Loans (US)

Rise Credit Review: Smart Financial Choice!

Need money fast? Rise Credit offers a quick application process, flexible terms and other benefits that make it an ideal option for your financial needs! Build a positive credit behavior!

Advertisement

From quick application to flexible terms, this online loan caters to your needs!

If you need to borrow money fast, review the features, benefits, and possible drawbacks the Rise Credit can offer. So take advantage of a risk-free guarantee loan and reach your financial goals!

Whether it’s for home repairs, moving expenses, medical bills, auto repairs, or unexpected expenses, Rise aims to offer a solution for common financial challenges. So keep reading and find out more!

- APR: Ranges from 60% to 299%.

- Loan Purpose: Their loans are designed to address various financial needs.

- Loan Amount: Borrowers can choose loans from $2250 to $5000.

- Credit Needed: N/A.

- Terms: You can personalize your repayment terms and choose between 16 to 36 months.

- Origination fee: N/A.

- Late Fee: N/A.

- Early Payoff Penalty: Rise Credit encourages early payoff and doesn’t impose additional fees.

Rise Credit: what can you expect?

If you’re worried about whether or not Rise Credit can meet your financial needs, review now some of its main features to understand how the platform works.

Whether you’re facing unexpected expenses, home repairs, medical bills, or other financial challenges, Rise provides a range of loan amounts from $2250 to $5000.

Moreover, the flexibility extends to the repayment terms, spanning from 16 to 36 months. This adaptability allows borrowers to tailor their loan experience based on their individual circumstances.

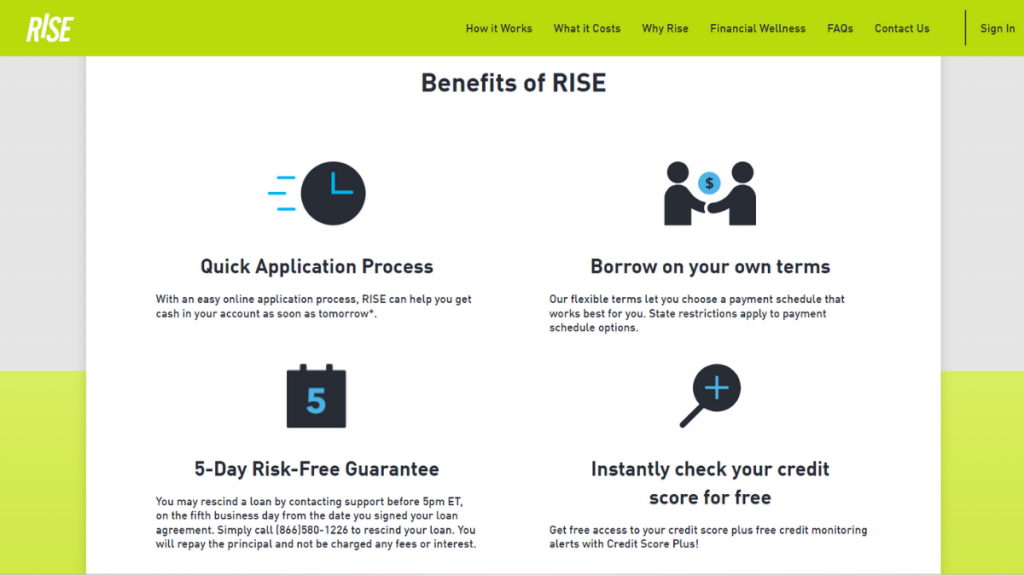

Besides, the online application is designed to be easy, secure, and user-friendly and you can apply in just a few easy steps. Plus, you can get your money as soon as the next business day.

Through the meticulous reporting of payments to a prominent credit bureau, Rise Credit allows you to demonstrate positive financial behavior. This empowers individuals to track their credit progress.

Still not sure about asking for a loan? Rise Credit adopts a customer-focused approach, emphasizing features such as the risk-free guarantee.

This means you can rescind a loan within the first five business days without incurring fees. So, as you can see, this platform has a commitment to customer satisfaction.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

A complete review of the Rise Credit platform requires a thorough understanding of its advantages and disadvantages.

So, navigate the intricacies to help you make an informed decision on whether Rise is the right fit for your unique circumstances.

Pros

- Personalized loan amounts;

- Within the opening five business days, it is possible to retract a loan;

- The terms for repayment exhibit a commendable level of flexibility;

- A suite of credit-building tools is provided;

- The application process is seamless.

Cons

- High Annual Percentage Rate;

- Flexibility may be subject to state restrictions;

- Eligibility hinges on meeting minimum income requirements.

What are the eligibility requirements?

So, to be eligible for a loan with Rise Credit, applicants must be at least 18 years old, possess an active email address to receive account information, and reside in a state where Rise Credit operates.

Additionally, applicants should have a regular source of income, ensuring they meet the minimum income requirements.

Learn how to request Rise Credit

Are you ready to apply for Rise Credit after this review? Then, keep reading to explore a seamless guide and understand how the online application process works. You can do it in minutes!

Learn how to request online

As Rise Credit is a prominent player in the online lending sphere, this means the platform is the perfect place to find quick and accessible financial solutions.

Further, check out how to apply!

- Access the official website: First, visit Rise Credit’s official website. On the homepage, you can find an option to check your availability or a button to apply directly.

- Application process: If you’re not yet subscribed, create your account on the platform. Then, log in and start filling out the online application form. Insert your personal and financial information as needed.

- Personalize your loan: After providing the necessary information, you should choose the loan amount needed and the repayment terms that best suit your financial situation.

- Submit the form: Once you’re done, review the information and submit it. If approved, funds may be deposited into your checking account.

What about another recommendation: CreditFresh!

However, if you’re still not sure Rise Credit is the right platform for your borrowing needs, then it’s time to review other available options, So, what about CreditFresh Lines of Credit?

Whether it’s managing unexpected expenses or handling ongoing financial needs, CreditFresh allows borrowers to draw funds as needed within their approved credit limit. Find out more today!

CreditFresh Review: Elevate Your Credit Experience

Review CreditFresh's Line of Credit and learn how to achieve financial flexibility. Borrow between $500 to $5,000 and repay at your pace!

Trending Topics

How to find and book cheap flights in 2022

Holiday Season is upon us, and traveling is about to become more expensive. Learn how to spot and book cheap flights to cut back costs.

Keep Reading

See how to apply for the St George Vertigo Card

Looking for a card with low fees? Read this post to find out how to apply for the St George Vertigo Card and get the lowest purchase rate.

Keep Reading

The most expensive things on Amazon in 2022

Wondering what the most expensive things are on Amazon? Check out this post for a list of items that will set you back a pretty penny.

Keep ReadingYou may also like

iPhone hacks that will help make your life a lot easier

Do you owe an iPhone? Are you using your device to its maximum potential? Check out a couple of iPhone hacks that’ll make your life easier.

Keep Reading

The Rarest Video Games of All-Time

If you like video games, you've probably already heard about some of the rarest video games on the market. Keep reading to learn more!

Keep Reading

8 simple ways to save money

From automating your savings to making small changes in your day, this blog post will guide you through 8 simple ways to save money.

Keep Reading