Credit Cards (SA)

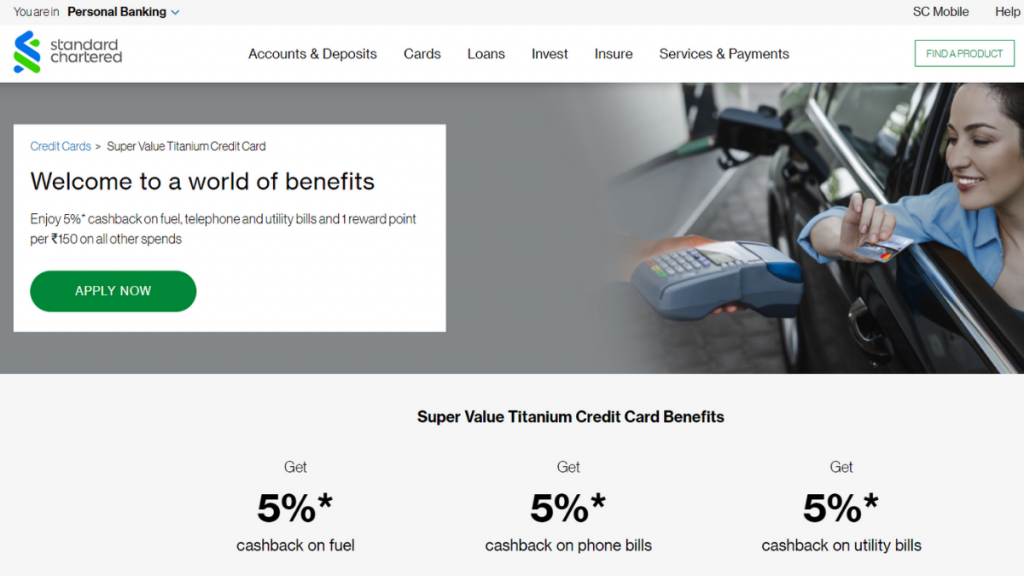

Super Value Titanium Card Review: Fuel Your Savings!

From 5% cashback on fuel to rewarding utility payments, discover why the Super Value Titanium Card is your key to smart spending! Experience the power of financial convenience!

Advertisement

Dive into a realm of cashback on essential expenditures, coupled with an amazing rewards program!

When choosing your next credit card, it’s essential to explore features, benefits, and unique propositions. So, if you’re interested in applying for the Super Value Titanium Card, get ready for a full review!

Whether you seek to save on everyday expenses, explore a world of rewards, or indulge in the exclusive benefits reserved for Premium Banking Customers, this card is as a key to financial empowerment.

- Credit Score: As this is a premium card, it’s recommended to have a good to excellent score to apply.

- Annual Fee: INR 750.

- Intro offer: N/A.

- Rewards: Enjoy a robust 5% cashback on fuel, phone bills, and utility payments. This feature transforms the card into a practical choice for your everyday expenses. Moreover, each expenditure of INR 150 on non-specified purchases earns you 1 reward point.

- P.A.: N/A.

- Other Fees: N/A.

Super Value Titanium Card: What can you expect?

Firstly, when you review the Super Value Titanium Card from Standard Chartered you might find the answer to substantial savings on daily expenses. So, let’s delve into its standout features.

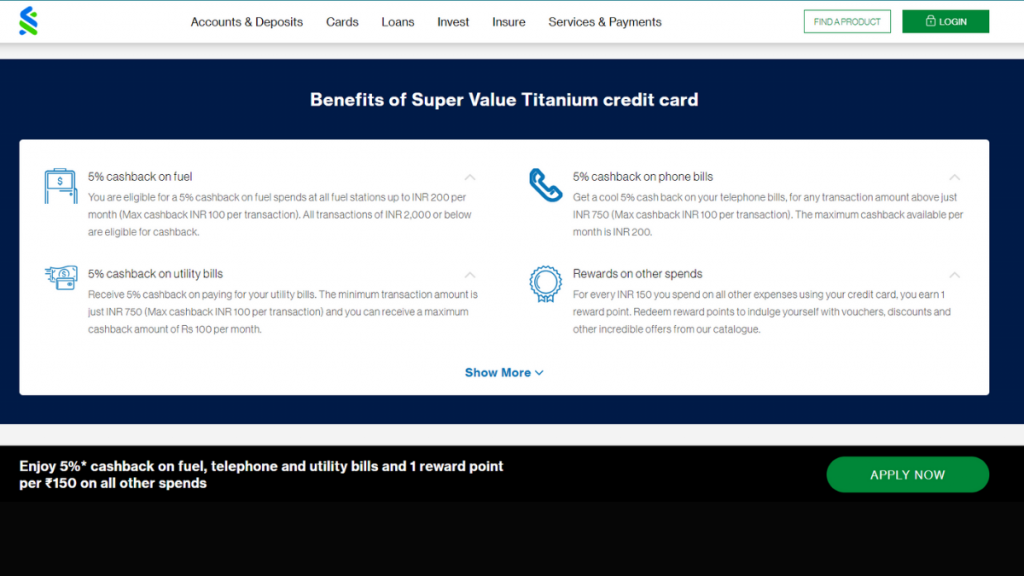

At the forefront is its cashback program, offering an enticing 5% return on fuel expenditures. This extends beyond mere fuel benefits, also encompassing cashback on phone bills and utility payments.

But, it’s crucial to note that these cashback benefits apply to fuel transactions of INR 2,000 or below, utility bills surpassing INR 750, and phone bills exceeding the same threshold.

Moreover, immerse yourself in a rewarding program. For every INR 150 spent on miscellaneous purchases, you accumulate 1 valuable reward point.

These points, later redeemable for a diverse array of options, add an extra layer of value to your spending.

While it incorporates modern conveniences like contactless payments, it also offers the flexibility of balance transfers up to INR 5,00,000 into convenient EMIs with zero fees.

Check if you are pre-approved for credit cards and loans with no impact to your credit score

You will be redirected to another website

Do the pros outweigh the cons?

As we journey through the myriad details of the Super Value Titanium Credit Card, it becomes evident that it transcends the conventional realms of credit card offerings.

However, you should carefully weigh the pros and drawbacks before applying, in order to make an informed decision.

Pros

- Enjoy a solid 5% cashback on fuel transactions;

- Extend the benefits to your routine expenses with 5% cashback on both phone bills and utility payments;

- Rewarding program where every INR 150 spent on miscellaneous purchases earns you 1 valuable reward point;

- Experience the convenience of contactless payments;

- If you’re a Premium Banking Customer, enjoy a complimentary Priority Pass membership.

Cons

- Be mindful of the specified thresholds for cashback rewards;

- Income eligibility requirement;

- Exercise caution regarding the annual fee, set at INR 750.

What are the eligibility requirements?

So, to be eligible for the Super Value Titanium Card, the primary applicant must fall within the age range of 21 to 65 years, and the minimum age for an add-on cardholder is 18 years.

Besides, a crucial criterion is a stable monthly income, with a minimum requirement of INR 55,000.

Learn how to get the Super Value Titanium Card

So, the journey to financial empowerment begins with a strategic and user-friendly application process. Ready to review a simple guide to apply for the Super Value Titanium Credit Card?

Moreover, this card is a gateway to savings, rewards, and digital convenience! While the application happens online, it’s important to review each step to ensure a seamless process carefully.

Apply online

From navigating the website to receiving your card at home, find out the details of this application process now!

- Access the official website: Firstly, go to the bank’s official website. Once you’re there, look for the “Cards” section and find the Super Value Titanium Card. Then, click to see all the details about it.

- Begin your application process: If you decide this card is the right one for you, click on “Apply Now”. The bank will ask for some basic information such as your name, contact details, birthday, and where you live.

- Share documents: Next, the bank might request some documents. For example, proof of who you are, where you live, and how much you earn. So, upload them online as requested.

- Wait for your answer: Once you’re done, submit your application and wait for a response. If you’re approved, the bank will issue you the Super Value Titanium Credit Card.

What about a similar credit card? Check out the Standard Bank World Citizen Card!

With no foreign transaction fees and exclusive travel perks, the Standard Bank World Citizen Card is a great alternative to the Super Value Titanium Credit Card, and you can review all of its features now!

From airport lounge access to concierge, this card brings a touch of luxury to your travels. Whether you’re a frequent flyer or value global financial flexibility, find out more about this premium card!

How to apply for the World Citizen Credit Card

Learn how to apply for the World Citizen Credit Card! This card is perfect for travelers who want to enjoy luxurious experiences.

Trending Topics

See how to apply for an ABSA Private Banking Credit Card

Want to enjoy a luxurious lifestyle? Apply for the ABSA Private Banking Credit Card! You'll get access to exclusive benefits.

Keep Reading

FNB Private Wealth Credit Metal Card review

Ready to take your credit card game up a notch? Check our FNB Private Wealth Credit Metal Card review, exclusive rewards and more.

Keep Reading

Absa Flexi Core Credit Card review: A card with convenient credit facility!

Looking for a great credit card? Our Absa Flexi Core Credit Card review has all you need to know about this exciting opportunity!

Keep ReadingYou may also like

See how to apply for the Absa Student Credit Card

Learn how to apply for the Absa Student Credit Card and begin your credit-building journey on the right foot. Read on for more!

Keep Reading

Standard Bank Blue Credit Card review

The Standard Bank Blue Credit Card is the perfect everyday credit card with a variety of features and benefits to suit your needs.

Keep Reading

Sanlam Loans review: everything you need to know

Find out everything you need about Sanlam Loans in this review. And discover why they may just be the lender for your next big purchase!

Keep Reading