US

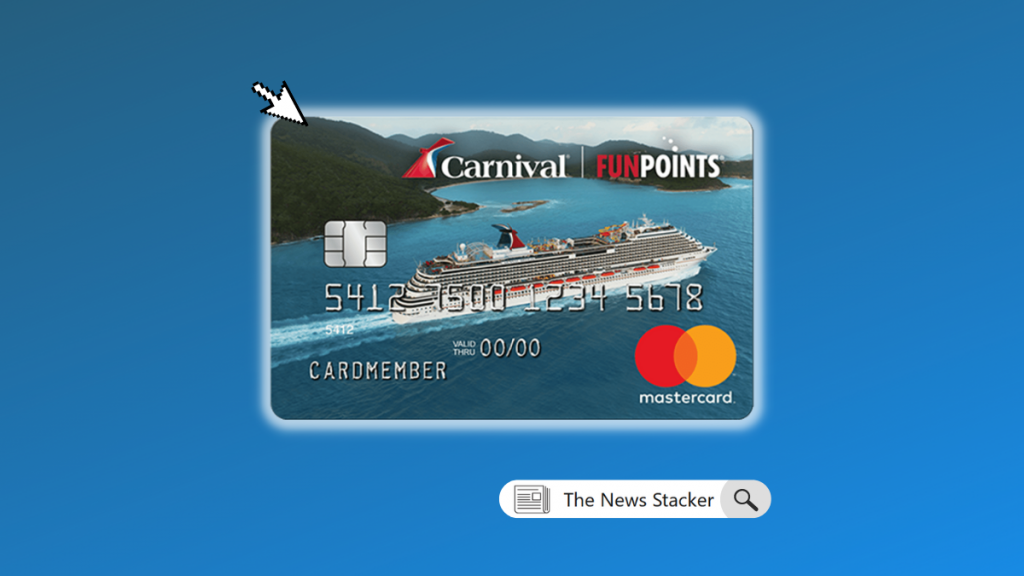

Carnival® World Mastercard® review: rewards on the world’s leading cruise lines

This Carnival® World Mastercard® review will show you how you can get the best of this card to enjoy amazing cruise trips onboard the best ships in the world!

Advertisement

Carnival® World Mastercard®: up to 2X FunPoints® on eligible purchases

Do you want to go on a cruise trip? Then, this Carnival® World Mastercard® review is worth reading.

It gathers how this card works and how the reward program can help you save money onboard the World’s Leading Cruise Lines.

See how to apply for the Carnival® World Mastercar

Check out how to apply for a Carnival® World Mastercard® and enjoy many perks while being onboard one of the greatest cruises in the world!

- Credit Score: Good to excellent

- Annual Fee: There is no annual fee to enjoy this credit card benefits

- Intro offer: 20,000 FunPoints® after you make your first purchase or balance transfer;

- Also, earn 1 FunPoint® for each dollar your spend on balance transfers you make within your first 30 days (up to 5,000 FunPoints®). *Terms apply.

- Rewards: 2x FunPoints® for each dollar you spend on any purchase with the Carnival Cruise Line and World’s Leading Cruise LinesSM brands; 1x FunPoints® for each dollar you spend on any other purchase you make with the card. *Terms apply.

- APRs: 0% intro APR for 6 billing cycles on purchases. Then, 18.74%, 24.74%, or 28.74% variable APR based on your creditworthiness.

- Other Fees:

So, read on to find out the main advantages and disadvantages of applying for this Mastercard.

Carnival® World Mastercard®: What can you expect?

If you are a fan of cruises, then this Carnival® World Mastercard® review is worth reading.

At first, it is important to mention although this card is not designed only for cruise travelers, it is more suitable for them, especially those who choose to go onboard the World’s Leading Cruise Lines.

The Carnival® World Mastercard® gathers all a traveler wants such as protection, a good reward program, no foreign transaction fees, and low costs.

However, the rewards can only be redeemed for statements credits toward Carnival purchases, and gifts and amenities.

On the other hand, if you plan to go on a cruise the next year, this Carnival card might be definitely an option.

Since it offers up to 2X FunPoints® per dollar spent on the World’s Leading Cruise Lines purchases, you may find it great for saving onboard.

Furthermore, it provides you with a 0% promotional APR on Carnival cruise bookings for six months.

And there is more!

In sum, you also get the following:

- 0% introductory APR on balance transfers for 15 months on transactions made within 45 days of the account opening;

- 10% back as statement credits for Carnival bookings through the website;

- An amazing welcome bonus of 20,000 FunPoints® right after your first transaction (purchase or balance transfer).

Lastly, there is no annual fee, which makes it even more fun to hold this credit card.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

This card offers some benefits at a very low cost, as shown in this Carnival® World Mastercard® review.

All in all, it is worth mentioning that this Mastercard can be more effective for those who plan to go on a Carnival cruise trip or other Leading Cruise Lines.

Pros

- It offers a welcome bonus, statement credit back on Carnival purchases, and low promotional APR on Carnival cruise bookings;

- It features up to 2X FunPoints® per dollar spent on the World’s Leading Cruise Lines purchases;

- It doesn’t charge an annual fee or foreign transaction fees.

Cons

- It lacks benefits to other travel goals.

What are the eligibility requirements?

This information couldn’t be found. But it is recommended a good credit score in the application since Barclays doesn’t offer prequalification with no impact on the credit reports.

Learn how to request the Carnival® World Mastercard®

If you are interested in planning to go on a trip onboard a leading cruise, then a Carnival® World Mastercard® is your next card, as can be seen in this review.

Therefore, learn how to apply for it!

See how to apply for the Carnival® World Mastercar

Check out how to apply for a Carnival® World Mastercard® and enjoy many perks while being onboard one of the greatest cruises in the world!

Trending Topics

See how to apply for the St George Vertigo Card

Looking for a card with low fees? Read this post to find out how to apply for the St George Vertigo Card and get the lowest purchase rate.

Keep Reading

Spotify HiFi: are Spotify users finally getting a high definition tier?

Spotify HiFi has become sort of an urban legend amongst music lovers, but Spotify might actually launch its high definition tier soon.

Keep Reading

See how to apply for the Capital One Venture Rewards

Learn how to apply for the Capital One Venture Rewards card and earn unlimited miles on every purchase, plus miles on hotels and rental cars.

Keep ReadingYou may also like

Facts and Curiosities about the Wellness Market

Discover some curiosities about the global wellness market. Take an in-depth look at this dynamic sector now!

Keep Reading

USB-C Charging will become standard in most European devices in 2024

The European Union requirement of USB-C charging on a series of electronic devices is putting Apple on a spot to change their Lightning port.

Keep Reading

United Quest℠ Card review: Take Your Travel Game to the Next Level

Take your travel game up a notch! Get tons of airline benefits, lounge access, and more. Read our United Quest℠ Card review for more!

Keep Reading