Loans (US)

MoneyKey Review: Your Financial Solution!

Discover the convenience of online loans with MoneyKey, a hassle-free way to bridge your financial gaps. Find out how their services can provide the support you need!

Advertisement

Navigate financial challenges with ease by choosing installment loans or lines of credit!

In need of quick cash for unexpected expenses? Then prepare to get an inside look on a platform that offers your financial solution. Learn everything about MoneyKey in this complete review!

Whether it’s for home renovations, traveling, or any unexpected expenses, MoneyKey offers different financial solutions catered to different needs. So, keep reading and learn all the features!

- APR: N/A.

- Loan Purpose: MoneyKey’s online loans serve diverse purposes.

- Loan Amount: Online loans ranging from $200 to $3,500.

- Credit Needed: N/A.

- Terms: For installment loans, terms vary from 6 to 12 months. For Lines of Credit, terms are personalized.

- Origination fee: None.

- Late Fee: N/A.

- Early Payoff Penalty: MoneyKey doesn’t charge an early payoff penalty.

MoneyKey: what can you expect?

Get ready to enter the world of MoneyKey online loans and review all the features about their installment loans and Lines of Credit. Then, you can be sure to make an informed financial decision.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Installment loans

Firstly, MoneyKey’s installment loans are considered short-term personal loans and offer a structured repayment plan, allowing you to borrow with confidence.

You can apply online for loan amounts that vary from $200 to $2,500. Then, if you are approved, you can expect the loan amount to be swiftly deposited into your bank account.

Moreover, the flexibility of installment loans shines through in the varying repayment terms, spanning from 6 to 12 months, depending on your state of residence.

Lines of Credit

If you’re looking for an open-ended borrowing solution, then keep reading this review of MoneyKey’s Lines of Credit that will redefine financial flexibility.

Unlike traditional payday or installment loans, a Line of Credit remains active even after you’ve paid it down to a zero balance.

Besides, the personalized terms of a Line of Credit empower you to draw the entire amount or smaller portions over time, ensuring you have access to funds when needed.

Moreover, interest and/or fees are charged only on the amount you use, not your entire credit limit. This provides a cost-effective approach to managing unexpected day-to-day expenses.

With the MoneyKey Line of Credit and the CC Flow Line of Credit, offered in collaboration with CC Flow, you gain a valuable financial tool for handling unexpected costs.

Do the pros outweigh the cons?

For a complete review of MoneyKey, you should also review the advantages and weigh the cons in order to make an informed financial decision. This will shed light on the intricacies of its financial solutions.

Pros

- Offers adaptable repayment structures;

- Quick access to approved funds;

- Wide range of loan options;

- Convenient online application process;

- Transparent terms and customer service.

Cons

- Variable APR may be high;

- Services vary by state;

- Limiting borrowing amounts.

What are the eligibility requirements?

So, applicants for MoneyKey online loans must review eligibility criteria to make sure they fit the requirements. Firstly, applicants should be of legal age to contract in their state of residence.

Besides, they must be either U.S. citizens or permanent residents and reside in a state where the specific product is offered.

Additionally, applicants need to have an active bank account and a regular source of income.

Learn how to request MoneyKey

While the application process for MoneyKey is very simple, below you’ll find a complete step-by-step to review. This will ensure you apply for their online loans smoothly and get the money quickly!

Learn how to request online

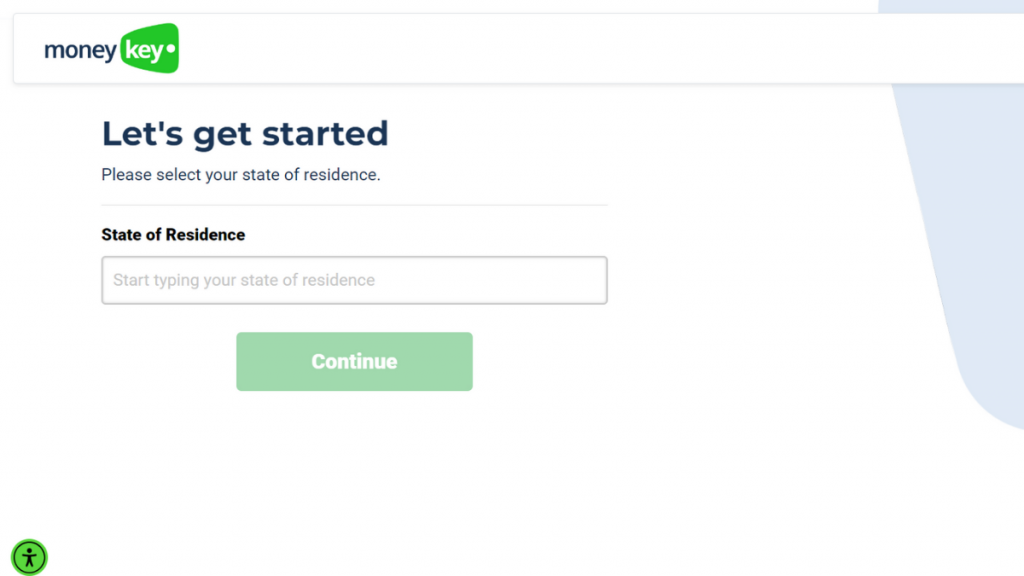

The MoneyKey application process prioritizes convenience and efficiency! Check out below a complete guide.

- Access the MoneyKey website: Firstly, visit the official website. Then, click on the option titled “Loans” on the top menu. Next, select the loan you need, installment loan or Line of Credit.

- Start application process: Initiate the online application process by clicking on the “Get Started” button on top of the page. This will direct you to the application form.

- Fill out the form: Complete the application form by providing accurate and detailed information. You’ll likely need to input personal details, financial information, and other relevant data.

- Submit and wait for approval: Depending on the loan type and your specific circumstances, MoneyKey may require supporting documents. When you’re done, submit the form and wait for approval. If approved, you’ll receive an offer.

- Accept offer: Finally, review your offer and accept the terms if they align with your financial goals. Then, funds will be deposited into your active bank account.

What about another recommendation: Rise Credit!

Still not sure about MoneyKey online loans? Then review the Rise Credit platform, a compelling alternative to MoneyKey. If you’re looking for transparent terms, this might be a good choice!

Rise Credit specializes in installment loans, providing a straightforward borrowing experience with flexibility in repayment. Curious to learn how it works and how to apply? Then click the link below!

Rise Credit Review: Smart Financial Choice!

Get access to flexible payment options and review tools to improve your credit with Rise Credit. Enjoy a 5-day risk-free guarantee!

Trending Topics

12 fun ideas to do when you are bored

Sometimes you need something to do. These are 12 fun ideas to do when you are bored. These will help you get off your couch and have fun!

Keep Reading

The best wireless headphones for 2023

Keep up with the technology trends with the best wireless headphones of 2023. The audio quality you've been dreaming of awaits!

Keep Reading

Which are the best delivery apps in the US?

There are a lot of great delivery apps out there, but which one is right for you? Check out our list of the best delivery apps in the US!

Keep ReadingYou may also like

Who has the most Grammys? The top 10 winners

Wondering who has won the most Grammys ever? We've got the answer for you - and it's probably not who you are thinking! Read on for more!

Keep Reading

Unlock de benefits of AARP Membership and save big!

Unlock a world of benefits and savings with AARP membership. Discover how joining this dynamic community can enhance your life after 50.

Keep Reading

See how to apply for the Mission Lane Visa credit card

If you're looking for a credit card with flexible requirements, this post will teach you how to apply for the Mission Lane Visa credit card.

Keep Reading