Apps

Achieve Financial Freedom: Top Apps for Building Wealth

Learn how today's technology can help you build strategies to achieve financial freedom. Discover the best apps that make it easier to grow your wealth and reach your goals faster.

Advertisement

Many of us dream of achieving financial freedom at some point in our lives. We want to be able to live comfortably without having to rely on paychecks to stay afloat.

Luckily, with the help of today’s technology, it’s never been easier to build strategies to help us reach our financial goals.

In this blog post, we’ll explore how you can start building those strategies today while highlighting the best apps that can help you reach the ultimate goal of financial freedom.

Simple Strategies for Building Wealth

To successfully build wealth, effective planning is crucial. The key to achieving any goal lies in selecting the right strategy. So, read on to discover our top tips for wealth-building.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Budgeting

If you’re looking for a way to achieve financial freedom, one strategy you absolutely need to know about is budgeting. Budgeting forms the cornerstone of financial success, allowing you to make informed choices about allocating resources.

With a detailed budget in place, you’ll be able to understand your income, expenses, and saving potential and use this knowledge to prioritize essential expenses and identify areas where you can cut back.

Saving

Creating a financial safety net is crucial if you’re hoping to achieve financial freedom. To do this, regularly put aside a portion of your income.

Having savings not only helps you feel better prepared for unexpected expenses but also allows you to invest in opportunities without relying solely on borrowing money.

By establishing a strong foundation of savings, you can feel more in control of your financial future and less burdened by debt.

Investing

With options like stocks, bonds, real estate, and mutual funds, there’s no shortage of ways to boost your wealth and earn returns that outpace inflation.

However, it’s important to keep in mind that investing requires some research, diversification, and a long-term mindset. As you navigate the world of investments, you may come across opportunities for capital growth, regular income, and even the magic of compounding.

Best Apps for Building Wealth: Achieve Financial Freedom

Change your life today! Take a new step towards a better financial future by checking out these apps:

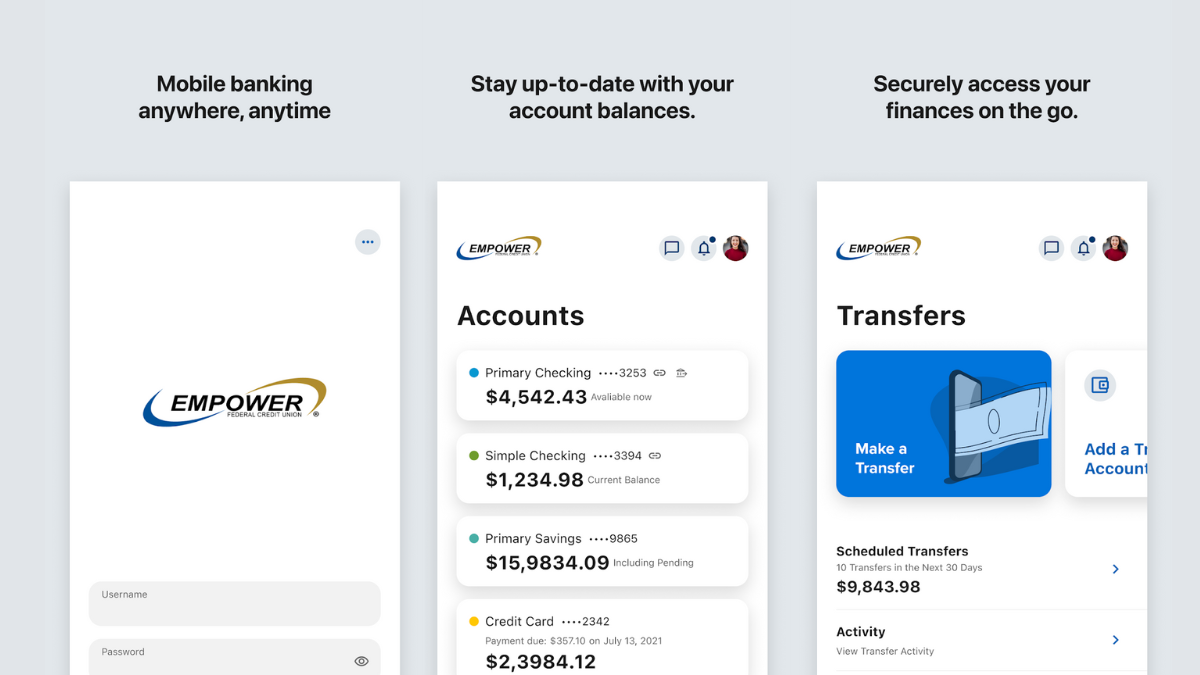

The best app for Managing Your Money: Empower

- Key Features: The first one is AutoSave. The app sets aside some cash every week, but only when you can afford it. You won’t even notice the money disappearing! And speaking of budgeting, this app has got you covered. It makes it super easy to set goals and sends you handy reminders when you’re getting close to crushing them. Oh, and let’s not forget about the Empower Cash Advance feature. Need up to $250 right now? No worries! This game-changer won’t charge you any interest, late fees, or hurt your credit. It’s time to take charge of your finances and achieve financial freedom!

- Free? You can try Empower for free for 14 days. After that, it’s just $8 per month to keep using all the amazing money management features in the Empower app.

- Why get it? Need cash fast? Empower is here for you, no interest, no late fees, and no credit checks. Get up to $250 when you’re in a bind. Plus, you can access your paycheck up to two days early! Struggling to save? Empower automatically finds money and sets it aside, so you don’t even miss it. Achieve your financial freedom easily, even with a low weekly target. Tired of juggling multiple apps for your finances? Empower has got you covered. Track your personal finances, budget, and save all in one user-friendly app. No more switching between apps!

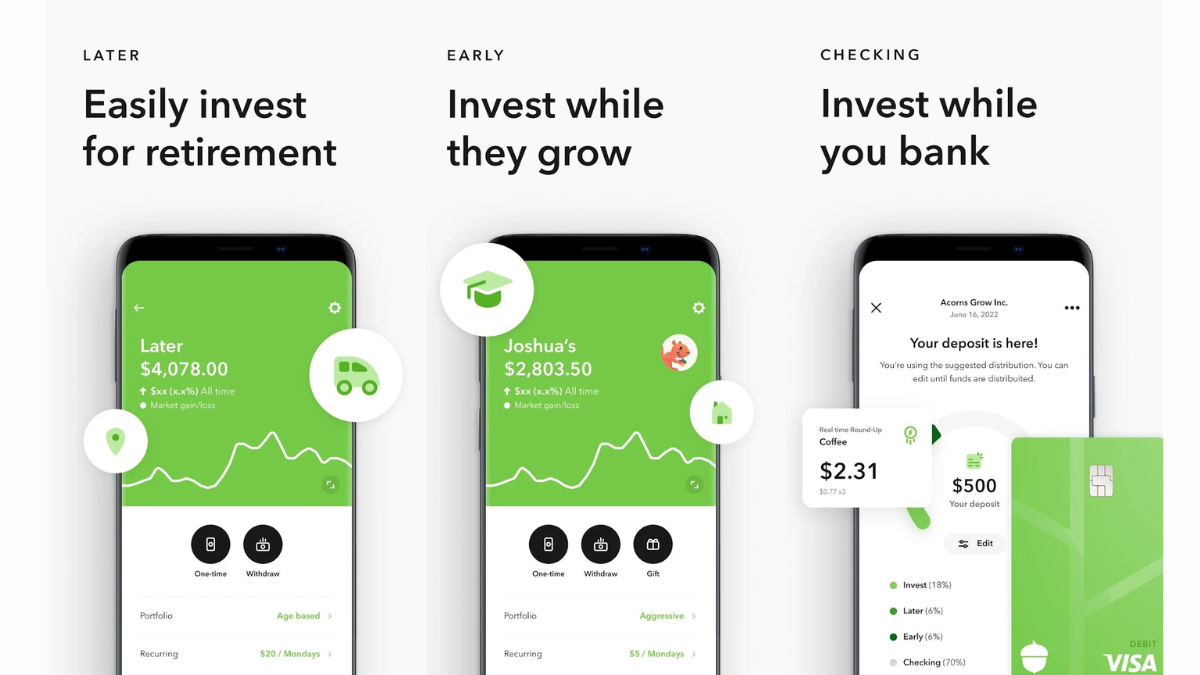

App for New Investors: Acorns

- Key Features: Their hands-off managed portfolio and Round-Ups feature automatically grow your investments in the market while providing portfolio rebalancing. Plus, you can start with small contributions, making investing accessible for everyone. Acorns also offers an ESG portfolio, focusing on sustainable companies for socially conscious investment. Alongside their checking account, which includes direct deposit and mobile check deposit features, Acorns also provides fee-free withdrawals from over 55,000 ATMs worldwide. To expand your knowledge of the stock market, Acorns offers custom financial literacy content on their “Money Basics” blog and Grow + CNBC website.

- Free? Acorns offers two awesome membership options: For just $3 per month, the Personal plan offers you a checking account, investment account, and retirement account. You can also upgrade to the Family plan for just $5 per month and enjoy all the benefits of the Personal plan, plus additional investment accounts for your children.

- Why get it? Acorns is an approachable platform for beginner investors to achieve financial freedom. With a simple interface and micro-investing feature, it makes investing easy. Your investments are safe in low-cost, diversified funds. It’s a solid choice for those who prefer a hands-off approach, but advanced investors can also customize portfolios.

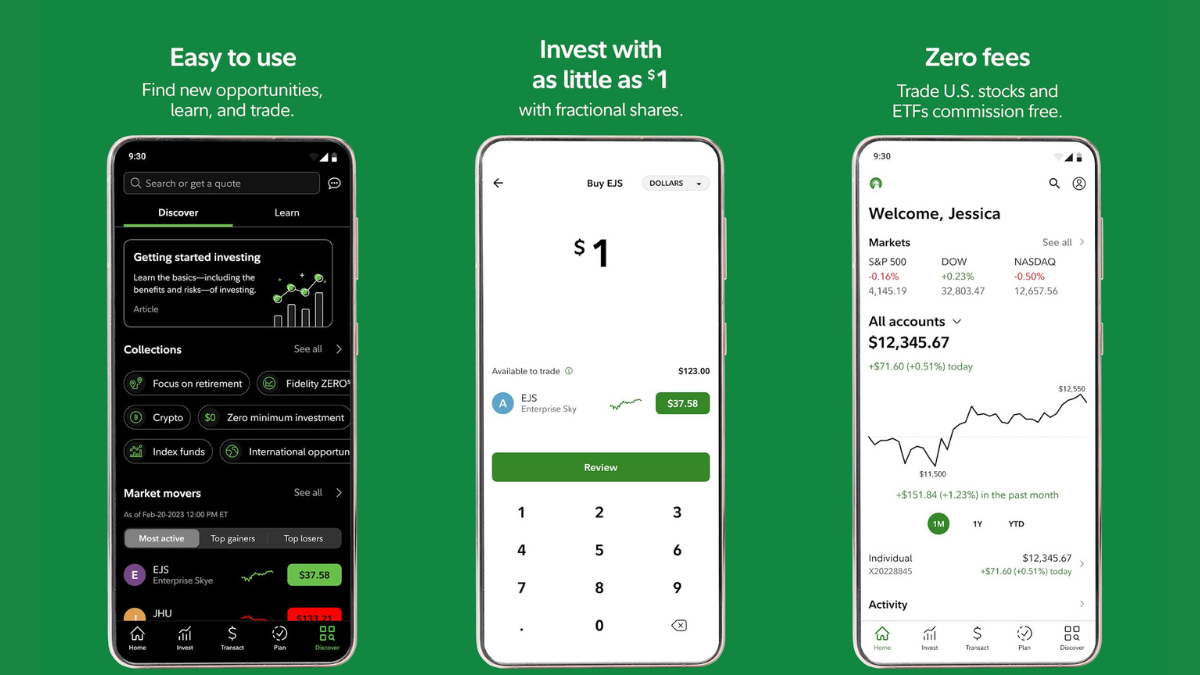

App for planning your retirement: Fidelity

- Key Features: In just 60 seconds, the app’s key feature allows you to get a snapshot of where you stand by answering just 6 simple questions. Once you’ve opened an account, the app’s digital planning tools provide you with the ability to set goals, build a plan, track your progress, and establish actionable next steps to get you closer to financial independence.

- Free? It’s free for both Android and iOS users. Save your money for more important things, like retirement!

- Why get it? With a user-friendly interface and accessible tools, Fidelity provides you with the resources you need to plan for your financial freedom. Also, this app assists you in creating a personalized financial plan that takes into account your current assets, including investments and savings, to generate a practical roadmap for retirement.

Finances are crucial in supporting various aspects of your life. And by reaching financial freedom, you get to enjoy precious moments with loved ones, prioritize health, savor good food, and indulge in leisure activities.

Furthermore, we are here to assist you in comprehending effective financial management. Explore our wide range of content. Keep up with The News Stacker for more insights.

Mr Price Money

Don't let budget limitations hold you back any longer. Find out how Mr Price Money can help get you shopping smarter today!

Trending Topics

Chase Slate Edge℠ Credit Card review

Want to learn more about the benefits of the Chase Slate Edge℠ Credit Card? Read this comprehensive review to discover if it's right for you.

Keep Reading

What are whole foods?

Do you know what whole foods are? This post will teach you the basics of this healthy eating trend and why you should take part in it.

Keep Reading

Discover It® Secured Credit Card review: A card that rewards your spending!

Learn in this Discover It® Secured review why this credit card might be what you need to build your credit while earning rewards.

Keep ReadingYou may also like

Common skin care mistakes you need to stop making

Find out the most common skin care mistakes that people make and how you can avoid them yourself for healthier and younger skin.

Keep Reading

The most expensive houses in the US: how much can they cost?

If you like luxury, these expensive houses located in the U.S. will be interesting to you. Read this post to see how much they cost.

Keep Reading

The great debate: who is the most famous person?

This post looks at some of history's most famous people and attempts to answer the question - who is the most famous person in the world?

Keep Reading