annual fee of $149 will be implemented.

- Intro offer: Receive a $50 cashback bonus on your newly acquired ANZ Rewards Platinum card when you make eligible purchases and 80,000 extra ANZ Reward Points.

- Rewards: For the initial $2,000 in spending, you’ll earn 1.5 ANZ Reward Points for every $1 spent. Beyond that, you’ll still receive 0.5 ANZ Reward Points for each $1 spent.

- P.A.: 20.49% p.a. interest rate on purchases.

- Other Fees: This card charges 3% of the value of each purchase made outside Australia. Besides, there’s a $65 fee annually for each additional cardholder.

ANZ Rewards Platinum Credit Card: What can you expect?

So, get ready for a rewarding journey with the ANZ Rewards Platinum Credit Card, where your everyday purchases are about to become more satisfying than ever before.

From groceries to gas, every dollar you spend will earn you valuable ANZ Reward Points.

Plus, treat yourself to a lavish introductory offer featuring an additional 80,000 ANZ Reward Points and a $50 cashback bonus for your newly obtained card.

Unlocking these incredible rewards is as simple as making $2,000 in eligible purchases within the initial 3 months from the date of approval!

Get ready to elevate your travel experiences. This card offers exclusive access to airport lounges, complimentary travel insurance, and a host of travel benefits, making your journeys smoother and more enjoyable.

But, as every benefit has its cost, the current annual fee for this credit card is $95. On the flip side, starting November 8, 2023, there is a change coming to the annual fee, marking an increase to $149.

You will be redirected to another website

Do the pros outweigh the cons?

Although the ANZ Rewards Platinum Credit Card can be a valuable asset in your financial arsenal, it’s crucial to carefully consider both its pros and cons before submitting your application.

Now, we’ll dive into the key benefits and potential downsides of this credit card. This will help you make a decision about whether it’s the right fit for your financial needs and lifestyle.

Pros

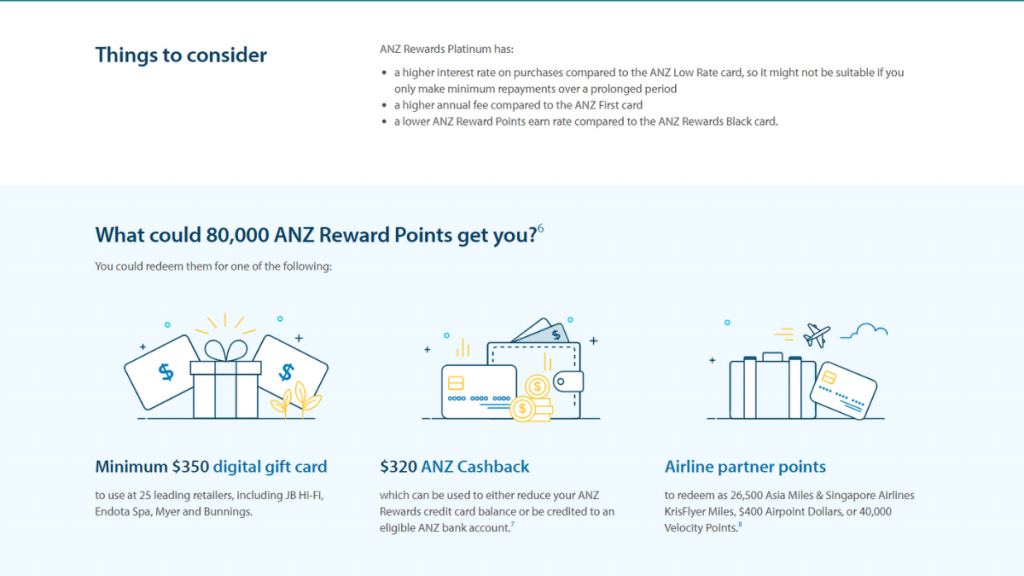

To kick things off, we must emphasize the card’s most prominent benefit, which is the introductory bonus of 80,000 extra ANZ Reward Points.

What’s more, you can pocket a $50 cashback reward by reaching $2,000 in eligible purchases within the first 3 months from the approval of your card. Other benefits this card offers include:

- $6,000 credit limit (at least);

- 1.5x points for each $1 spent;

- Personal Concierge available 24/7;

- Travel Insurance;

- Rental Vehicle Insurance;

- Global Assist;

- Purchase Protection and Extended Warranty Insurance;

- Fraud Protection.

Cons

While this card boasts an incredible rewards program, it’s important to note that there’s a limit of just $2,000 before your ANZ Reward Points start to decrease.

Once you hit this threshold, your rewards will drop to 0.5 points for eligible purchases. Besides, some of the drawbacks of this card include:

- High annual fee;

- High p.a. interest rate on purchases;

- Overseas transaction fee of 3% of the value of the transaction;

- For each additional cardholder, there’s a fee of $65 annually.

What are the eligibility requirements?

If you want to apply for the ANZ Rewards Platinum Credit Card, you must be 18 years of age or older, have at least a good credit score, and be an Australian or New Zealand citizen.

Besides, for non-permanent residents, it’s a requirement to have over 9 months left on your visa.

Learn how to get the ANZ Rewards Platinum Credit Card

So, are you convinced this is the perfect card for you? Then all you have to do is apply now! And we can help you with an easy-to-follow step-by-step. You can either apply online or even use your smartphone.

Are you ready to embark on a journey towards a world of privileges, rewards, and endless possibilities? The ANZ Rewards Platinum Credit Card awaits! Let’s get started with the application process!

Apply online

Firstly, visit the official ANZ website using your web browser. On the ANZ website, look for the “Credit Cards” section and click to access it. Then, scroll down and select the ANZ Rewards Platinum Credit Card.

Finally, click on the “Apply Online Now” button and prepare to fill out the application form. Fill out the required information, which typically includes personal details, financial information, and contact information.

Once you’re confident everything is correct, submit your application. Then, ANZ will review your application, including your creditworthiness and the information you provided. This may take some time!

If you’re approved, you’ll receive your credit card by mail, and all you need to do is activate the card as per the instructions provided with it.

Apply in person

Start by using ANZ’s official website or app to find the nearest ANZ branch to your location. While not always necessary, it’s a good idea to call ahead and schedule an appointment with a bank representative.

Before visiting the branch, gather all the necessary documents, such as proof of identity, proof of income, and any other documents ANZ may require. Then, visit the ANZ branch and bring all your documents.

Inform the bank representative that you’re interested in applying for the ANZ Rewards Platinum Credit Card. Fill out the credit card application form and provide the supporting documents required.

Once you’re done, ANZ will review your application and conduct any necessary credit checks. If your application is approved, you’ll receive your ANZ Rewards Platinum Credit Card by mail.

As you can see, the ANZ Rewards Platinum Credit Card is your ticket to a life enriched with exclusive benefits. With a generous rewards program, complimentary travel insurance, and much more!

Not sure this is the right fit for you? If you’re just starting your credit card journey or prefer a more straightforward and hassle-free option, the ANZ First Credit Card is an excellent choice.

With competitive interest rates, it’s designed for those looking for a simple and cost-effective solution. To learn more about the ANZ First Credit Card and find out if it’s the right fit for you, click on the following link!

ANZ First Credit Card review

Unlock the benefits of the ANZ First Credit Card to make an informed choice! Learn about its robust security, flexible payments, and more!

Trending Topics

Coles No Annual Fee Mastercard review: Freedom from Pesky Credit Card Fees

Discover a credit card without an annual fee that offers rewards! Learn all about the Coles No Annual Fee Mastercard in our review.

Keep Reading

See how to apply for the ANZ Low Rate Credit Card

Ready to apply for the ANZ Low Rate Credit Card? Discover how to do it in just a few simple steps, and get an answer within one minute!

Keep Reading

See how to apply for the HSBC Premier Credit Card

Take your finances to the next level and learn how you can apply for the HSBC Premier Card to discover its rewards and benefits today.

Keep ReadingYou may also like

The best apps for meditation: Recharge in a minute with an application

Technology is here to help us stay mindful even in the busiest times. Here are 3 of the best meditation application for free!

Keep Reading

See how to apply for the NAB StraightUp Credit Card

Looking for a credit card that suits your needs? Here's how you can apply for the NAB StraightUp Credit Card and get the best perks!

Keep Reading

Hacks for Sustainable Travel On a Budget

Don't skimp on an adventure. Discover hacks that let you travel on a budget without harming the environment. Read more to find out how!

Keep Reading