Credit Cards (US)

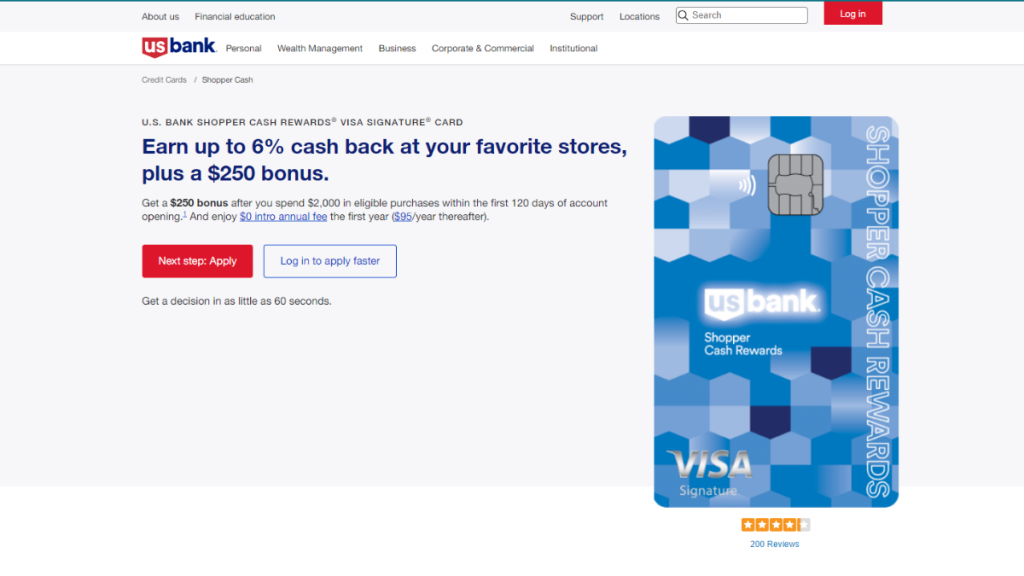

US Bank Shopper Cash Rewards® Visa Signature® Review: Tailored Perks!

Experience the joy of smart spending with the US Bank Shopper Cash Rewards® Visa Signature® Card. Your favorite retailers, exclusive rewards, and easy redemption options await!

Advertisement

Enjoy cash back on your favorite stores, get an intro bonus, and pay zero annual fee in the first year!

When looking for a financial tool that offers personalized rewards, the US Bank Shopper Cash Rewards® Card appears as a great alternative to review! But is this the right card for you?

Whether you’re a savvy shopper or just getting started on your credit card adventure, explore the features, perks, and potential pitfalls of this unique cash-back powerhouse and learn how to apply online!

- Credit Score: 700 or higher to be more likely to qualify.

- Annual Fee: While it provides a zero annual fee for the first year, it’s essential to note this fee is $95 from the start of the second year.

- Intro offer: As a welcoming incentive, the card presents a generous $250 bonus.

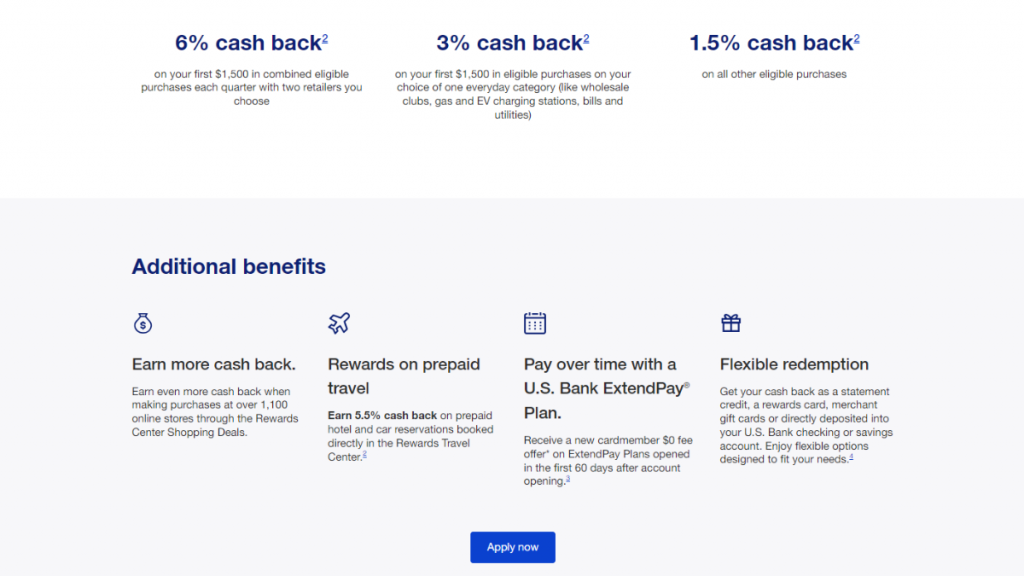

- Rewards: Cardholders can earn up to 6% cash back. However, this applies only on the first $1,500 spent in combined eligible purchases. Moreover, users get 3% cash back. This is also on the first $1,500 in one everyday category. And finally, 1.5% cash back on all other eligible purchases.

- APR: 19.74% to 29.74%.

- Other Fees: Includes a 3% foreign transaction fee, a 5% cash advance fee (with a $10 minimum), a 3% balance transfer fee (with a $5 minimum), and a 3% fee for convenience checks (with a $5 minimum).

US Bank Shopper Cash Rewards®: What can you expect?

If you want a financial tool that opens the door to personalized savings, then it’s time to review the perks of the US Bank Shopper Cash Rewards® Visa Signature® Credit Card.

Imagine choosing two favorite retailers from a diverse list, including major players like Amazon, Target, and Walmart.

After personalizing your retailers, you can earn up to 6% cash back! Though it’s only on the first $1,500 spent on eligible purchases, it’s still a great deal.

Moreover, the card offers a generous $250 bonus for new cardholders. All you need to do is spend $2,000 on eligible purchases to get this bonus. And that must be done within the initial 120 days.

Beyond the allure of rewards, the card provides a rapid decision-making process, with applicants often receiving approval in as little as 60 seconds. And you can apply online!

However, be on the lookout for the annual fee. Afterall, it’s charged after the first year.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

Still not sure this is the right financial companion for you? Then it’s time to review the benefits and potential disadvantages of the US Bank Shopper Cash Rewards® Visa Signature® Card before applying!

Pros

- New cardholders are greeted with a substantial bonus;

- Enjoy cash back at some specific and popular retailers;

- Quarterly cash-back bonanza;

- Freedom to redeem rewards in multiple ways.

Cons

- Annual fee after the initial period;

- Overseas transaction fee;

- Balance transfer fees;

- The 6% cash back is limited to the initial $1,500;

- The variable APR is high.

What are the eligibility requirements?

So, want to get the US Bank Shopper Cash Rewards® after this review? Eligibility is typically contingent on factors such as a good to excellent credit score and a positive credit history.

Moreover, a sufficient income indicates financial capacity. Applicants must also have U.S. citizenship or legal permanent residency, and be at least 18 years old.

Learn how to get the US Bank Shopper Cash Rewards®

Ready to make the most out of your spending? Then it’s time to review a complete step-by-step on how to apply for the US Bank Shopper Cash Rewards® Credit Card!

This easy guide navigates the ins and outs of securing this coveted cash-back powerhouse. And you can apply online from the comfort of your home!

Apply online

So, by applying online, you can get the answer to your application process in just 60 seconds! Learn how!

- Visit the official website: Firstly, begin your journey towards rewards by visiting the official US Bank website. Next, select the “Personal” tab and choose “Credit Cards”. Click to access the card’s webpage.

- Explore details: Take your time to review everything the US Bank Shopper Cash Rewards® has to offer. Then, click on “Apply”.

- Application process: Fill out the online application form with accuracy and completeness. The U.S. Bank will ask for details regarding your income, employment, and housing situation.

- Submit and await approval: Once satisfied, submit your application. U.S. Bank will process your information. You may receive a decision in under 60 seconds. If approved, your card will be mailed to the address provided during the application process.

What about a similar credit card? Check out the MyPoint Credit Union Platinum Visa® Card!

Want to review alternative options as good as the US Bank Shopper Cash Rewards® Credit Card? Then discover the MyPoint Credit Union Platinum Visa®! This card focuses on simplicity and flexibility.

This card ensures you have the essential tools for responsible spending without the added complexities.

For a detailed exploration of how the MyPoint Credit Union Platinum Visa® Card, you can access it below now!

MyPoint Credit Union Platinum Visa® Review

Discover the MyPoint Credit Union Platinum Visa® in this in-depth review. Earn points and enjoy peace of mind with travel insurance.

Trending Topics

Habit trackers: The 5 tips from therapists to keep up with your goals

Learn how to use habit trackers with this guide from therapists. From understanding why they work to identifying the best app for you.

Keep Reading

Amazing lemon cleaning hacks for your home

Are you looking for a sustainable and natural way to clean your home? Check out these easy and effective lemon cleaning hacks!

Keep Reading

Upstart Personal Loan review: Get personalized rates

Do you want to get fast funding from a lender that views more than your credit score? Then check out our Upstart Personal Loan review.

Keep ReadingYou may also like

Celebrity Cruises Visa Signature® Credit Card review

Get in-depth insight into the benefits and features of the Celebrity Cruises Visa Signature® Credit Card in our comprehensive review!

Keep Reading

Blue Cash Preferred® Card from American Express review: Exclusive benefits and rewards

In this Blue Cash Preferred® Card review, we’ll discuss everything you need to know about this card with exclusive benefits and rewards.

Keep Reading

See how to apply for Barnes & Noble Mastercard®

Check out how to apply for the Barnes & Noble Mastercard® and get good benefits at the largest bookstore on the internet at a $0 annual fee.

Keep Reading