Finances

Credit card application: how is it evaluated?

Understanding how your credit card application is evaluated can help you make the best decisions for your financial future. This post will tell you how to do it.

Advertisement

Get the inside scoop on how your lenders analyze your credit

If you’re like most people, you’ve probably applied for a few credit cards in your lifetime. And if you’re like most people, you may have wondered how your credit card application is evaluated.

Do issuers look at your credit score? Your income? Your job history? How do they decide whether to approve or deny your application?

These are common questions, and you’ll find the answer by reading this post all the way.

Get into excellent credit scores range

In this post, we'll outline some tips to help you boost your credit rating and get into the excellent range. Stay tuned!

Factors issuers take into consideration to get your credit card application evaluated

There are a few different factors that issuers take into consideration when making this decision. It includes your credit history, income, and debts.

Here’s a look at how your credit card application is evaluated and what you can do to improve your chances of approval.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Credit Score

There are many things that go into consideration when a bank evaluates a potential customer for a new credit card. Of course, the biggest factor taken into account is your credit score.

This three-digit number reflects how responsible you have been with debt in the past. Banks will use it to determine whether or not they want to lend you money.

If you have a high credit score, it means that you’re seen as a low-risk borrower. It also means you’re more likely to be approved for a credit card.

On the other hand, if you have a low credit score, it may be more difficult to get approval for a new credit card.

Credit History

Your credit history includes information about your past borrowing and payments. As well as any outstanding debts that you may have.

The issuer will use this information to assess your level of risk, and will then make a decision about whether or not to approve your application.

In general, the better your credit history, the more likely you are to be approved for a new credit card.

So if you’re hoping to get a yes for a card, it’s important to make sure that you have a strong credit history.

Income

Issuers use this information to help determine how likely an applicant is to repay their debt.

Those with higher incomes can usually afford to pay off their debts.. And as such, are more likely to get a credit card with a higher limit and better rewards.

Those with lower incomes may still get approval for a credit card. But may have to provide additional information or documentation to prove their ability to repay the debt.

Employment history

A steady job indicates that the applicant is likely to have a stable source of income. Which makes it more likely that the applicant will be able to make payments on time.

A strong employment history may also help to offset other factors, such as a high debt-to-income ratio.

Debts

In addition to your income and employment history, they will also look at your credit history and any outstanding debts you may have.

This is because having a lot of debt can make it more difficult to pay your bills on time, which can negatively impact your credit score.

Recent Inquiries

Inquiries occur when companies request your credit report in order to make a lending decision, and too many inquiries can signal that you’re in financial distress.

As a result, it’s important to be mindful of the number of credit inquiries you have in the months leading up to a credit card application.

Too many inquiries could result in a denial, so it’s best to only apply for new credit when necessary.

Credit utilization ratio

For example, if your credit limit is $1,000 and you have a balance of $300, your credit utilization ratio is 30%. Generally speaking, issuers prefer to see a credit utilization ratio of 30% or less.

This shows that you’re using your credit responsibly and not to a overextent.

What to do if your credit card application gets denied

If you’ve been denied a credit card, it’s important to find out why.

You can request a free copy of your credit report from each of the three major credit bureaus to see what information the issuer was looking at.

Once you know what factors are affecting your score, you can work on improving them.

For example, if you have a history of late payments, you can work on paying your bills on time in the future.

By taking these steps, you can improve your chances of approval for a new credit card.

What to avoid on your credit card application:

There are several common mistakes people make when completing a credit application

Firstly, be sure to double-check all the information you enter. This includes things like your social security number, date of birth, and current address.

Secondly, make sure you’re honest about your financial situation. Trying to hide anything will only make things worse in the long run.

Lastly, don’t forget to read the fine print! It may seem like a tedious task, but it’s important to understand all the terms and conditions before signing on the dotted line.

The bottom line is that there’s no one factor that determines whether or not the approval for a new credit card.

Instead, issuers look at your overall financial picture to decide whether or not you’re a good candidate for the card.

So if you’re thinking about applying for a new credit card, make sure you understand how your application will be evaluated.

The best Chase Freedom® credit card: find out which one is right for you

Now that you know how a credit card application is evaluated, how about taking a look at some credit card options?

Keep reading our following article to know which are The best Chase Freedom® credit card and see if anyone is best for you.

The best Chase Freedom® credit card

Need a new credit card? Check out our list of the best Chase Freedom® unlimited credit cards and find the perfect one for you.

Trending Topics

See how to apply for the Royal Caribbean® Visa Signature®

Looking for exclusive rewards when you book a cruise? Learn how to apply for the Royal Caribbean® Visa Signature® and earn bonus points!

Keep Reading

Everything you need to know about Spotify HiFi

Wondering if the new Spotify HiFi tier is worth it? We've got everything you need to know, including what lossless audio quality means.

Keep Reading

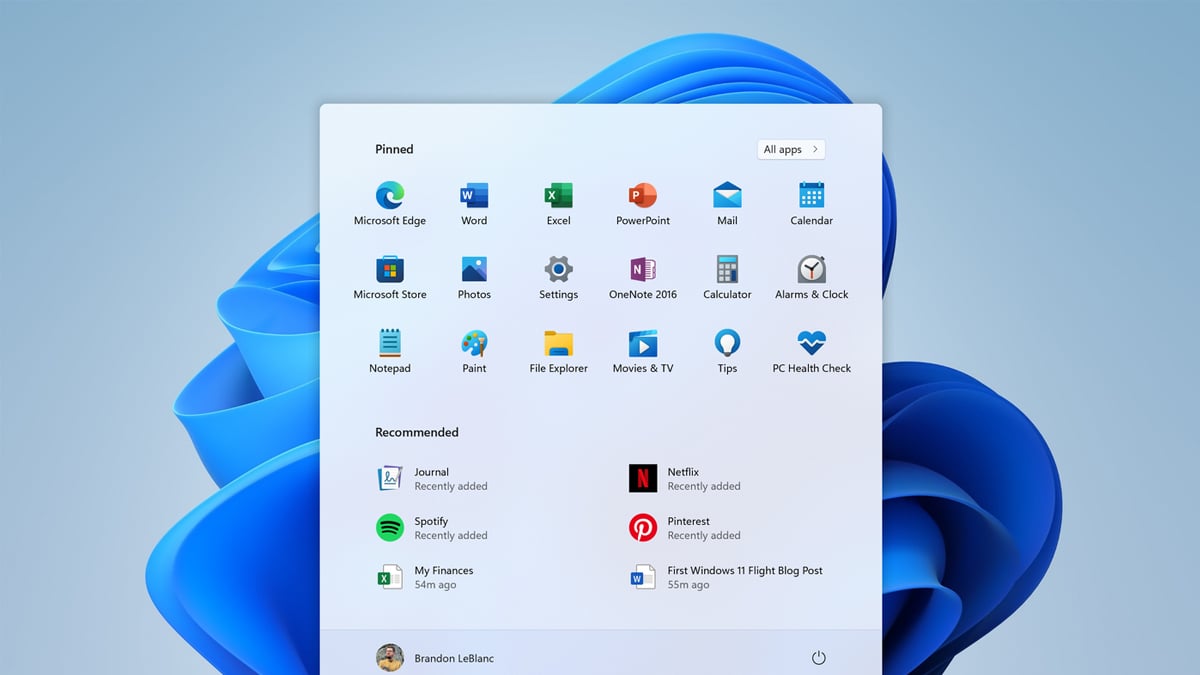

Change these Windows 11 settings to optimize your PC

Learn how to change a few Windows 11 default settings to optimize your computer’s potential, improve your security, and much more!

Keep ReadingYou may also like

iPhone hacks that will help make your life a lot easier

Do you owe an iPhone? Are you using your device to its maximum potential? Check out a couple of iPhone hacks that’ll make your life easier.

Keep Reading

US Bank Altitude® Go Secured Visa® Review: Secure Your Credit!

If you want to build credit responsibly, explore this review of the US Bank Altitude® Go Secured Visa® card. Discover financial freedom!

Keep Reading

TikTok or Instagram? Which one is the best app?

With so many social media platforms, it can be hard to decide which is right for you. Is it TikTok or Instagram? Read this post to find out!

Keep Reading