Credit Cards (US)

MyPoint Credit Union Platinum Visa® Review: Rewards and Security!

From a generous credit line to MyPremium Perks, find out why the MyPoint Credit Union Platinum Visa® stands out in the crowd. Maximize your spending today!

Advertisement

From points to cash back, explore the benefits of this remarkable credit card now!

Get ready to review all the features and advantages of the MyPoint Credit Union Platinum Visa® Card to unveil the key to unlocking a world of perks and rewards through your everyday spending.

From a generous credit line to travel insurance, this credit card is designed to enhance your financial journey. Explore what makes this card a standout choice for those seeking more from their credit experience.

- Credit Score: FICO score of 670 or higher.

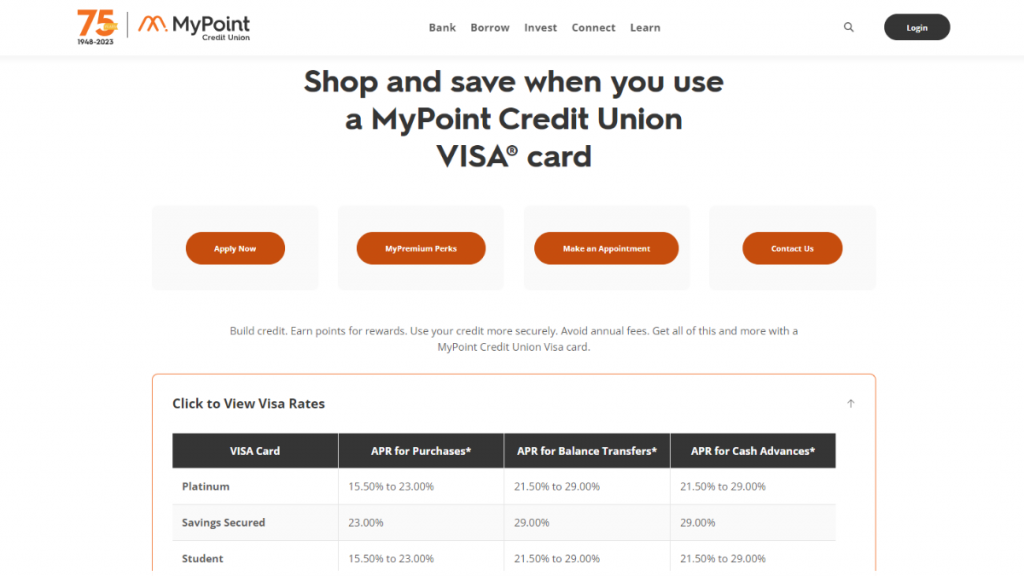

- Annual Fee: Cardholders don’t need to worry about annual fees for the first three years. On the fourth anniversary of sign-up, an annual fee of $35 is charged.

- Intro offer: While the card doesn’t have a traditional introductory bonus, the MyPremium Perks Program offers a unique ongoing benefit. Cardmembers earn one point for every $1 spent, and members from the previous Choice Rewards program have their existing points carried over.

- Rewards: With the MyPremium Perks Program, you can accumulate points for every purchase, and these points can be redeemed for cash back, merchandise, gift cards, travel, and more.

- APR: 15.50% to 23.00% for purchases.

- Other Fees: N/A.

MyPoint Credit Union Platinum Visa®: What can you expect?

So, in this MyPoint Credit Union Platinum Visa® review, we delve into the financial world’s hidden gem, a credit card that offers value and rewards for responsible spenders.

One of the standout features of this credit card is the substantial credit line it offers, reaching up to $50,000. This means you have the flexibility to make larger purchases or carry a balance when necessary.

Managing your MyPoint Credit Union Platinum Visa® account is simple, with 24/7 online access through MyPoint Credit Union Online. It’s all about making your financial life more convenient!

However, this credit card truly shines with the MyPremium Perks Program. By enrolling in the program, you earn one point for every $1 spent on your card.

Additionally, while there’s a possibility of an annual fee, the first three years are fee-free, and even after that, you can qualify for a fee waiver with a minimum annual purchase of $6,000.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Do the pros outweigh the cons?

In summary, the MyPoint Credit Union Platinum Visa® is a financial companion that gives back to its cardholders, but it’s essential to review its advantages and drawbacks before you apply.

Pros

- Substantial credit line of up to $50,000;

- Travel Accident Insurance;

- Convenient account access;

- Automatic payments;

- MyPremium Perks program.

Cons

- Annual fee after 3 years;

- Specific APR depends on factors like your creditworthiness;

- No introductory bonus.

What are the eligibility requirements?

So, the MyPoint Credit Union Platinum Visa® typically requires applicants to have a good to excellent credit score for approval. This means that a FICO score of 670 or higher is often necessary.

Furthermore, meeting this credit score threshold is a key factor if you’re seeking approval for the card and accessing its features and benefits.

Learn how to get the MyPoint Credit Union Platinum Visa®

So, in this review, you’ll find that the steps to secure your MyPoint Credit Union Platinum Visa® are quite simple and straightforward. Keep reading, and find below an easy guide on how to apply!

Apply online

Whether you’re looking to enhance your purchasing power or earn rewards on your spending, this card could be the right fit for you!

- Visit the MyPoint Credit Union website: To begin the application process, visit the official MyPoint Credit Union website and click on the “Borrow” option on the main menu. Then, select “Credit Cards”.

- Online application: When the page loads, find the button “Apply now” and click to access the online application. This form will require personal and financial information, such as your social security number and income details.

- Submit and await: Once complete, submit your application online. If approved, you’ll receive your MyPoint Credit Union Platinum Visa® card by mail. Upon receipt, activate your card following the provided instructions.

What about a similar credit card? Check out the Vast Visa® Platinum Card!

If, even after this in-depth review, you’re still looking for an alternative to the MyPoint Credit Union Platinum Visa® card, the Vast Visa® Platinum Card presents an enticing option.

With its array of rewards, it’s designed to cater to diverse preferences. Curious? Then access a full review by clicking the link below!

Vast Visa® Platinum Card: Financial Freedom!

Read this review and find out why the Vast Visa® Platinum Card is your key to financial empowerment. No annual fees and intro APR included!

Trending Topics

Learn which is the cheapest day to fly

Are you already planning to book your next plane ticket? Then learn which is the cheapest day to fly to save some serious money!

Keep Reading

See how to apply for the Chase Sapphire Reserve® Credit Card

Want to know how to apply for the Chase Sapphire Reserve® Card? We'll walk you through the application process step-by-step.

Keep Reading

Music documentaries we’re excited to watch in 2022

From the life of a music legend to the story of an underground rapper, these music documentaries will keep you entertained all year long.

Keep ReadingYou may also like

Google Maps secret places: 6 locations that are hidden from you!

Ever heard about the Google Maps secret places? Read on to learn about the hidden places that you can’t access in real life.

Keep Reading

How to get 50 dollars fast: earn that extra money with these simple ways!

Do you need to make some extra buck? We got you covered. Check out in this article some ways to get 50 dollars fast.

Keep Reading

What is Ben and Jerry’s stock symbol?

Let's look closely at Ben and Jerry's stock symbol and what it means for investors. You can invest in your favorite ice cream company!

Keep Reading