Credit Cards (US)

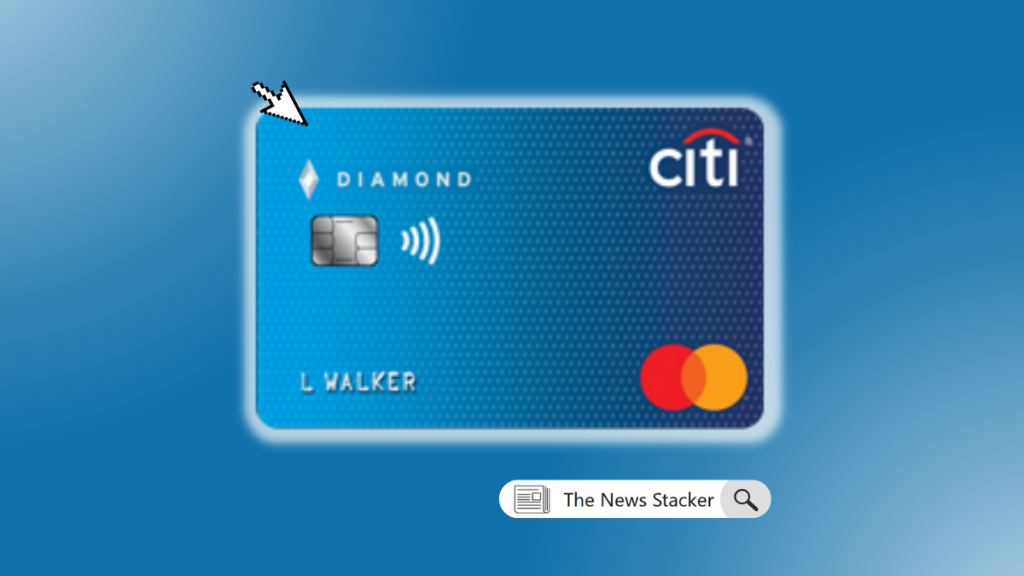

Citi® Secured Mastercard® Credit Card review: Low APR and no annual fee

If you're looking for a secured credit card with a low APR and no annual fee, the Citi® Secured Mastercard® Credit Card is a great option. Read this review to learn more.

Advertisement

Citi® Secured Mastercard® Credit Card: Build your credibility quickly

Are you looking for a way to build or rebuild your credit? If you are, this Citi® Secured Mastercard® Credit Card review is a helpful guide in your search for the perfect secured credit card.

See how to apply for the Citi® Secured Mastercard®

Learn how to apply for the Citi® Secured Mastercard®, a secured credit card that can help you rebuild your credit history.

- Credit Score: You don’t need a credit history for this card.

- Annual Fee: $0

- Intro offer: None

- Rewards: None

- APRs: There is a 26.99% variable APR

- Other Fees: Balance transfer fee of $5 or 5%, whichever is greater

This secured credit card gives customers a sensible way to manage their finances while building their credit health over time.

In this blog post, we’ll review the key features of this card and provide an assessment of its overall benefits and drawbacks. Read on for more information!

Citi® Secured Mastercard® Credit Card: What can you expect?

Looking to build your credit with a starter card? Look no further than the Citi® Secured Mastercard®! After all, it was specially designed for those with limited or no credit history.

Firstly, there’s no annual fee, and you can report all activities to all three major bureaus. So, you could build your credibility quickly!

In addition, if you have an existing financial relationship with Citibank, this could work in your favor. This means holds on higher security deposits, and even greater reward opportunities should be within reach.

Further, check out our Citi® Secured Mastercard® Credit Card review today, and get ready to embark on a journey towards establishing good financial foundations!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Get the facts and make an informed decision. Take a closer look at this Citi® Secured Mastercard® Credit Card review.

Now, discover what advantages you can gain and which potential drawbacks should be considered.

Pros

- No annual fee

- $200 minimum for the security deposit

- Low APR compared to other secured cards

- Reports to all three credit bureaus

Cons

- No additional benefits

- No rewards

- Other secured cards offer better rates and benefits

What are the eligibility requirements?

Build your credit without taking risks with the Citi® Secured Mastercard®, designed to accommodate individuals who have yet to establish a strong financial history.

Furthermore, this card requires no minimum score. Just apply and begin creating lasting financial stability today!

Learn how to request the Citi® Secured Mastercard® Credit Card

With just a few easy steps, you can become eligible for the Citi® Secured Mastercard®, an affordable option to help build and establish credit.

Take control of your financial future today. Learn how to apply in the link below!

See how to apply for the Citi® Secured Mastercard®

Learn how to apply for the Citi® Secured Mastercard®, a secured credit card that can help you rebuild your credit history.

Trending Topics

See how to apply for the Priceline VIP Rewards™ Visa® Card

Find out why you should apply for the Priceline VIP Rewards™ Visa® Card and prepare for total luxury. Don't miss out on this opportunity!

Keep Reading

See how to apply for the SoFi Personal Loan

Wondering how to apply for a SoFi Personal Loan? Our step-by-step guide will take you through the application process from start to finish.

Keep Reading

The Hilton Honors American Express Business Credit Card review

Get the complete scoop on this exclusive Hilton Honors American Express Business Credit Card review. Learn about all its benefits.

Keep ReadingYou may also like

See how to apply for a DirectAxis Loan

Learn how to apply for a DirectAxis Loan and get the cash you need to cover your expenses. Their online process makes it easy!

Keep Reading

US Bank Shopper Cash Rewards® Visa Signature® Review: Tailored Perks!

Learn how to unlock a world of savings with the US Bank Shopper Cash Rewards® Card in this review! Earn up to 6% cash back!

Keep Reading

See how to apply for the Hilton Honors American Express Business Credit Card

Get rewarded for your travels with rewards and bonus points when you apply for the Hilton Honors American Express Business Credit Card.

Keep Reading