Credit Cards (US)

Priceline VIP Rewards™ Visa® Card review: Enjoy VIP Gold Status

Looking for an amazing rewards credit card? See why the Priceline VIP Rewards™ Visa® Card is one of the best options for globetrotters and those seeking an outstanding travel experience.

Advertisement

Priceline VIP Rewards™ Visa® Card: Get Up to $100 Welcome Bonus

Ready to make your travels even more rewarding? Check out this Priceline VIP Rewards™ Visa® Card review. A fantastic option for globetrotters seeking an amazing rewards credit card!

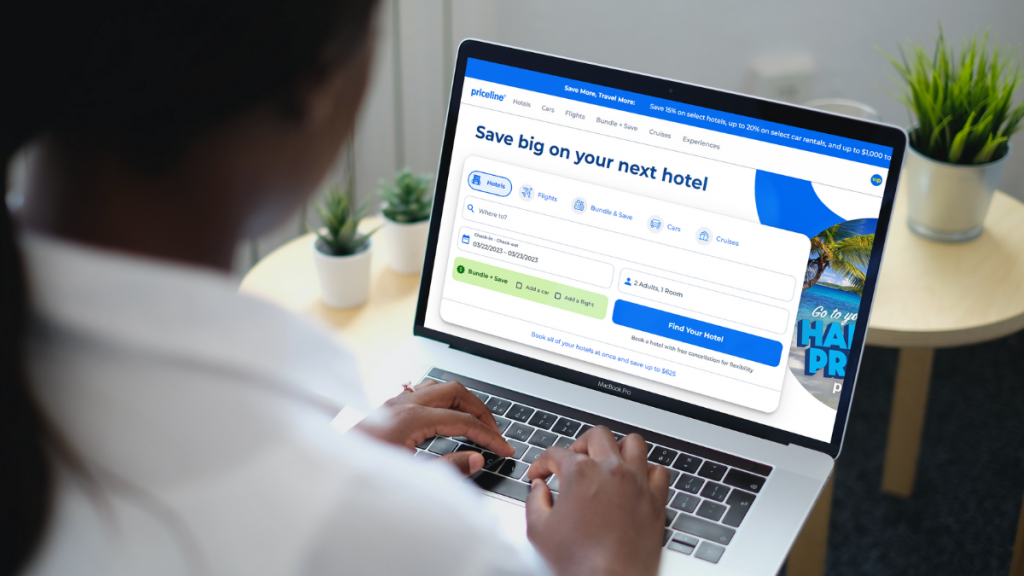

How to apply for the Priceline VIP Rewards™ Visa®?

Find out why you should apply for the Priceline VIP Rewards™ Visa® Card and prepare for total luxury. Don't miss out on this opportunity!

- Credit Score: Good – Excellent

- Annual Fee: This card doesn’t charge an annual fee

- Intro offer: 10,000 bonus points after spending $1,000 on purchases within 90 days of the account opening

- Rewards: 5X points per dollar spent on Priceline bookings; 2X points spent on gas and restaurant purchases; 1X points on everything else

- APRs: Purchases and balance transfers: 19.74%, 24.74%, or 29.74%, depending on your creditworthiness (variable); Cash Advances: 29.99% (variable)

- Other Fees: Balance transfer fee: $5 or 5% of the amount of each transaction, whichever is greater; Cash Advance: $10 or 5% of the amount of each transaction, whichever is greater; Late Payment: up to $40; Returned Payment: up to $40

With a sleek design, intriguing offers, and an impressive roster of rewards – this card has plenty to keep any savvy shopper occupied!

But don’t take our word for it – stick around to the end of this Priceline VIP Rewards™ Visa® Card review as we explore how this card can give you an edge on your spending.

Priceline VIP Rewards™ Visa® Card: What can you expect?

Undoubtedly, Priceline is one of the best online travel agents out there. And the Priceline VIP Rewards™ Visa® Card takes things to another level.

With this card, you get a big welcome bonus of up to $100 in statement credit after spending just $1,000 within 90 days.

Plus, you can rack up points pretty quickly with 5x points for Priceline bookings, 2x for gas and restaurant purchases, and 1x for everything else – points that don’t expire!

That’s not all, though. You’ll also receive exclusive access and VIP Gold status when you hold this card.

Additionally, get up to $100 Global Entry or TSA PreCheck application fee credit each anniversary once you’ve spent $10,000 within a year.

So if you’re looking for rewards while booking an unforgettable vacation, look no further than the Priceline VIP Rewards™ Visa® Card!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

Ready to take your travels up a notch? The Priceline VIP Rewards™ Visa® Card could be the answer! Offering great benefits and rewards, it’s worth looking into.

But there are some drawbacks too. Let’s explore so you can decide if this card fits in with your travel plans.

Pros

- This card doesn’t charge an annual or foreign transaction fee;

- There is a 0% introductory APR on balance transfers;

- Unlimited rewards of up to 5X points on eligible purchases;

- This card offers protection and exclusive access to credit scores, Gold status, and Global Entry or TSA PreCheck through credits.

Cons

- The Priceline VIP Rewards™ Visa® Card balance transfer fee

- There is a high standard of APR

What are the eligibility requirements?

If you’re considering applying for a card, credit scores matter! Our recommendation is to have at least a good score under your belt.

With the right digits in place, you can confidently set off on the path of financial freedom!

Learn how to request the Priceline VIP Rewards™ Visa® Card

After this review, can you explore the world with your very own Priceline VIP Rewards™ Visa® Card? This amazing reward and travel card can take you places.

Ready to apply? It’s easy-peasy, so don’t wait another minute. Let’s get started on that application today! Trust us. It’ll be a journey worth taking.

How to apply for the Priceline VIP Rewards™ Visa®?

Find out why you should apply for the Priceline VIP Rewards™ Visa® Card and prepare for total luxury. Don't miss out on this opportunity!

Trending Topics

Spotify might soon be raising its subscription prices

Spotify is considering raising subscription prices, following the likes of Apple and YouTube. Read on to learn what this means to you.

Keep Reading

What does your resume say about you?

Your resume is one of the most important tools you have to get a job, so what does your resume say about you? Learn how to build a great one.

Keep Reading

Netflix’s ad-supported tier is coming in November

Netflix is finally rolling out its ad-supported tier plan in November! Read on to learn more about the service and how to subscribe to it.

Keep ReadingYou may also like

Chase Sapphire Preferred® Credit Card review

The Chase Sapphire Preferred® Credit Card offers unparalleled rewards potential for cardholders. Check our full review to learn more!

Keep Reading

See how to apply for the Ink Business Premier℠ Credit Card

Learn how to apply for the Ink Business Premier℠ Credit Card. This guide covers all benefits, eligibility requirements, and more.

Keep Reading

Unlock de benefits of AARP Membership and save big!

Unlock a world of benefits and savings with AARP membership. Discover how joining this dynamic community can enhance your life after 50.

Keep Reading