Credit Cards (US)

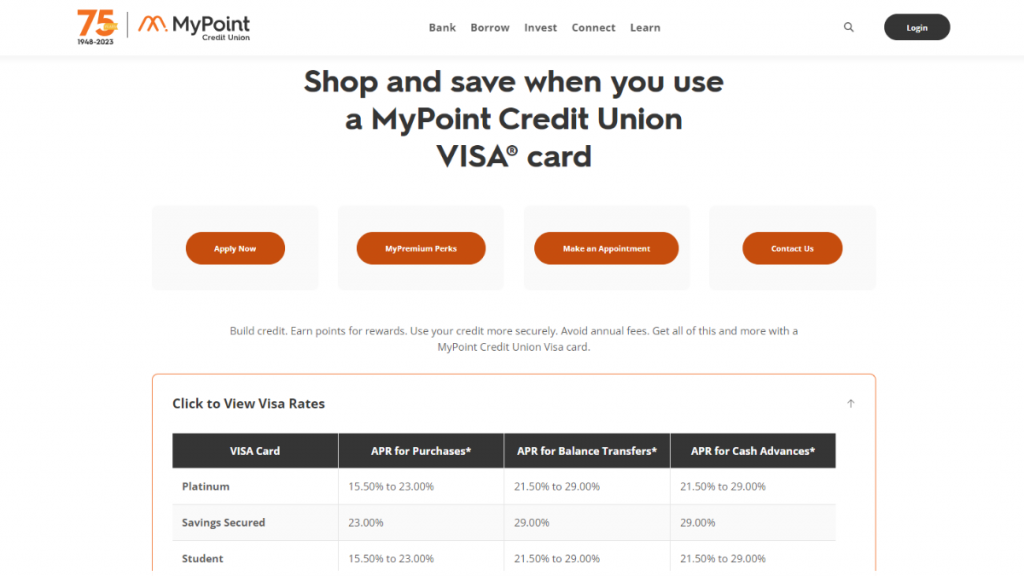

MyPoint Credit Union Platinum Visa® Review: Rewards and Security!

From a generous credit line to MyPremium Perks, find out why the MyPoint Credit Union Platinum Visa® stands out in the crowd. Maximize your spending today!

Advertisement

From points to cash back, explore the benefits of this remarkable credit card now!

Get ready to review all the features and advantages of the MyPoint Credit Union Platinum Visa® Card to unveil the key to unlocking a world of perks and rewards through your everyday spending.

From a generous credit line to travel insurance, this credit card is designed to enhance your financial journey. Explore what makes this card a standout choice for those seeking more from their credit experience.

- Credit Score: FICO score of 670 or higher.

- Annual Fee: Cardholders don’t need to worry about annual fees for the first three years. On the fourth anniversary of sign-up, an annual fee of $35 is charged.

- Intro offer: While the card doesn’t have a traditional introductory bonus, the MyPremium Perks Program offers a unique ongoing benefit. Cardmembers earn one point for every $1 spent, and members from the previous Choice Rewards program have their existing points carried over.

- Rewards: With the MyPremium Perks Program, you can accumulate points for every purchase, and these points can be redeemed for cash back, merchandise, gift cards, travel, and more.

- APR: 15.50% to 23.00% for purchases.

- Other Fees: N/A.

MyPoint Credit Union Platinum Visa®: What can you expect?

So, in this MyPoint Credit Union Platinum Visa® review, we delve into the financial world’s hidden gem, a credit card that offers value and rewards for responsible spenders.

One of the standout features of this credit card is the substantial credit line it offers, reaching up to $50,000. This means you have the flexibility to make larger purchases or carry a balance when necessary.

Managing your MyPoint Credit Union Platinum Visa® account is simple, with 24/7 online access through MyPoint Credit Union Online. It’s all about making your financial life more convenient!

However, this credit card truly shines with the MyPremium Perks Program. By enrolling in the program, you earn one point for every $1 spent on your card.

Additionally, while there’s a possibility of an annual fee, the first three years are fee-free, and even after that, you can qualify for a fee waiver with a minimum annual purchase of $6,000.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

In summary, the MyPoint Credit Union Platinum Visa® is a financial companion that gives back to its cardholders, but it’s essential to review its advantages and drawbacks before you apply.

Pros

- Substantial credit line of up to $50,000;

- Travel Accident Insurance;

- Convenient account access;

- Automatic payments;

- MyPremium Perks program.

Cons

- Annual fee after 3 years;

- Specific APR depends on factors like your creditworthiness;

- No introductory bonus.

What are the eligibility requirements?

So, the MyPoint Credit Union Platinum Visa® typically requires applicants to have a good to excellent credit score for approval. This means that a FICO score of 670 or higher is often necessary.

Furthermore, meeting this credit score threshold is a key factor if you’re seeking approval for the card and accessing its features and benefits.

Learn how to get the MyPoint Credit Union Platinum Visa®

So, in this review, you’ll find that the steps to secure your MyPoint Credit Union Platinum Visa® are quite simple and straightforward. Keep reading, and find below an easy guide on how to apply!

Apply online

Whether you’re looking to enhance your purchasing power or earn rewards on your spending, this card could be the right fit for you!

- Visit the MyPoint Credit Union website: To begin the application process, visit the official MyPoint Credit Union website and click on the “Borrow” option on the main menu. Then, select “Credit Cards”.

- Online application: When the page loads, find the button “Apply now” and click to access the online application. This form will require personal and financial information, such as your social security number and income details.

- Submit and await: Once complete, submit your application online. If approved, you’ll receive your MyPoint Credit Union Platinum Visa® card by mail. Upon receipt, activate your card following the provided instructions.

What about a similar credit card? Check out the Vast Visa® Platinum Card!

If, even after this in-depth review, you’re still looking for an alternative to the MyPoint Credit Union Platinum Visa® card, the Vast Visa® Platinum Card presents an enticing option.

With its array of rewards, it’s designed to cater to diverse preferences. Curious? Then access a full review by clicking the link below!

Vast Visa® Platinum Card: Financial Freedom!

Read this review and find out why the Vast Visa® Platinum Card is your key to financial empowerment. No annual fees and intro APR included!

Trending Topics

What are the best museums in the US?

This post has an interesting list of the best museums in the US to enjoy a nice day with your family. Choose one and go see it!

Keep Reading

The TOP 12 richest people in the world

The amount of money owned by the richest people in the world will amaze you. Read this post to see how much money they have.

Keep Reading

Achieve Financial Freedom: Top Apps for Building Wealth

Stop relying on paychecks alone. Learn the apps and strategies you need to build wealth and achieve financial freedom today. Get started now!

Keep ReadingYou may also like

Discover the Best Apps to Learn Spanish and Master the Language

Looking for the best apps to learn Spanish? Discover our top recommendations for language learning apps. Start your language-learning journey!

Keep Reading

Financial travel checklist for a worry-free vacation

Make your travel planning a breeze with this comprehensive travel checklist of everything you'll need for a worry-free vacation.

Keep Reading

How can you save with Evouchers?

Shopping just got smarter and more affordable! Learn how to save with evouchers and get tips and tricks to maximize your savings.

Keep Reading