Credit Cards (US)

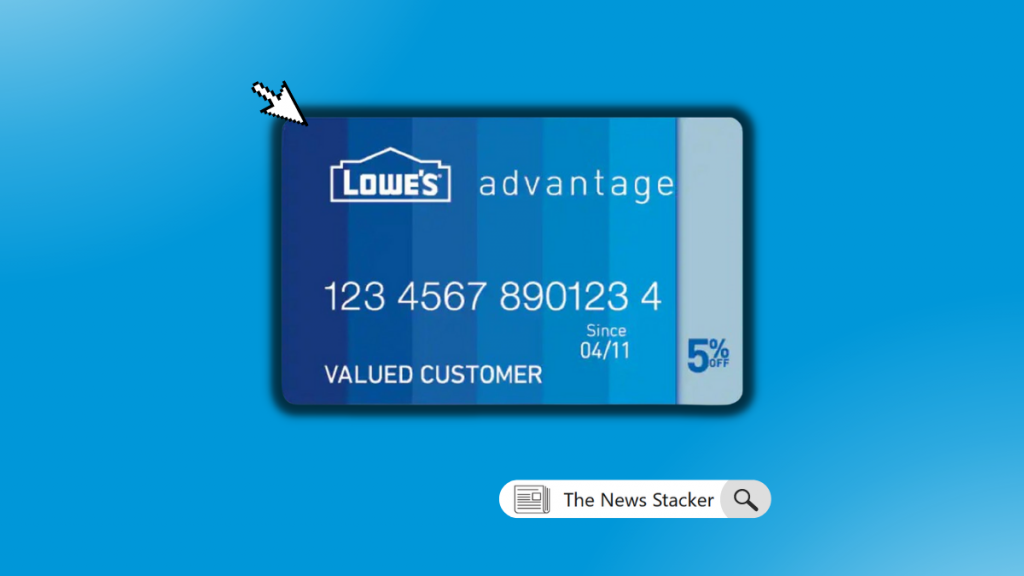

Lowe’s Advantage Card review: Save Big on Home Improvement Projects

Learn more about the advantages of using a Lowe's Advantage Card for home improvement projects. This review covers this card's benefits, rewards, and payment options to help you save money on remodeling expenses.

Advertisement

Lowe’s Advantage Card: No interest payments on qualifying items over $299

If you’re looking for a Lowe’s Advantage Card review, then you don’t have to look any further. This card is the cream of the crop for home improvement credit cards!

How to apply for the Lowe's Advantage Card

Get rid of the trips to the hardware store without spending extra money. Apply for a Lowe's Advantage Card and enjoy easy savings.

You get an awesome point reward system and an automatic discount with every purchase made at Lowe’s stores. Now that is convenient!

- Credit Score: 690-850 (Good – Excellent)

- Annual Fee: $0

- Intro offer: 20% off the first purchase

- Rewards: This card offers no rewards program

- APRs: 26.99% fixed

- Other Fees: None

It’s like Lowe’s read your mind because their Lowe’s Advantage Card can make any home improvement project a piece of cake.

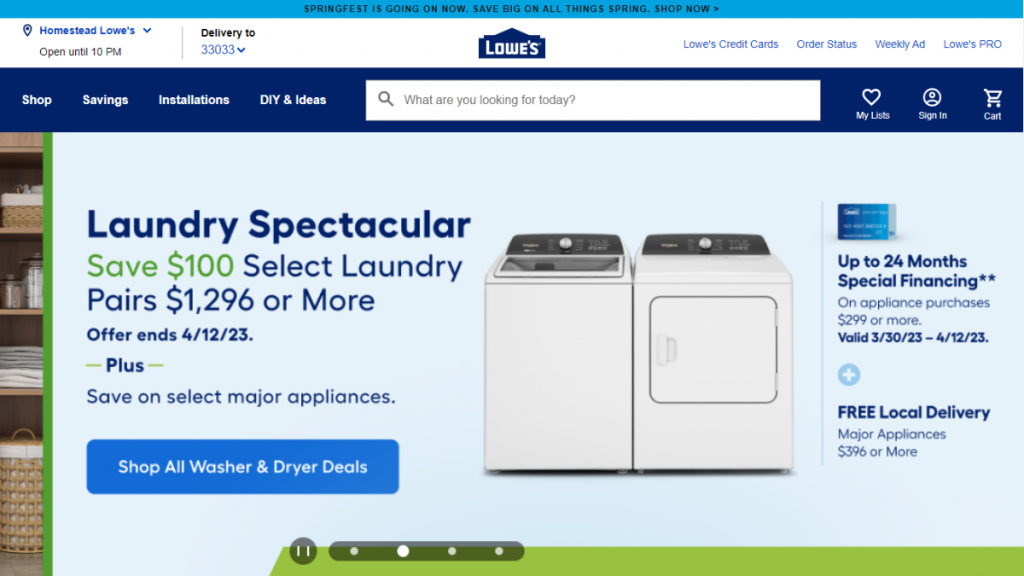

With a 5 percent discount automatically built in for purchases, plus two years of no interest payments on qualifying items over $299, what’s not to love?

Reading through this Lowe’s Advantage Card review, it’s quite clear to see why it could be one of the best credit cards available for making a home renovation much more affordable.

Lowe’s Advantage Card: What can you expect?

The Lowe’s Advantage Card, issued by Synchrony Bank, will surely please those of us who splurge on the occasional home renovation.

Not only can you snag 5% off every eligible purchase or project up to January 31, 2024 (bonus if you’re a new user and get 20% off on your first order with a maximum of $100 off).

But also 84 fixed payments of reduced APR with no prepayment penalty and 0 percent interest if you can pay it off within six months.

Your purchase is $299 or above! If your two conditions fit your purchasing style, this card – and its reward programs – are just for you. Time to start making that renovation checklist!

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

Our Lowe’s Advantage Card review is here to guide you through the best—and not-so-great—aspects of this product.

We’ll break down all its advantages and potential drawbacks, arming you with everything you need to know before applying!

Pros

- 5% discount on almost everything Lowe’s sells with an alternative option for special financing plans

- Periodic promotional offers for cardholders.

- No annual fee

- 20% off the first purchase when you open and use a new account until 1/31/24

Cons

- Rewards are limited

- There’s no intro to APR

- It can only be used in Lowe’s stores

What are the eligibility requirements?

Shopping at Lowe’s doesn’t have to be a hassle! Applying for the Lowe’s Advantage Card is as easy as 1-2-3, so you can get cozy knowing that your purchases can earn you rewards.

Speaking of which, one of the first steps to becoming eligible is having a good credit score – most reviewers recommend 690-850. So make sure you check out your credit score before applying!

Learn how to request the Lowe’s Advantage Card

Congrats on reading our Lowe’s Advantage Card review – we know it was full of helpful and interesting info about the card.

But before you get too excited, here’s what you need to do next: see how to apply for the card! Below is a link to some extra details about the application process.

Take a few minutes to review this, and be sure you have all that’s needed to make your way to the Lowe’s checkout with your new card in hand.

How to apply for the Lowe's Advantage Card

Get rid of the trips to the hardware store without spending extra money. Apply for a Lowe's Advantage Card and enjoy easy savings.

Trending Topics

Top 5 easiest sports to play: find the right one for you

Looking for a sport to play? Here are the top 5 easiest sports that you can easily learn and get started with.

Keep Reading

Top Best Grocery Delivery Apps: Shop & Save Time!

Find the best grocery delivery apps & get fresh foods fast! Save time, compare services, and enjoy the ease of home-delivered groceries.

Keep Reading

Parler: meet the social media platform soon-to-be-owned by Kanye West

Kanye West and controversy walk side-by-side, and after being banned from big social media platforms, the artist is acquiring Parler.

Keep ReadingYou may also like

The most exciting shows to watch on Netflix in June

With a new month comes a fresh lineup of programming. Check out our picks of shows to watch on Netflix in June and get the popcorn ready!

Keep Reading

See how to apply for the Navy Federal GO REWARDS® Credit Card

Get all the information you need to apply for the Navy Federal GO REWARDS® Card. Learn about rewards, interest rates, benefits, and more.

Keep Reading

What animals make funny noises?

Laugh at the weird and wacky noises that different animals make - from lions to crickets, these animals make funny sounds!

Keep Reading