Reviews (AU)

ING Personal Loan Review: Make Your Dreams a Reality!

Say goodbye to financial surprises and hello to control. The ING Personal Loan offers a personalised fixed rate, no ongoing fees, and the ability to pay off your loan faster. Apply in just 20 minutes for a world of financial possibilities.

Advertisement

From a low fixed interest rate to same-day funds for existing customers, embrace financial freedom!

If you’re looking for a solution that bridges aspirations to attainable realities, then review the ING Personal Loan! Embrace flexibility, and turn financial ambitions into tangible accomplishments.

Whether one envisions a dream wedding, home renovations, or the adventure of a lifetime, the ING Personal Loan is a versatile companion in turning those dreams into reality. So find out more!

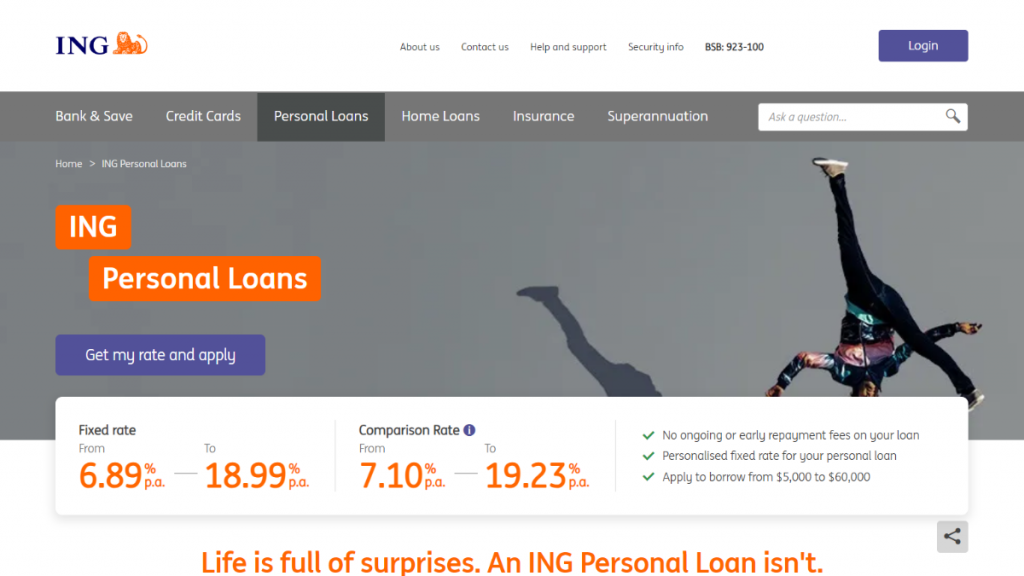

- APR: Competitive APR ranging from 6.89% to 18.99%.

- Loan Purpose: Whether it’s for a dream wedding, home renovations, travel adventures, or debt consolidation, the ING Personal Loan is designed to empower your financial aspirations.

- Loan Amount: Amounts ranging from $5,000 to $60,000.

- Credit Needed: Secure an ING Personal Loan with a good credit rating.

- Terms: N/A.

- Origination fee: N/A.

- Late Fee: N/A.

- Early Payoff Penalty: Embrace financial freedom without worrying about early repayment penalties.

ING Personal Loan: what can you expect?

While the ING Personal Loan can be a convenient way to achieve your goals, it’s important to review its features and understand exactly how it works.

Firstly, unlike one-size-fits-all approaches, this loan offers a personalized fixed interest rate, ensuring that your borrowing experience is uniquely suited to your financial profile.

Besides, the absence of ongoing fees adds to the affordability, ensuring that your focus remains on achieving your financial objectives rather than navigating hidden costs.

Embrace financial freedom with the flexibility to repay your loan on your terms. The ING Personal Loan permits extra repayments without penalties, allowing you to pay off your loan faster if you wish.

Finally, the online application process takes about 20 minutes, streamlining the journey to financial assistance.

For existing ING customers, the added perk of same-day funds means that once your loan is approved, the money can be seamlessly deposited into your Orange Everyday account!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

When you’re making personal finance decisions, it involves weighing the pros and cons of various loan options. So, below, you can review the pros and drawbacks of the ING Personal Loan.

Pros

- Personalized fixed interest rate tailored to your credit profile;

- Competitive Annual Percentage Rate (APR) ranging from 6.89% to 18.99%;

- Flexibility to borrow amounts ranging from $5,000 to $60,000;

- Absence of ongoing fees;

- Flexibility to make extra repayments;

- If you’re an existing ING customer, enjoy the convenience of same-day funds.

Cons

- Credit-dependent interest rates;

- Currently not available to self-employed applicants;

- Minimum annual income requirement.

What are the eligibility requirements?

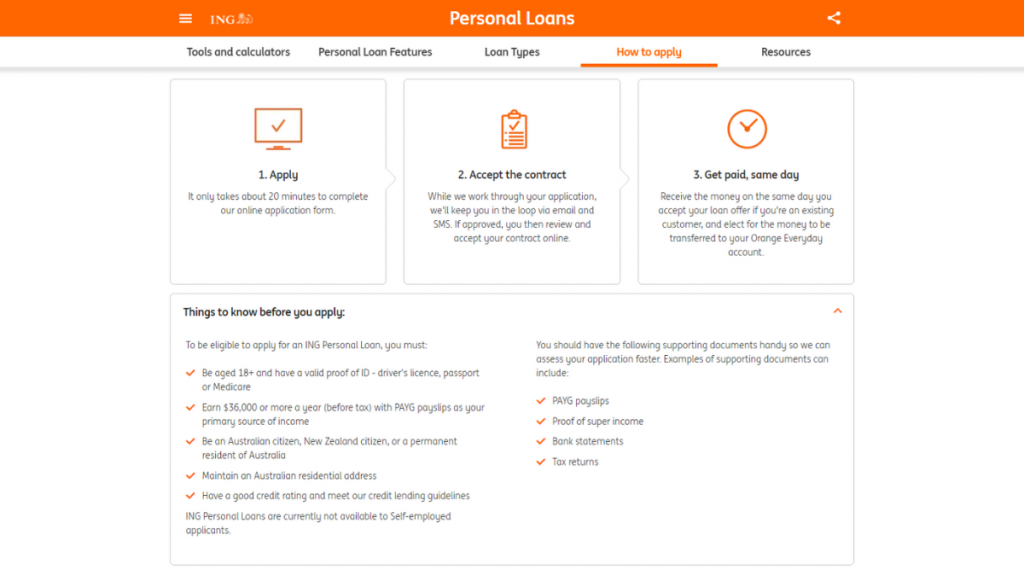

So, to qualify for the ING Personal Loan, applicants must be 18 years or older, hold a valid form of identification, and earn a minimum annual income of $36,000, primarily through PAYG payslips.

Moreover, eligibility extends to Australian citizens, New Zealand citizens, and permanent residents with a good credit rating.

Learn how to request the ING Personal Loan

If you’ve made your decision and want to apply for the ING Personal Loan, review a hassle-free step-by-step below. Unlock the doors to financial possibilities with a seamless application!

Learn how to request online

Whether it’s for debt consolidation, a new car, or a life-changing adventure, the ING Personal Loan is your ally in turning aspirations into realities.

- Access the website: Firstly, go to the ING official website. Then, locate the “Personal Loans” option on the main menu. Select the loan that best fits your needs and click to review it.

- Online application: Find the “Get my rate and apply” button and click to start your online application.

- Complete the form: The user-friendly form takes approximately 20 minutes to complete, gathering essential information about your financial situation, loan amount preferences, and personal details.

- Submit: Once you’re done, submit the form. Stay informed about the progress. ING will keep you in the loop via email and SMS, providing updates on the status of your application.

- Accept offer: Upon approval, you will receive the loan contract electronically. If satisfied, proceed to accept the contract online, signaling your commitment to the agreed-upon terms.

What about another recommendation: Quick Cash Loans!

Although the ING Personal Loan is a convenient option when it comes to fulfilling your dreams, it’s important to review other alternatives. So, meet the ANZ Personal Loans to address your financial needs.

With ANZ, borrowers can access a range of loan options tailored to diverse requirements. Benefit from competitive interest rates and flexible repayment terms. Further, find out more in the link below!

See how to apply for Quick Cash Loans

Are you looking for an instant financial solution tailored to your budget? Apply for Quick Cash Loans today and borrow the money you need.

Trending Topics

Qantas Premier Platinum Credit Card review: Enjoy Premium Travel Benefits

Discover all the perks and potential savings of the Qantas Premier Platinum Credit Card in our review. Get a full breakdown here.

Keep Reading

See how to apply for the Qantas Premier Platinum Credit Card

Find out how to apply for the Qantas Premier Platinum Credit Card today and take advantage of exclusive rewards.

Keep Reading

Best Apps for Calorie Counting: The Ultimate Guide for Aussies

Dive into Australia's top picks for the best apps for calorie counting. Boost your health journey with our expert recommendations!

Keep ReadingYou may also like

The Low Rate Credit Card from American Express® review: An Easy Way To Save Money

Check out our in-depth The Low Rate Credit Card from American Express® review to see if it works for you. Learn more here.

Keep Reading

Bendigo Ready Credit Card Review: Ignite your travel dreams

Get ready for spontaneous trips abroad! Check out our detailed Bendigo Ready Credit Card review to learn about it. Start your journey here!

Keep ReadingThe News Stacker recommendation – Citi Rewards Card review

Unlock exclusive rewards and discounts when you sign up for a Citi Rewards Card. Find out how to get more from your spending today!

Keep Reading