Loans (SA)

Up to R300,000: Apply for a Wesbank Personal Loans now

Learn how to apply for a Wesbank Personal Loan today and be pleasantly surprised by the simple and stress-free process. Keep reading!

Advertisement

Wesbank Loan: Easily Achieve Financial Freedom

Are you ready to apply for Wesbank Personal Loans? Don’t worry, the process is easy, and we’re here to guide you every step of the way.

We’ll walk you through each step, from completing the online application to submitting the required documents.

You’ll be pleasantly surprised at how simple and stress-free the process can be.

Apply for a Wesbank Personal Loan today and take the first step towards financial freedom.

Learn how to get Wesbank Loan online

To apply for a Wesbank loan, navigate to their website and the Personal Loans section. From there, you can use their handy loan calculator to determine the loan amount.

Once you’ve got that sorted, go ahead and hit the “Apply Now” button to start the online application process.

We know filling out forms can be a drag, but take the time to accurately fill in all the required personal, financial, and employment details.

And don’t forget to upload the necessary supporting documents, such as proof of income and identification.

Once thoroughly reviewed your application, simply hit the submit button and sit tight while it’s processed. Applying for a loan has never been easier!

You will be redirected to another website

How to get it using the app

With their user-friendly mobile app, you can easily apply for personal loans.

Plus, the app provides a secure platform to track the status of your application and manage your loan account.

Downloadable on iOS and Android devices, the app ensures easy access to your loan application anytime, anywhere.

In short, Wesbank Personal Loans is the perfect solution for anyone seeking financial help, whether for a home renovation, debt consolidation, or dream vacation.

Don’t let financial emergencies stress you out – apply for the Wesbank Loan today!

What about a similar loan? Check out the DirectAxis Loan

Want a hassle-free loan with flexible options and personalized rates? Look no further than DirectAxis Loan!

With fast decision-making and up to R200,000 to borrow, getting ahead has never been easier.

Plus, their experienced financial advisors are ready to assist with any questions.

All you need is a good credit record, a monthly income of R5,000+, and your salary paid into a bank account.

Apply on their website and get a response in minutes. So don’t miss out – learn more below!

See how to apply for a DirectAxis Loan

Learn how to easily and quickly apply for a DirectAxis Loan. With just a few clicks, you could have your loan approved and be on your way to financial freedom!

Trending Topics

Mr Price Money: Break Free from Budget Limitations and Shop Smarter

Stop saying no to the things you need or want. Say hello to Mr Price Money and shop smarter today! Unleash your purchasing power.

Keep Reading

See how to apply for the FNB Gold Business Card

Applying for the FNB Gold Business Card is easy - follow this easy guide and you could be enjoying its benefits in no time!

Keep Reading

See how to apply for the Capitec Credit Card

A simple, step-by-step guide on how to apply for a Capitec Credit Card. Plus, learn more about the benefits of having a Capitec credit card.

Keep ReadingYou may also like

British Airways Credit Card review: Take off on a journey of luxury and convenience

Looking for an amazing way to get exclusive bonuses? Our British Airways credit card review can help turn your travel dreams into reality.

Keep Reading

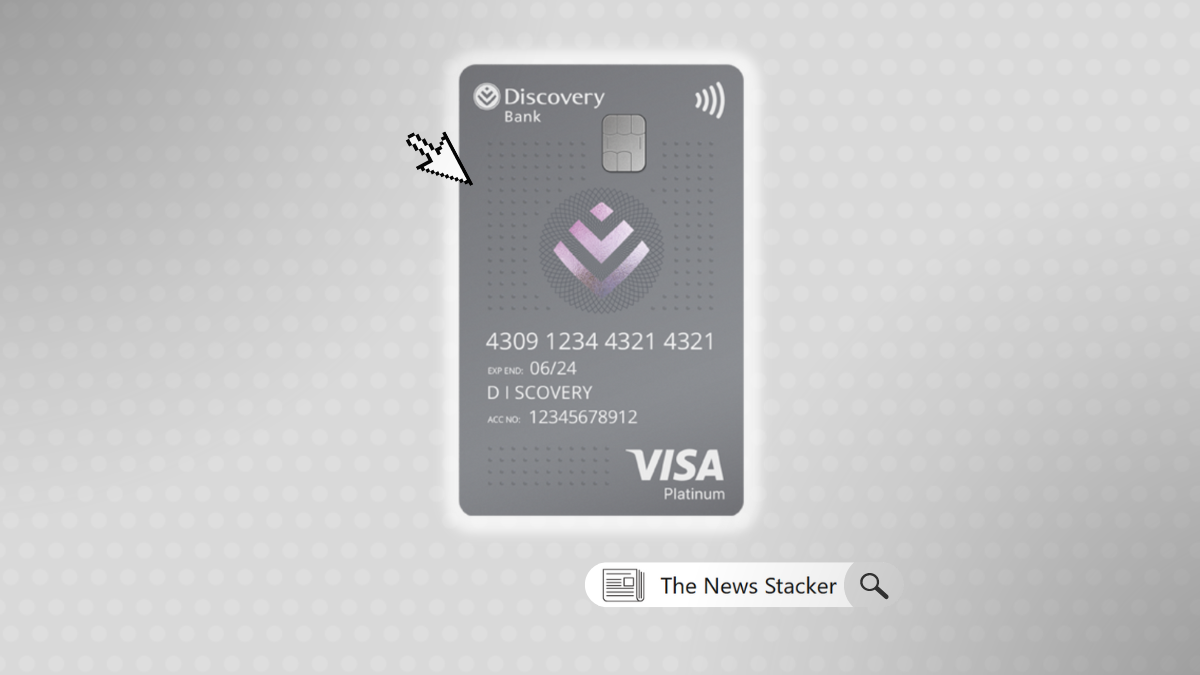

See how to apply for the Discovery Bank Platinum Card

You can now apply for the Discovery Bank Platinum Card and enjoy amazing lifestyle rewards, shopping deals, and more!

Keep Reading

See how to apply: Standard Bank Blue Credit Card

Want to apply for the Standard Bank Blue Credit Card? Here's how you can do it, and what you can expect in return. Read on for more!

Keep Reading