US

Pre-approval for Capital One Auto Financing: Your Path to a New Vehicle!

Are you ready to hit the road in your dream car? Make your car-buying journey smoother and more enjoyable with the auto financing pre-approval process!

Advertisement

Rev up your dreams of owning a new car with Capital One’s hassle-free auto financing pre-approval process! We all know that finding the perfect vehicle can be an exhilarating experience!

SoFi Personal Loan review

If you’re looking for a personal loan, you’ll want to deal with the best company. And right now, there is no better than SoFi. Read on and learn more!

But when it comes to securing the right financing, the road can sometimes be a bit bumpy. That’s where Capital One comes in, offering a stress-free solution to make your car-buying journey a bit easier.

So, dive deep into the world of auto financing pre-approval with Capital One, exploring how this innovative service can empower you to take control of your car purchase!

What is pre-approval for auto financing?

Auto financing pre-approval is a process through which a lender, such as a bank, or financial institution like Capital One, assesses your creditworthiness and provides you with conditional approval for a car loan.

This happens before you actually go to a dealership to purchase a vehicle! It’s essentially a way to determine how much money you can borrow and what interest rate you might qualify for.

But remember, this is based on your financial situation and credit history! This involves reviewing your credit score and credit report to determine how responsible you’ve been with managing debt and making payments.

However, keep in mind that pre-approval is not a guarantee of final approval, and the terms of the loan may change based on the lender’s final review and the specific details of the car transaction.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

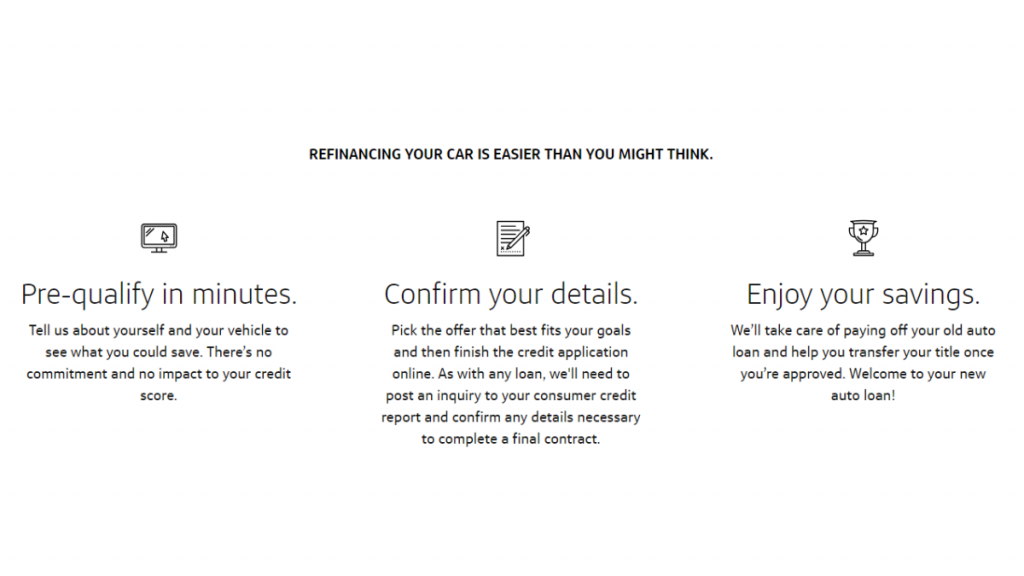

How does it work?

Essentially, the lender will typically perform a credit check to assess your creditworthiness based on details about your income, employment, and credit history. If approved, they issue a pre-approval offer.

As this is a process initiated by the lender, you should get an auto financing pre-approval offer from Capital One through the mail or even e-mail. But, if you want, you can start a pre-qualification process.

Pre-qualification provides a rough estimate of how much you might be able to borrow and at what rate, but it’s not a firm commitment. You start by applying either online, over the phone, or in person.

Get a head start by submitting an application for pre-qualification or pre-approval when seeking auto financing with Capital One! Stay ahead of the game by following the step-by-step below.

Visit Capital One website

First, open your web browser and navigate to the official Capital One website. Once on the homepage, explore the option “Auto” on the menu. Click on this section to start the pre-approval process.

Pre-approval option

Within the Auto Financing section, look for an option that mentions “Pre-Approval” or “Get Pre-Qualified.” Click on this option to begin your pre-approval application. You should see a form to fill in with your information.

Personal information

Capital One will need some personal and financial information to assess if you’re eligible for an auto financing pre-approval. This will include details such as:

- Your full name and date of birth;

- Your home address;

- Contact information;

- Your current employer;

- Job title and gross monthly income.

As part of the pre-approval process, Capital One will perform a soft credit check. This is a routine credit inquiry that doesn’t negatively impact your credit score.

Vehicle information

Then, you may need to provide information about the car you intend to purchase. This can include the make, model, year, and, in some cases, the vehicle identification number (VIN) if you have a specific car in mind.

If you are qualified, you will see a list of card offers that you may be eligible for. So, take your time to carefully review each offer.

Submit your application

Once you’re confident that everything is correct, submit your pre-qualification application. Capital One will review your credit history and, if approved for an auto financing, you’ll get a pre-approval offer.

This offer will outline the loan amount you’re eligible for, the interest rate and any specific conditions or terms of the loan. With your pre-approval in hand, you can confidently shop for a car.

But please remember that pre-approval offers typically have an expiration date, so it’s essential to start your car search relatively soon after receiving it.

Whether you’re a seasoned car enthusiast or a first-time buyer, discover how Capital One’s pre-approval for auto financing can provide you with budget clarity, negotiation power, and peace of mind!

Improved financial planning

Firstly, pre-approval allows you to plan your finances more effectively. Afterall, you can anticipate your monthly car payments and factor them into your budget, ensuring you can comfortably manage your loan.

What is an auto loan

An auto loan can help you purchase the car of your dreams. Here's everything you need to know about auto loans, including the basics and how to get the best deal.

Faster transaction

Once you’ve chosen a car, the financing process is faster with pre-approval. You’ve already completed much of the paperwork, so finalizing the loan is usually quicker and more straightforward.

Budget clarity

Capital One’s pre-approval for auto financing offers you an in-depth understanding of your borrowing potential. Besides, this will allow you to understand what your monthly payments might be.

By knowing your budget, you gain invaluable financial clarity. This helps you set a realistic goal for your car purchase and prevents you from considering vehicles that are out of your price range.

Negotiation power

Armed with a pre-approval from Capital One, you step onto dealership lots with unwavering negotiation power. Afterall, you have a concrete offer in hand!

This allows you to confidently compare it to any financing deals presented by dealerships. This will put you in the driver’s seat of your car-buying experience.

Time efficiency

Say goodbye to long hours spent at the dealership’s finance office. Capital One’s pre-approval for auto financing streamlines the car-buying process, enabling you to focus on selecting the right vehicle.

Most of all, you won’t have to deal with the hassle of securing financing on the spot, allowing you to savor the excitement of choosing your vehicle without the pressure of immediate financial arrangements.

Interest rate control

Pre-approval often comes with a locked-in interest rate. This will ensure you secure a competitive rate that can potentially save you substantial money over the life of your auto loan.

No more worries about being subjected to dealership financing rates! With Capital One’s auto financing pre-approval, you can confidently navigate the dealership experience!

Avoid high-pressure sales tactics

Without pre-approval, some dealerships might pressure you into accepting less favorable financing terms. With pre-approval, you can decline offers that don’t match or improve upon what you already have.

Peace of mind

Knowing that you’re pre-approved for a loan can alleviate the stress associated with car shopping. You can shop with confidence, knowing you won’t face any last-minute financing surprises or disappointments.

Does pre-approval guarantee me a loan for purchasing a car?

While pre-approval is a valuable step in the car-buying process, it’s not a guaranteed loan offer. It provides you with a strong estimate of what you’re likely to qualify for, but it’s not guaranteed approval.

Moreover, the final loan terms are determined after a more comprehensive evaluation during the final application process. However, it’s a strong indication of your eligibility and potential loan terms.

Afterall, a pre-approval for auto financing with Capital One is based on your current financial situation and creditworthiness. So, be prepared for the lender’s final review when you’ve selected your vehicle.

Finally, several factors are typically considered to assess your creditworthiness and eligibility and help Capital One evaluate the risk associated with lending to you and determine the terms of the loan.

Credit score

Your credit score is one of the most crucial factors. Capital One will review your credit report and score to gauge your credit history and how responsible you’ve been with managing credit accounts and making payments.

A higher credit score generally leads to better loan terms. Besides, the institution will review your credit history to check for any past delinquencies, bankruptcies, or negative marks on your credit report.

Income

Your income and employment history will be assessed to determine your ability to repay the loan.

They may ask for details about your current job, and a stable income and employment history are typically favorable.

Debt-to-income ratio

Your ratio compares your monthly debt obligations to your income. Capital One will use this ratio to assess your capacity to take on additional debt.

A lower DTI ratio is generally more favorable for loan approval.

Choose a personal loan

Don’t know where to start when it comes to personal loans? This guide will break down everything you need to know in order to make an informed decision.

Down payment

While not always required for pre-approval, a larger down payment can strengthen your application. This will reduce the loan amount and the lender’s risk.

Vehicle details

If you have a specific car in mind, Capital One may want information about the make, model, year, and purchase price. The age and mileage of the vehicle can also affect loan approval and terms.

Financial obligations

Any other financial obligations, such as existing loans or credit card debt, will be considered in the assessment. Lenders want to ensure that you can comfortably manage your debt load.

And what are the top lenders to go to when you’re looking for auto financing? Check below the top 6 lenders for this year and choose the right one for you!

Compare the top 6 Lenders for 2023!

Wondering which lenders will be the best for you in 2023? Check out our comparison of the top six providers now!

Trending Topics

Cheapest vs most expensive things in the world: find out the opposites in pricing

Can you guess what is the cheapest vs most expensive things in the world? The prices range from $0.15 to trillions!

Keep Reading

Top apps to edit photos for free on Android & iPhone

Looking for the best apps to edit your photos? Check out our list of top three free photo editing apps available on both Android and iOS!

Keep Reading

See how to apply for the Mission Money™ debit card

Want an easy way to get your hands on some cash? Apply for the Mission Money™ debit card and have your funds available anytime, anywhere.

Keep ReadingYou may also like

Foods that make you happy – according to science!

According to scientific research, there are some types of foods that can make you happy. Curious as to know what they are? Read on for more!

Keep Reading

Learn how to curb your drinking habits

There are plenty of ways to curb your drinking habits to a healthy amount. This article presents a few interesting pointers to help you out.

Keep Reading

Learn how you can adjust to the time change

The end of daylight savings can cause negative health impacts and leave people feeling out of place. Here’s how to adjust to the time change.

Keep Reading