Loans (AU)

See how to apply for Quick Cash Loans

Enjoy up to $5,000 with competitive rates and flexible repayment options tailored to make your life easier. Learn how to apply for a Quick Cash Loan today!

Advertisement

Quick Cash Loans: Get Approved in Under 4 minutes!

Looking for a quick financial solution that won’t strain your wallet? Apply for Quick Cash Loans today and borrow anywhere between $200 to $5,000, with repayments tailored to coincide with your payday.

Direct debit repayments allow you to focus on the more important things without worrying about repayment dates.

With a minimum repayment time of 42 days and a maximum of 3 months, our loans offer flexible repayment options that suit your needs.

So why wait? Apply for a Quick Cash Loan today and take the first step towards financial freedom.

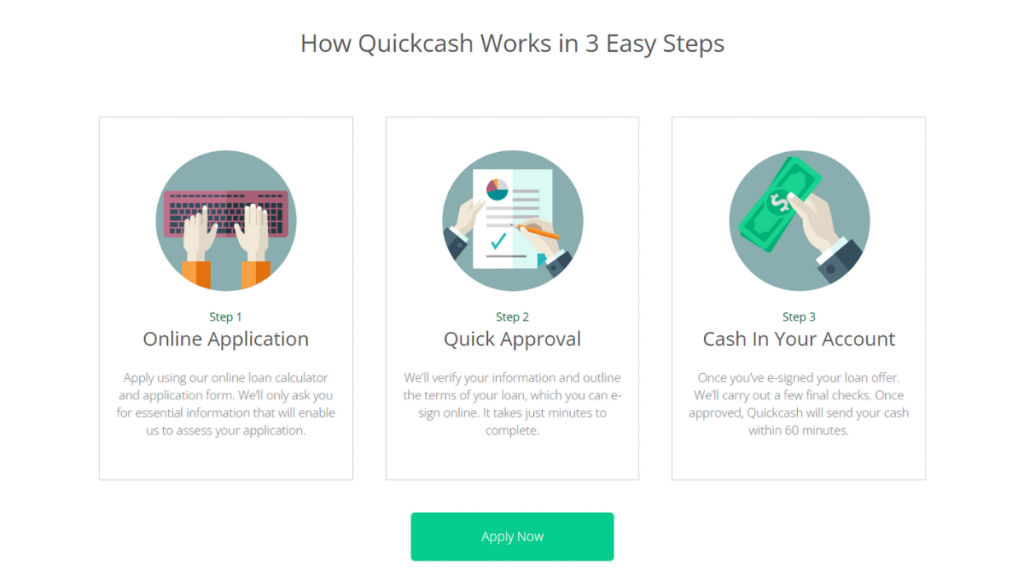

Learn how to get the Quick Cash Loans online

Looking to apply for Quick Cash loans? Well, the good news is that it’s easy-peasy! You only need to submit a full online application to their website.

But before you get too excited, don’t forget to check that you meet their eligibility requirements.

You need to be at least 18 years old and have a job with a regular income. Additionally, you must be either an Australian citizen or a permanent resident.

So, if you meet these criteria, what are you waiting for? Apply for that loan today!

You will be redirected to another website

How to get it using the app

While the company doesn’t offer an app now, its website is optimized for mobile use, making the application process accessible from anywhere.

Whether you need cash for unexpected expenses or to pay bills, apply for Quick Cash Loans today and see how they can assist you!

What about a similar loan? Check out the Cashngo Loans

When it comes to needing quick cash loans, there are many options to choose from.

However, not all loans are created equal. CashnGo offers a convenient alternative to traditional banks, catering specifically to those who need a smaller amount for a shorter period.

Applying is easy, and almost anyone with a steady income can be approved for up to $5,000.

Plus, unlike some lenders, CashnGo allows you to establish flexible repayment terms to fit your budget and timeline.

And with an upfront presentation of all costs, you can be sure you’re making an informed choice. Check out how to apply for CashnGo loans and compare them to Quick Cash Loans!

Quick and simple: Apply for the Cashngo Loans

Need some quick cash? With fast and easy loans of up to $2,000, find out how to apply for a CashnGo Loan today. Read on!

Trending Topics

ANZ Frequent Flyer Black Review: Adventure Companion!

Unlock a world of travel rewards and enjoy exclusive perks! Find out more on this ANZ Frequent Flyer Black Credit review.

Keep Reading

Citi Rewards Card review: Earn points for travel!

Read our Citi Rewards Card review and uncover all the details about its benefits, drawbacks, rates, and fees!

Keep Reading

CommBank Neo Card review: Get cashback with zero hidden fees

Are you looking for a straightforward card? Check out the CommBank Neo Card review, which offers cashback with zero hidden fees.

Keep ReadingYou may also like

ING Personal Loan Review: Make Your Dreams a Reality!

Enjoy a low fixed interest rate, no ongoing fees, and the freedom to pay it off faster. Discover the ING Personal Loan in this review!

Keep Reading

HSBC Low Rate Card Review: Low-rate Advantages!

Learn how to uncover the financial freedom you deserve with the HSBC Low Rate Credit Card in this review. Apply online in just 10 minutes!

Keep Reading

The 5 Best Prepaid Travel Cards for Australians

Don't get caught out abroad! Check out our list of the five best prepaid travel cards for Australians and find the one that suits your needs.

Keep Reading