Credit Cards (US)

Vast Visa Signature® College Real Rewards Card review: Your Financial Ally!

Is the Vast Visa Signature® College Real Rewards Card a smart choice for your financial portfolio? Our review evaluates its perks, redemption options, and suitability for various spending styles!

Advertisement

This dynamic credit card is a financial game-changer designed to reward your everyday spending!

In this review of the Vast Visa Signature® College Real Rewards Card, you’ll find that this card not only helps you build a solid credit history but also rewards you for your everyday spending!

From cashback on your purchases to a manageable APR, the Vast Visa Signature® College Real Rewards Card review will unpack the features and benefits that make this card a standout choice!

Whether you’re a college student just starting your financial journey or a young professional looking to make the most of your spending, this card might be the key to unlocking financial success.

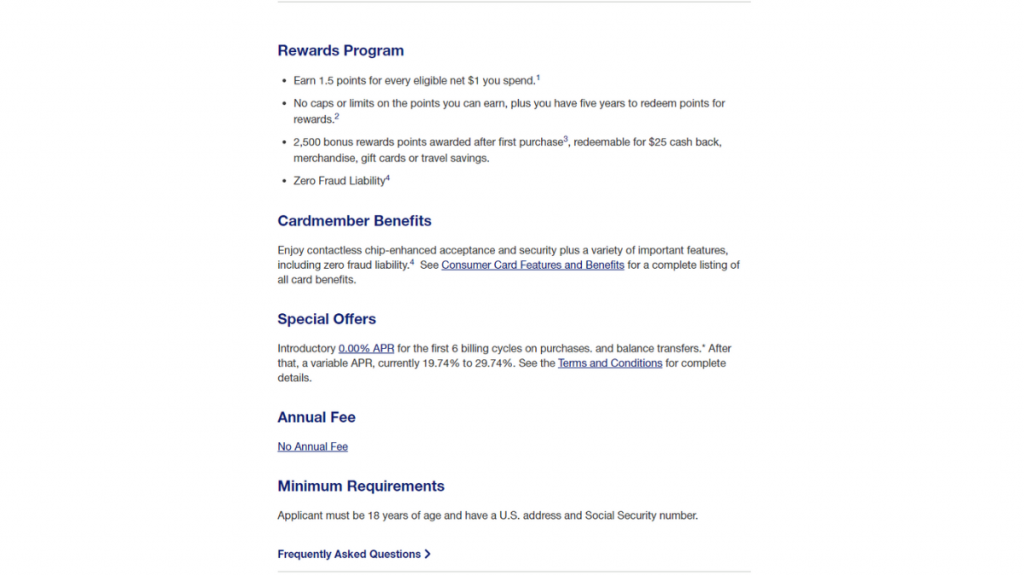

- Credit Score: Customized for individuals starting their credit journey.

- Annual Fee: Access all the perks of this card without annual expenses.

- Intro offer: Embark on a journey with a special 0% APR for your first 6 billing cycles.

- Rewards: Earn a solid 1.5% cash back on all eligible purchases while enjoying the peace of mind that comes with Zero Fraud Liability and Travel Assistance as a cardholder.

- APRs: After the introductory phase ends, the APR will vary, falling within the range of 19.74% to 29.74%.

- Other Fees: Anticipate a 3% fee for Foreign Transactions and balance transfers when using this card, alongside a $41 fee for late payments.

Vast Visa Signature® College Real Rewards Card: What can you expect?

The Vast Visa Signature® College Real Rewards Card shines with its remarkable cashback rewards program. Cardholders can revel in the simplicity of earning a flat 1.5% cashback on every eligible purchase.

Notably, there’s no annual fee, ensuring cost-efficiency right from the start. Furthermore, this card often greets you with a 0% introductory APR, adding a welcome cushion for initial purchases.

However, when you review its drawbacks, it’s important to mention the Vast Visa Signature® College Real Rewards Card has a 3% fee on foreign transactions. This will increase the cost of international purchases.

Frequent travelers might want to explore other options better suited to their lifestyle. In sum, this credit card bundles a compelling array of benefits for those seeking to navigate their financial terrain effectively.

Nevertheless, it’s vital to conduct a meticulous assessment of your financial needs to ascertain if this card aligns seamlessly with your unique financial goals and aspirations.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

Considering applying for this credit card but still not sure it’s the right fit for you? Then review the pros and cons of the Vast Visa Signature® College Real Rewards Card before you decide!

Whether you’re on the hunt for cashback rewards or concerned about potential fees, we’ll break down the details of this card, helping you navigate the world of credit with confidence.

Pros

- 1.5% cashback for every dollar you spend on qualifying purchases

- Enjoy flexibility in how you redeem your rewards

- Annual fee waived

- Robust Fraud Protection

- Access 24/7 customer service

- Travel Assistance

- Take advantage of a 0% introductory APR

- Receive a boost of 2,500 points with your very first purchase

Cons

- Be mindful of foreign transaction fees

- Travel benefits may be limited in comparison to other cards

- Simple and flat rewards

- APR significantly increases after the introductory period ends

What are the eligibility requirements?

Having a strong credit score can improve your odds of approval and open doors to more favorable terms. However, this credit card is primarily crafted for individuals with limited credit experience.

It’s crucial to understand that Vast Bank will conduct a comprehensive review of your creditworthiness when you apply for the Vast Visa Signature® College Real Rewards Card.

This assessment may encompass various factors beyond your credit score, including your income and overall financial stability.

Learn how to get the Vast Visa Signature® College Real Rewards Card

So, are you ready to unlock the path to financial opportunity? Whether you’re a student looking to build your credit or someone seeking cashback rewards, we’ll help you with the application process!

Get ready to take charge of your financial future by following these simple steps to secure your very own Vast Visa Signature® College Real Rewards Card!

Apply online

Firstly, gather the necessary information such as your personal details, contact information, employment details, and annual income.

Then, go to the official website of Vast Bank and find the “Credit Cards” section under the “Personal” tab.

Browse through the available credit cards and select the Vast Visa Signature® College Real Rewards Card to review the terms and conditions. When you’re done, click on “Apply Now” to start the process.

Complete all the required fields accurately and honestly and submit your application. If your application is approved, you’ll receive your Vast Visa Signature® College Real Rewards Card by mail.

Finally, just follow the instructions provided to activate your card. It’s that easy!

What about a similar credit card? Check out the BankAmericard® for Students!

If you’re not sure the Vast Visa Signature® College Real Rewards Card is the right card for you, how about you review another option? The BankAmericard® for Students is an attractive alternative!

The BankAmericard® for Students comes with a 0% introductory APR on purchases and balance transfers for the first 18 billing cycles. Besides, this credit card has no annual fee!

If you’re interested in exploring the BankAmericard® for Students further and understanding how it works, we invite you to check out our full review below! Discover how this card can help you achieve your goals.

How to apply for the BankAmericard® for Students

Learn how to easily and quickly apply for the BankAmericard® for Students Credit Card.

Trending Topics

See how to apply for the Avant Credit Card

Don't let your credit score keep you from getting the things you need. Apply for the Avant Credit Card and get the credit you deserve!

Keep Reading

What is a mid-term goal? Learn how to achieve it!

A mid-term goal is part of any successful goal-setting strategy, but do you know how to set it? This comprehensive guide will tell you!

Keep Reading

Facts and Curiosities about the Wellness Market

Discover some curiosities about the global wellness market. Take an in-depth look at this dynamic sector now!

Keep ReadingYou may also like

The 8 best smartwatches for fitness

If you're serious about getting in shape, a smartwatch can be an invaluable tool. Check out our list of the 8 best smartwatches for fitness!

Keep Reading

See how to apply for the Delta SkyMiles® Reserve American Express Card

Looking to get more rewarding flights? Get your rewards faster and travel further when you apply for the Delta SkyMiles® Reserve Card.

Keep Reading

The best places to stay at Yosemite National Park

Campsite or luxury accommodation: we've got the perfect place. Get inspired with our list of the best places to stay in Yosemite!

Keep Reading