Credit Cards (US)

First Citizens Bank Rewards Review: Ideal Perks!

Earn points on daily essentials, enjoy a 0% intro APR on balance transfers, and choose from cash back, gift cards, or merchandise with the First Citizens Bank Rewards. Learn more!

Advertisement

Take advantage of a 0% intro APR and enjoy a range of redemption options!

Learn how to turn your spending into rewards in this First Citizens Bank Rewards Card review. So, keep reading and discover a credit card that fits your lifestyle!

If you’re looking to maximize your everyday purchases, the First Citizens Bank Rewards Card might be the right fit for your lifestyle. Get ready to learn how to make your card work for you!

- Credit Score: FICO score of 670+.

- Annual Fee: $0.

- Intro offer: If you want to consolidate debt and save on interest, know this credit card comes with 0% APR on balance transfers. But it’s only within the first 12 months of use.

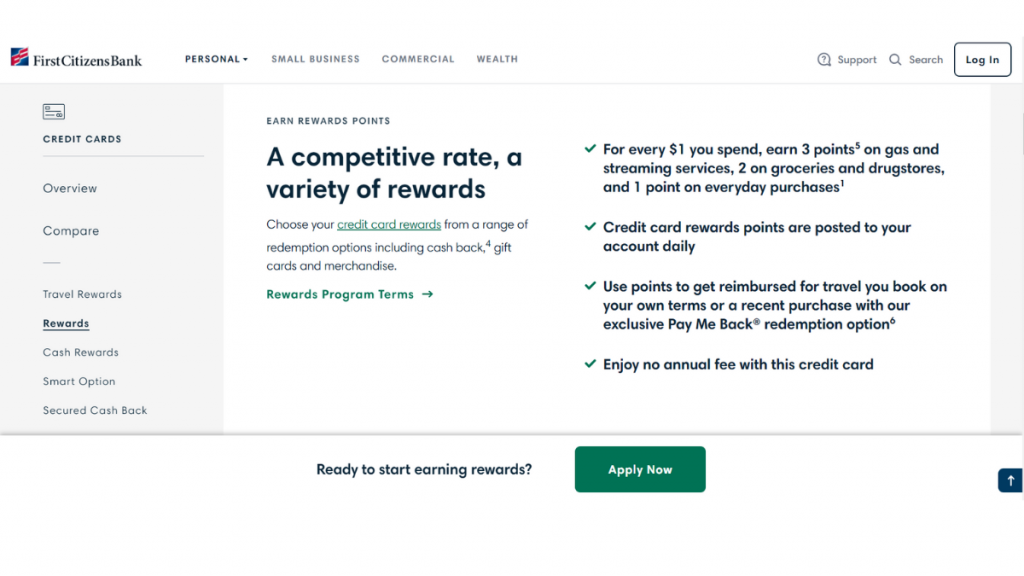

- Rewards: Besides a variety of redemption options, this card comes with an incredible Rewards Program for everyday spending. If you like streaming services, prepare to get 4x points. Moreover, gas stations also give you 4x points. Plus, you get 2x points when doing your everyday groceries or buying at drugstores. Finally, all other purchases give you 1x point.

- APR: 18.24% to 27.24% variable.

- Other Fees: There’s a foreign transaction fee of 3% associated with this card.

First Citizens Bank Rewards: What can you expect?

Whether you’re fueling up, stocking your pantry, or indulging in streaming services, this review will show that the First Citizens Bank Rewards Card can be the best option for your everyday purchases.

Firstly, this card gives you 3x points when putting gas in your car. Like streaming services? Then you can also get 3x points on those! Moreover, you get double the points on groceries and drugstores.

Finally, this card also gives you 1x point on all other purchases. And all that comes with the absence of an annual fee. This offers a cost-effective solution for a rewarding credit card experience.

Looking for an introductory offer that sets the tone for smart financial management? Then enjoy 0% intro APR on balance transfers! This lasts for the first 12 months of use.

This feature allows you to consolidate debt and save on interest, providing a practical solution for those looking to streamline their finances.

What sets the First Citizens Bank Rewards Card apart is not just its rewards structure but also the diverse redemption options available. You can redeem your points for cash back, merchandise, and more!

Plus, users also enjoy the convenience of contactless payments, text and email alerts, and simplify their financial routine by automating bill payments through Digital Banking.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

In order to fully explore the First Citizens Bank Rewards Card, it’s important to review its advantages and weigh the drawbacks before you decide to apply.

Whether you’re considering this card for its 0% introductory APR or weighing the impact of foreign transaction fees, discover a strategic analysis below.

Pros

- Access its benefits without any additional costs of annual fees;

- Take advantage of the 0% introductory APR;

- Dynamic Rewards Program;

- Real-time alerts and automation for secure transactions;

- Utilize points for travel reimbursement.

Cons

- This card charges a foreign transaction fee;

- Late payments may incur fees;

- Limited bonus categories.

What are the eligibility requirements?

So, to be eligible for the First Citizens Bank Rewards Card, aspiring cardholders should ideally possess a good to excellent credit score.

Moreover, applicants should be at least 18 years old and have a valid Social Security number.

Learn how to get the First Citizens Bank Rewards

Curious about how to bring this credit card to your wallet? Then, review a seamless step-by-step on how to apply for the First Citizens Bank Rewards Card and start making the most out of your daily purchases.

Apply online

From navigating eligibility requirements to submitting your application, check out how to apply for this credit card in a few easy steps!

- Visit the First Citizens Bank website: Begin by accessing the official website. Then, find the “Personal” option on the menu and click on it. Next, select “Credit Card” and find the First Citizens Bank Rewards Card to review the terms and conditions.

- Click to apply: When you’re done, click on “Apply Now”. Then, fill out the online application form with accurate and up-to-date information.

- Submit your application: Ensure all information is entered correctly to expedite the approval process. Once you’re done, click to submit the online form.

- Await approval: You may receive an instant decision, or the bank may need additional time to process your request. If approved, the First Citizens Bank Rewards Card will be sent to your registered address.

What about a similar credit card? Check out the Pelican Pledge Visa Card!

However, if you think the First Citizens Bank Rewards Card isn’t the right fit for your wallet, explore a distinctive approach to credit card with the Pelican Pledge Visa Card. Earn rewards with responsible usage!

With this card, you can enjoy points on your everyday purchases and relish the simplicity of redeeming them for travel, merchandise, or even charitable donations.

Choose a card that resonates with both your financial goals and values!

Pelican Pledge Visa Card Review: Build Your Credit

Discover a smart way to build your credit while using your savings as collateral in this Pelican Pledge Visa Card review!

Trending Topics

The 5 Best Places to Find Your Credit Score Reports

Looking for the best way to check your credit score reports? Check out our top 5 picks to help you keep track of your credit score.

Keep Reading

Cash App: Learn how to use and transfer money easily!

Learn about the innovative digital payment platform Cash App. Find out what it is and how to use it for stress-free transactions.

Keep Reading

See how to apply for the St George Vertigo Card

Looking for a card with low fees? Read this post to find out how to apply for the St George Vertigo Card and get the lowest purchase rate.

Keep ReadingYou may also like

Best options trading book: top 5 readings to trade like a pro

Options trading doesn’t have to be complicated. With this list of the best options trading book, you’ll become an expert!

Keep Reading

See how to apply for the Premium Rewards® Elite Card

Learn how you can apply online for the Bank of America Premium Rewards® Elite Card and get started on earning valuable rewards!

Keep Reading

Chase Sapphire Preferred® Credit Card review

The Chase Sapphire Preferred® Credit Card offers unparalleled rewards potential for cardholders. Check our full review to learn more!

Keep Reading