Debit Cards (US)

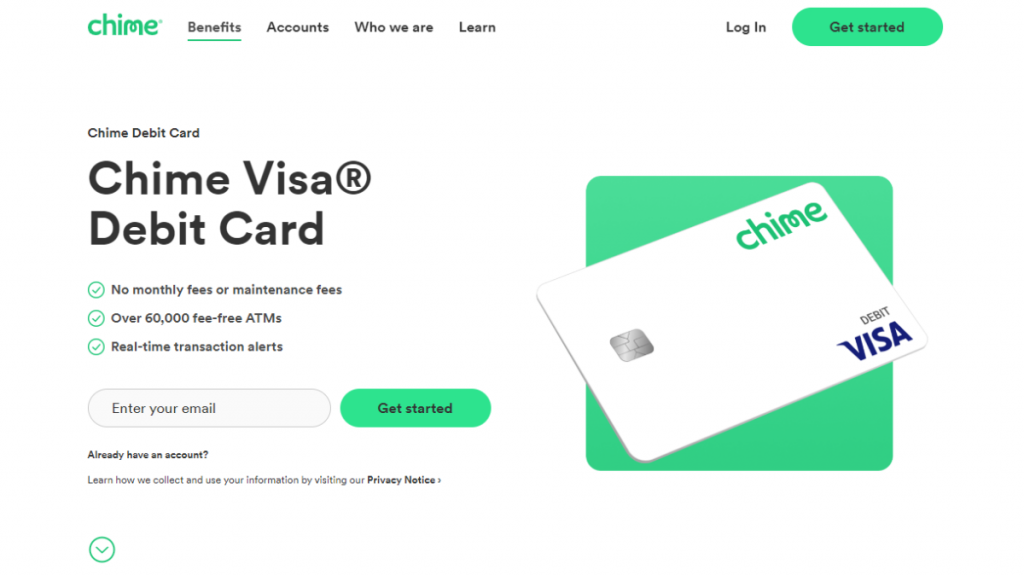

Chime Visa® Debit Card Review: Say Goodbye to Monthly Fees!

The Chime Visa® Debit Card is a debit card that puts you in control. Enjoy no maintenance fees, 60,000+ fee-free ATMs, and customizable security features. Learn more today!

Advertisement

Get started in minutes, access your money with ease, and grow your savings effortlessly!

In this Chime Visa® Debit Card review, you’re about to embark on a financial journey that redefines the way we think about banking. Can you imagine a debit card that offers more than just transactions?

So, Chime has brought to the table a revolutionary approach to personal finance, making it a standout choice for those seeking convenience and financial freedom. Explore the intricacies of this card now.

- Credit Score: Credit check isn’t necessary.

- Annual Fee: None.

- Intro offer: The Chime Visa® Debit Card typically doesn’t come with traditional introductory offers like cashback bonuses or reward points, as it’s primarily a debit card rather than a credit card.

- Rewards: While the Chime Visa® Debit Card doesn’t offer traditional credit card rewards, it provides users with the opportunity to save money effortlessly.

- APR: Since this isn’t a credit card, it doesn’t have an APR.

- Other Fees: N/A

Chime Visa® Debit Card: What can you expect?

In this Chime Visa® Debit Card review, let’s explore what to expect from this exceptional financial tool. Firstly, this is not your typical debit card, it’s a gateway to a world of modern and hassle-free banking.

When you choose this card, you can expect a financial experience that is designed to put you in control of your money while eliminating the typical fees and other complexities.

This debit card stands out with its commitment to cost-effective banking. It eliminates the burden of monthly fees, providing a no-fee checking account for users.

Moreover, you gain access to over 60,000 fee-free ATMs, ensuring you can withdraw cash without incurring additional charges. Convenience and affordability go hand in hand.

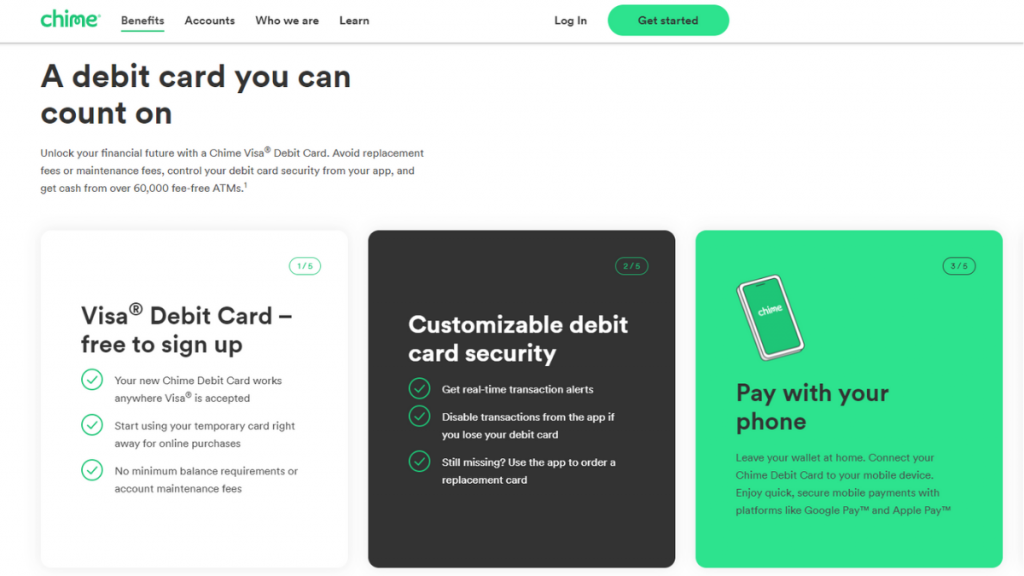

With the Chime app, you gain the upper hand with instantaneous transaction alerts that keep you informed about every card-related action in real-time.

Furthermore, the app offers the flexibility to personalize your card’s security by enabling you to disable transactions directly from your mobile device.

Besides, you can leave your physical wallet behind and connect your Chime Debit Card to your mobile device for quick and secure payments using Google Pay and Apple Pay.

Whether you’re managing your daily expenses or growing your savings, the Chime Visa® Debit Card is a powerful financial tool that unlocks your potential.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Do the pros outweigh the cons?

In essence, the Chime Visa® Debit Card offers a host of benefits you can review below that redefine the way you manage your finances. However, it’s also essential to look at the cons before you apply.

Pros

- No monthly fees;

- Enjoy access to an extensive network of ATMs;

- Immediate transaction notifications in real-time;

- Customizable security in the app;

- Seamlessly integrates with payment platforms;

- Automatic savings;

- EMV chip technology.

Cons

- No credit card rewards;

- Primarily designed for domestic use;

- No joint accounts;

- Deposit limitations;

- Limited physical branches;

- Overdraft features.

What are the eligibility requirements?

To apply for the Chime Visa® Debit Card you should review the specific eligibility criteria. Moreover, this includes being a U.S. citizen or legal resident of the 50 United States and being at least 18 years old.

Learn how to get the Chime Visa® Debit Card

Obtaining a Chime Visa® Debit Card is your entry into the banking world free of fees.

So, are you ready to order your new debit card and enjoy a hassle-free financial life?

Apply online

If you’re ready to take the first step toward unlocking financial freedom, review this easy guide to apply for the Chime Visa® Debit Card today!

- Visit the Chime website: Go to the official Chime website and navigate to the “Benefits” section on the menu. Then click on “Free Debit Card”.

- Provide information: As soon as you access the Chime Visa® Debit Card page, click on “Get Started” to fill out your application online. Provide personal information such as name, address, and more.

- Complete the enrollment: Follow the prompts on the Chime website to complete the enrollment process. Once you’ve successfully completed the enrollment, Chime will process your request.

- Receive your debit card: Your new Chime Visa® Debit Card will arrive in the mail within the next business days. Keep an eye on your mailbox for this exciting delivery.

What about a similar credit card? Check out the Brink’s Prepaid Mastercard®!

Looking for an alternative to the Chime Visa® Debit Card no review now? Consider the Brink’s Prepaid Mastercard®! Expect features such as direct deposit, mobile check load, and a user-friendly mobile app.

Moreover, this card is known for its commitment to keeping fees to a minimum, making it a cost-effective choice for those who want to avoid hidden charges. Learn more by clicking below to see the full review!

Brink's Prepaid Mastercard® Review

Unlock the power of Brink's Prepaid Mastercard® with this review. Get paid faster, earn rewards, and control your finances effortlessly.

Trending Topics

Spotify might soon be raising its subscription prices

Spotify is considering raising subscription prices, following the likes of Apple and YouTube. Read on to learn what this means to you.

Keep Reading

Learn how to effectively quit smoking and leave this habit for good

Want to quit smoking? Check out these tips to help you on your way! From setting a date, to dealing with cravings, we've got you covered.

Keep Reading

White House announces plans to end hunger in the U.S.

The White House presented a summary to end hunger by 2030, plus plans to increase overall food and health quality for Americans.

Keep ReadingYou may also like

Who are the top 12 richest NFL players

The richest NFL players are very very rich. Do you know how much money a football player can earn during his career? This post will tell you.

Keep Reading

Best 3DS Games: have a great gaming experience!

Looking for the best games available on your Nintendo 3DS? Check out this list of the most outstanding titles, from classic to newer series.

Keep Reading

How tall is Shaq O’Neal? The towering figure of NBA history

Get the answer to the age-old question, "How tall is Shaq?" and get some fun facts about the basketball's iconic player!

Keep Reading