Credit Cards (AU)

HSBC Low Rate Card Review: Low-rate Advantages!

Featuring a competitive 12.99% p.a. interest rate, this card offers more than meets the eye. Elevate your spending experience with the HSBC Low Rate Credit Card! Learn more!

Advertisement

Your gateway to smart, cost-effective spending!

Welcome to the gateway of financial empowerment! This HSBC Low Rate Card review unveils a credit solution designed for those who value smart, cost-effective spending!

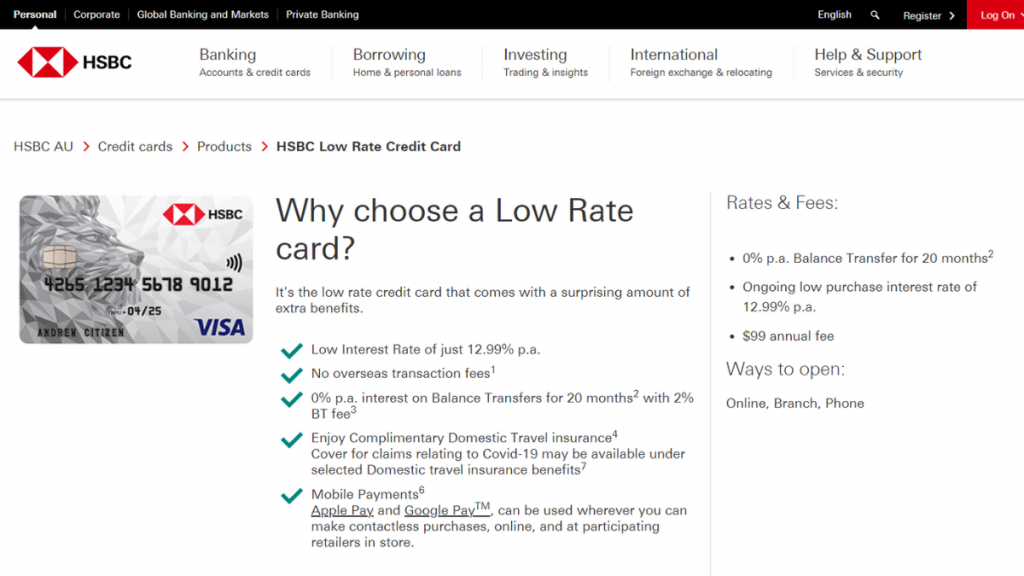

In a landscape of myriad options, this card stands out with its competitive 12.99% p.a. interest rate and an array of exclusive benefits. So, explore the intricacies of the HSBC Low Rate Card now!

- Credit Score: While specific score requirements may vary, applicants with a solid credit history are likely to qualify.

- Annual Fee: To access the advantages of the HSBC Low Rate Credit Card, cardholders are subject to an annual fee of $99.

- Intro offer: New cardholders can enjoy 0% p.a. interest on Balance Transfers for a substantial 20 months, providing a valuable opportunity to manage existing balances without incurring additional interest charges.

- Rewards: The HSBC Low Rate Credit Card, while focused on providing a low-interest rate and cost-effective features, does not offer a traditional rewards program.

- P.A.: 12.99% p.a. on purchases.

- Other Fees: There’s a 2% fee associated with Balance Transfers, providing an initial period of 0% p.a. interest for 20 months. For cash advances, cardholders face the higher of 3% or $4, reinforcing the importance of responsible card use to avoid unnecessary fees.

HSBC Low Rate Card: What can you expect?

As you’ll find in this HSBC Low Rate Card review, potential cardholders can anticipate a credit solution that prioritizes financial efficiency and flexibility.

Firstly, its remarkable 12.99% p.a. interest rate sets the stage for a strategic approach to borrowing. Besides, cardholders are provided with a gracious window to navigate existing balances.

After all, you get 0% p.a. interest on Balance Transfers extending over a substantial 20 months. And the card isn’t confined to the local utility, with the notable absence of overseas transaction fees.

Furthermore, revels in the contemporary convenience afforded by mobile payments through Apple Pay and Google PayTM, turning each transaction into a secure and effortless experience.

While the HSBC Low Rate Card doesn’t shy away from its $99 annual fee, it beckons potential users with a promise, a commitment to low rates, and an array of valuable perks.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

Although the HSBC Low Rate Card positions itself as an indispensable ally, it’s essential to review the advantages and drawbacks before you decide to apply.

With a focus on affordability and strategic benefits, this card stands ready to empower individuals on their journey to financial resilience and smart spending. Find out more!

Pros

- Highly competitive interest rate;

- Extended introductory offer;

- Absence of overseas transaction fees;

- Mobile payment convenience;

- Obtain multiple additional cards at no extra cost;

- Complimentary Domestic Travel Insurance.

Cons

- Annual commitment of $99;

- 2% balance transfer fee associated with the offer;

- Higher interest rates for cash advances;

- Absence of a rewards program;

- Individuals must have a minimum annual income of $40,000.

What are the eligibility requirements?

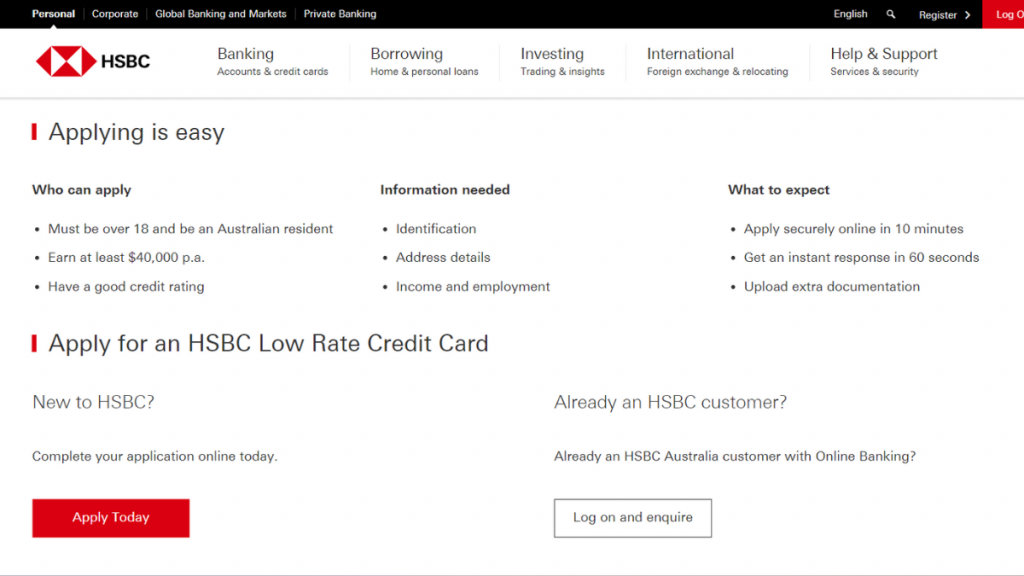

Firstly, to be eligible for the HSBC Low Rate Credit Card, applicants must meet specific criteria. Individuals must be over 18 years old and Australian residents.

Moreover, a minimum annual income of $40,000 is required, emphasizing financial stability.

Learn how to get the HSBC Low Rate Card

Embark on a journey towards smart and cost-effective spending and review now how to secure your very own HSBC Low Rate Credit Card. Applying for this financial ally is a seamless process!

Then, you’ll have access to a competitive 12.99% p.a. interest rate, 0% p.a. on Balance Transfers for 20 months, and a host of exclusive benefits!

Apply online

So, follow this step-by-step guide to navigate the online application of the HSBC Low Rate Card and set yourself on the path to enhanced financial flexibility!

- Visit the HSBC website: Begin your application journey by visiting the official HSBC website. Then, find the option for “Credit Cards” and click to access the cards available.

- Start the application process: Find the HSBC Low Rate Card and click to access the card’s official page. Click on “Apply Today”. The next step involves providing essential personal details. But remember, ensure accuracy in these details, as they form the foundation of your application.

- Review and submit: Once you’re done, review the information and submit your application. Then, in approximately 60 seconds, you’ll receive feedback on your application status.

- Approval: If approved, HSBC will proceed with the issuance of your HSBC Low Rate Credit Card.

What about a similar credit card? Check out the ING Orange One Low Rate Credit Card!

With a competitively low interest rate and a commitment to transparency, the ING Orange One Card offers a great alternative to the HSBC Low Rate Card, and you can review its features by clicking the link below.

This card is well-suited for budget-conscious individuals, giving you the freedom to focus on your spending priorities. Besides, it’s ideal for travelers seeking a card that aligns with their global lifestyle.

ING Orange One Low Rate Review

Discover financial freedom in this ING Orange One Low Rate review. Enjoy zero ING fees on international transactions for eligible users.

Trending Topics

Progen Lending Solutions review: Get the perfect financial solution for you

Our comprehensive Progen Lending Solutions review will help you discover how to get the perfect financial solution for your needs.

Keep Reading

Cashngo Loans review: Get your Cash Now with Affordable Loans

Find out more about Cashngo Loans with our full review. Borrow up to $2K quickly and fulfill your financial needs! Read on and learn more!

Keep Reading

See how to apply for the Coles No Annual Fee Mastercard

Enjoy unbeatable perks without any annual fees. Learn more about how to apply the Coles No Annual Fee Mastercard.

Keep ReadingYou may also like

The American Express Essential® Credit Card review

Get the lowdown on The American Express Essential® Credit Card and find out what makes it stand out from other cards in the market.

Keep Reading

How to apply for the Low Rate Credit Card from American Express®

Find out all the features and benefits when you apply for The Low Rate Credit Card from American Express® today! Read on!

Keep Reading

NAB StraightUp Credit Card review

Take a detailed look at the features and benefits of the innovative NAB StraightUp Credit Card and see if it’s right for your needs!

Keep Reading